What Is the Rate of Change (ROC)?

The Rate of Change (ROC) indicator is a tool used in stock investing to help investors and traders analyze the speed at which the price of a stock is changing over time. It’s a helpful tool because it can provide insights into whether a stock’s price is trending upwards, downwards, or staying relatively stable. Here’s how it works:

Calculating the ROC

To calculate the ROC, you need two pieces of information: the current price of the stock and the price of the stock from a certain number of periods ago (e.g., days or weeks). The formula for calculating ROC is:

ROC = (Current Price−Price n periods ago / Price N Periods Ago) x 100

For example, if you’re looking at the daily price of a stock and want to calculate the ROC for a 10-day period, you’d take the current price and subtract the price from 10 days ago, then divide by the price from 10 days ago, and multiply by 100 to express it as a percentage.

Interpreting ROC

The ROC value you get can be positive, negative, or close to zero, and each scenario provides different information:

- Positive ROC: If the ROC is positive, it means the stock’s price is increasing. The larger the positive ROC, the faster the price is rising. This might be a sign that the stock is in an upward trend.

- Negative ROC: If the ROC is negative, it means the stock’s price is decreasing. The larger the negative ROC, the faster the price is falling. This could indicate a downward trend.

- Close to Zero ROC: When the ROC is close to zero, it suggests that the stock’s price isn’t changing much. This might be a sign of a stable or sideways trend.

Using ROC in Investment Decisions

- Trend Confirmation: ROC can help confirm whether a stock is in an upward or downward trend. If you see a consistent positive ROC over several periods, it may support the idea that the stock is on an upward trend, and vice versa.

- Identifying Potential Turning Points: Sudden changes in the ROC, especially from positive to negative or vice versa, can indicate potential turning points in a stock’s price. Investors might use this information to make decisions about buying or selling.

- Risk Management: ROC can also be useful in assessing the volatility of a stock. Higher ROC values suggest greater price volatility, which can help investors manage their risk.

At Equilyst Analytics, you can:

- hire me as your private stock investment consultant

- hire me as your crypto and stock investment content writer

- subscribe to my members-only stock analyses

- subscribe to my members-only stock screener so you’ll know which stocks I’m monitoring daily

9 Bluechip Stocks That Are Bullish Based on 10-day ROC

Here are the nine Philippine bluechip stocks that are bullish based on their 10-day ROC as of closing on September 22, 2023, together with their month-to-date Market Sentiment Index ratings from September 1, 2023 to September 22, 2023:

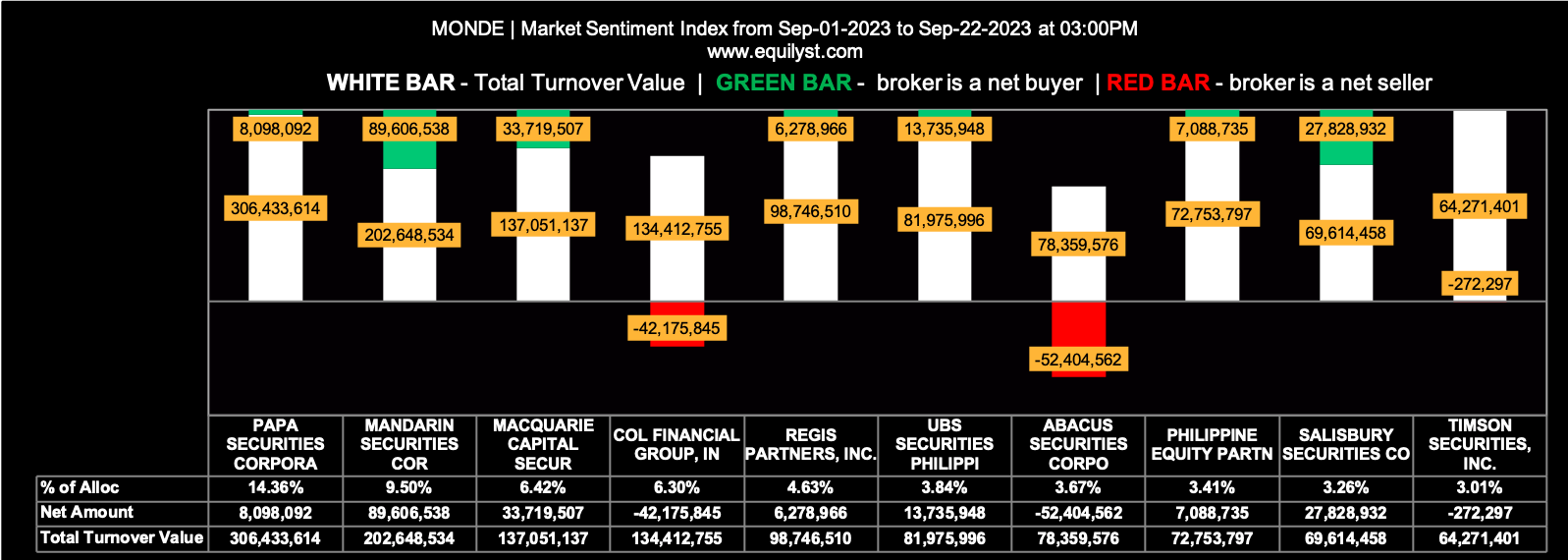

Monde Nissin Corporation (MONDE)

Market Sentiment Index: BEARISH

25 of the 85 participating brokers, or 29.41% of all participants, registered a positive Net Amount

18 of the 85 participating brokers, or 21.18% of all participants, registered a higher Buying Average than Selling Average

85 Participating Brokers’ Buying Average: ₱7.96581

85 Participating Brokers’ Selling Average: ₱8.23066

4 out of 85 participants, or 4.71% of all participants, registered a 100% BUYING activity

17 out of 85 participants, or 20.00% of all participants, registered a 100% SELLING activity

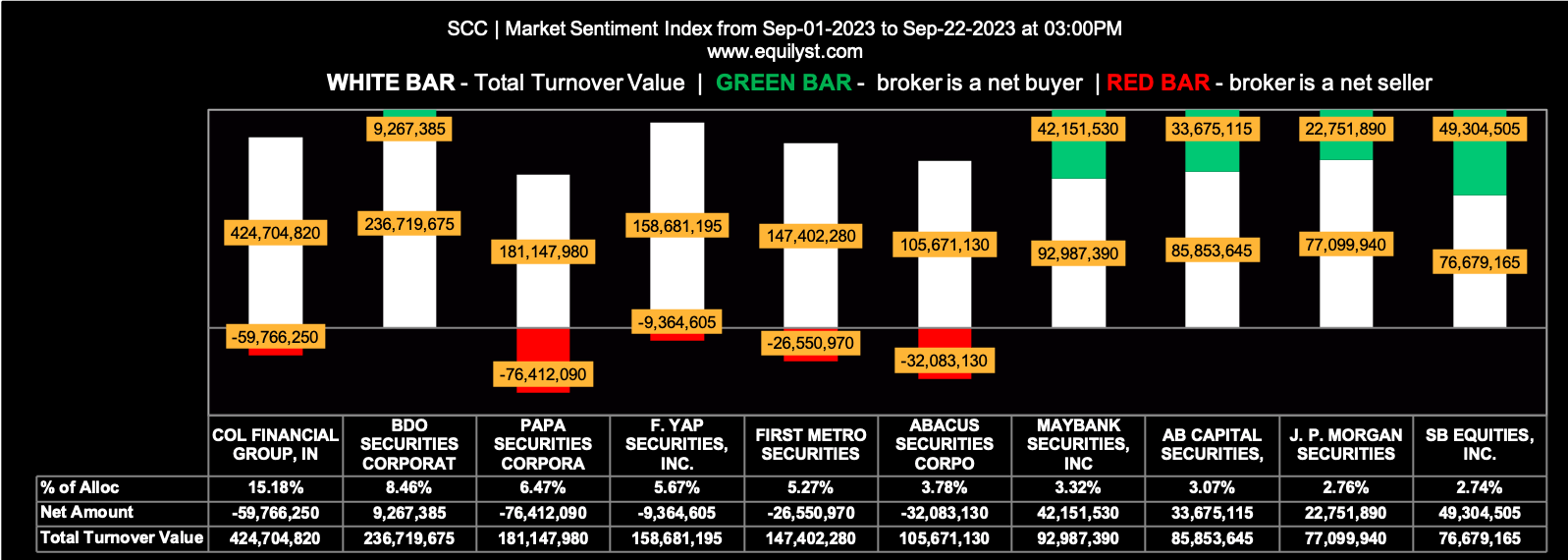

Semirara Mining and Power Corporation (SCC)

Market Sentiment Index: BEARISH

29 of the 95 participating brokers, or 30.53% of all participants, registered a positive Net Amount

26 of the 95 participating brokers, or 27.37% of all participants, registered a higher Buying Average than Selling Average

95 Participating Brokers’ Buying Average: ₱33.56258

95 Participating Brokers’ Selling Average: ₱34.16851

5 out of 95 participants, or 5.26% of all participants, registered a 100% BUYING activity

21 out of 95 participants, or 22.11% of all participants, registered a 100% SELLING activity

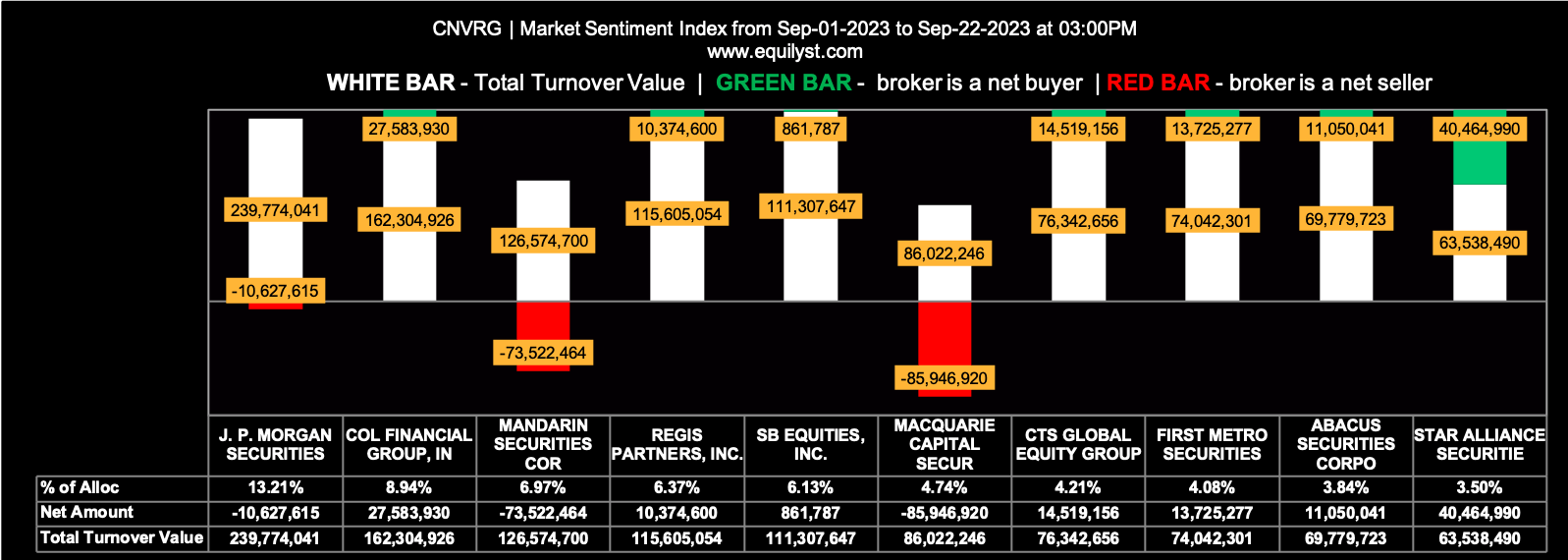

Converge Information and Communications Technology Solutions (CNVRG)

Market Sentiment Index: BEARISH

48 of the 92 participating brokers, or 52.17% of all participants, registered a positive Net Amount

40 of the 92 participating brokers, or 43.48% of all participants, registered a higher Buying Average than Selling Average

92 Participating Brokers’ Buying Average: ₱8.55587

92 Participating Brokers’ Selling Average: ₱8.60681

10 out of 92 participants, or 10.87% of all participants, registered a 100% BUYING activity

10 out of 92 participants, or 10.87% of all participants, registered a 100% SELLING activity

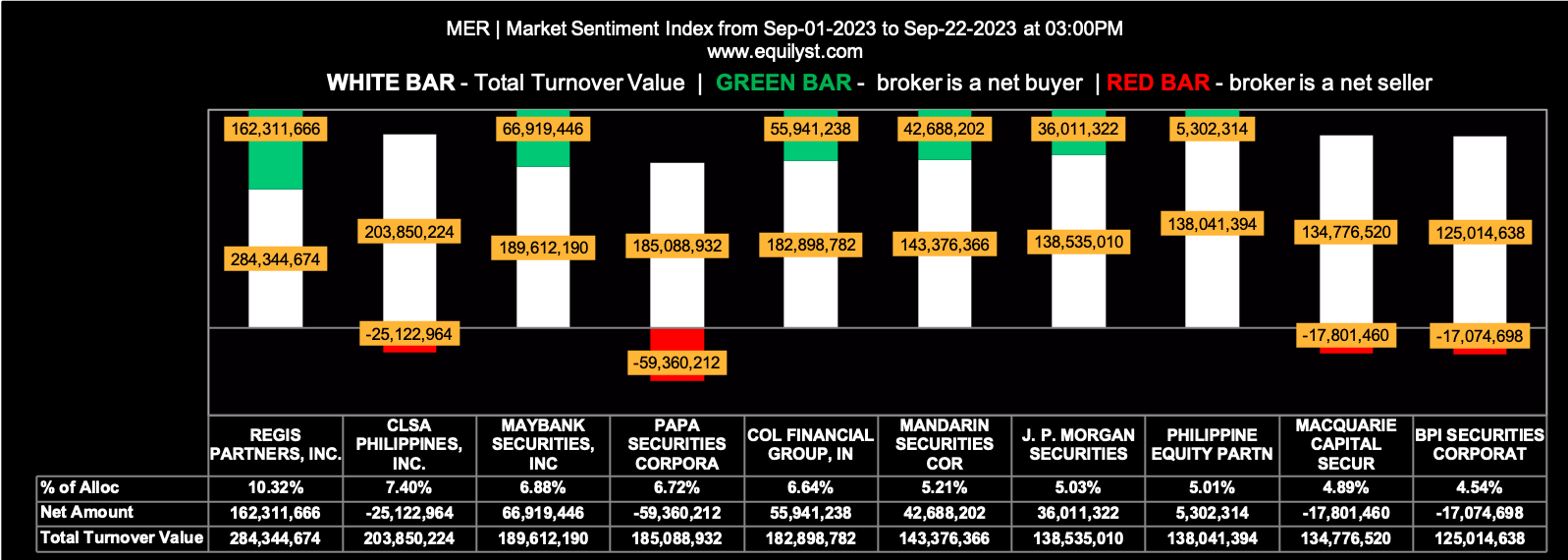

Manila Electric Company (MER)

Market Sentiment Index: BEARISH

22 of the 86 participating brokers, or 25.58% of all participants, registered a positive Net Amount

21 of the 86 participating brokers, or 24.42% of all participants, registered a higher Buying Average than Selling Average

86 Participating Brokers’ Buying Average: ₱358.16368

86 Participating Brokers’ Selling Average: ₱360.28452

3 out of 86 participants, or 3.49% of all participants, registered a 100% BUYING activity

28 out of 86 participants, or 32.56% of all participants, registered a 100% SELLING activity

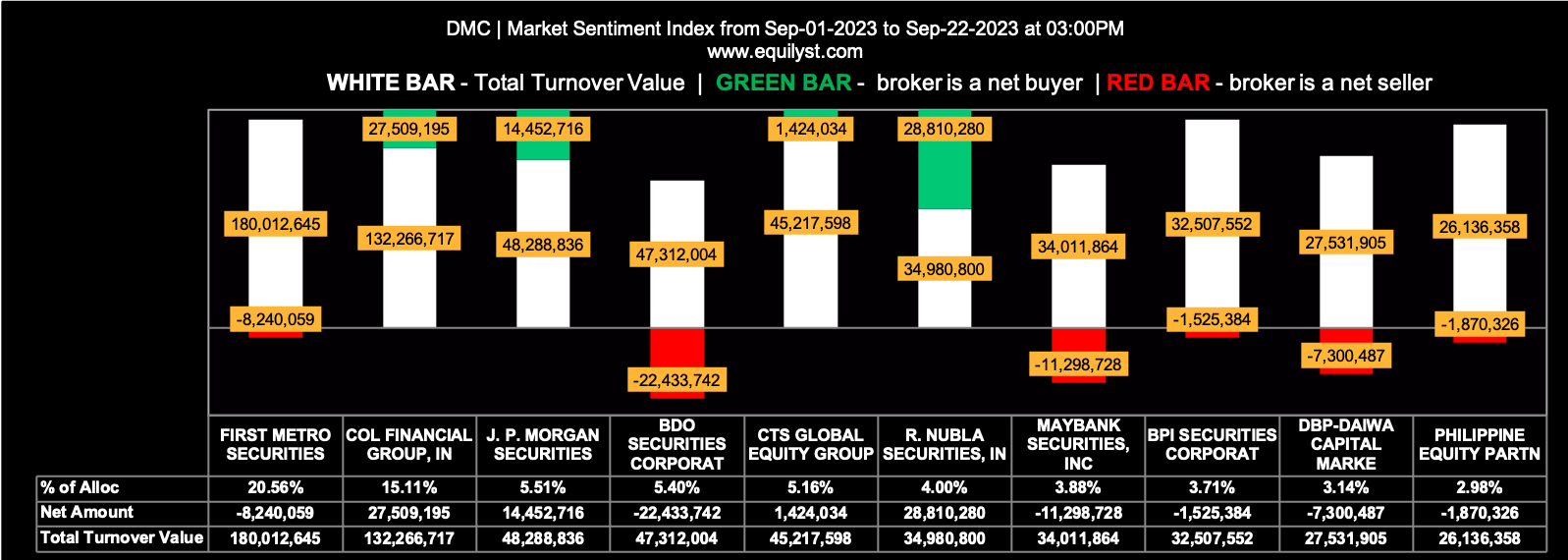

DMCI Holdings (DMC)

Market Sentiment Index: BEARISH

26 of the 86 participating brokers, or 30.23% of all participants, registered a positive Net Amount

44 of the 86 participating brokers, or 51.16% of all participants, registered a higher Buying Average than Selling Average

86 Participating Brokers’ Buying Average: ₱10.33342

86 Participating Brokers’ Selling Average: ₱10.29982

5 out of 86 participants, or 5.81% of all participants, registered a 100% BUYING activity

16 out of 86 participants, or 18.60% of all participants, registered a 100% SELLING activity

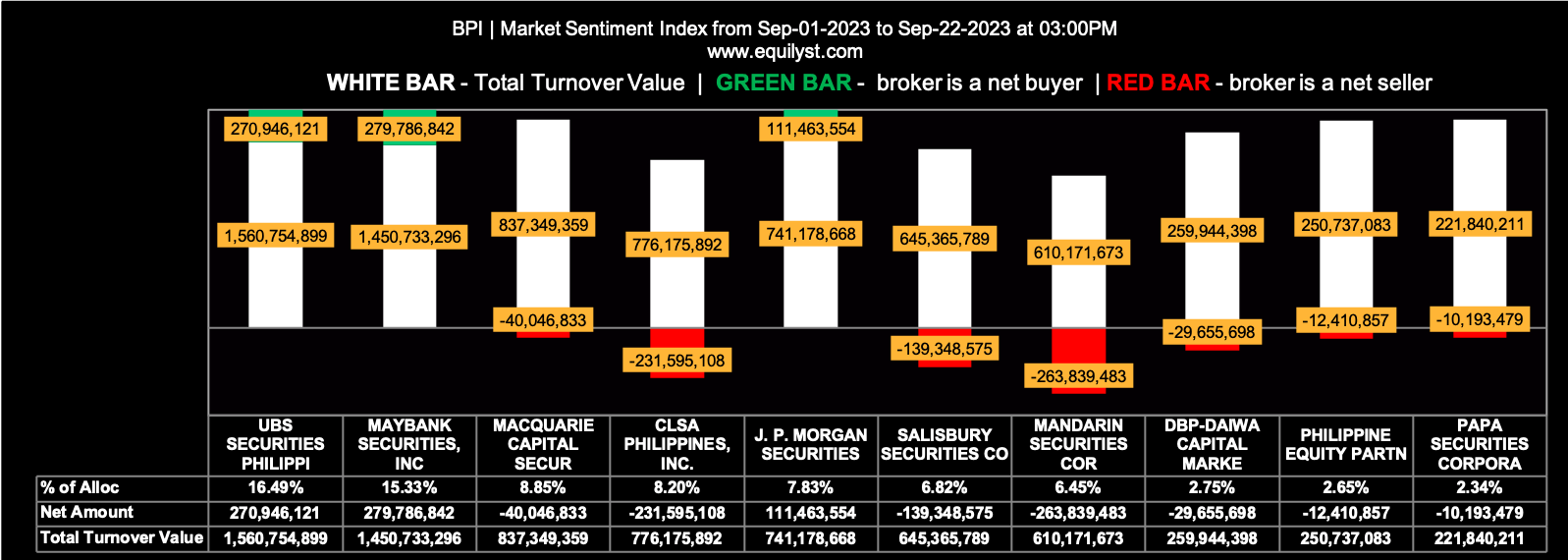

Bank of the Philippine Islands (BPI)

Market Sentiment Index: BEARISH

34 of the 76 participating brokers, or 44.74% of all participants, registered a positive Net Amount

24 of the 76 participating brokers, or 31.58% of all participants, registered a higher Buying Average than Selling Average

76 Participating Brokers’ Buying Average: ₱106.38948

76 Participating Brokers’ Selling Average: ₱107.51168

9 out of 76 participants, or 11.84% of all participants, registered a 100% BUYING activity

9 out of 76 participants, or 11.84% of all participants, registered a 100% SELLING activity

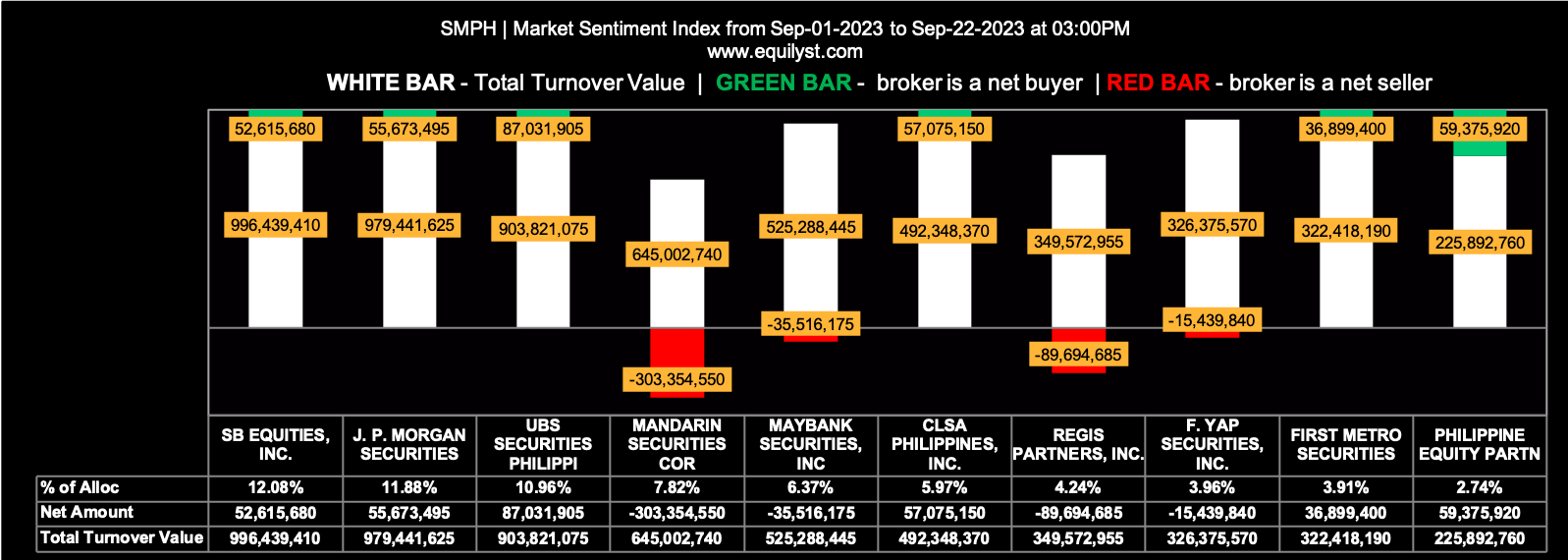

SM Prime Holdings (SMPH)

Market Sentiment Index: BEARISH

56 of the 91 participating brokers, or 61.54% of all participants, registered a positive Net Amount

40 of the 91 participating brokers, or 43.96% of all participants, registered a higher Buying Average than Selling Average

91 Participating Brokers’ Buying Average: ₱29.44258

91 Participating Brokers’ Selling Average: ₱29.67607

15 out of 91 participants, or 16.48% of all participants, registered a 100% BUYING activity

4 out of 91 participants, or 4.40% of all participants, registered a 100% SELLING activity

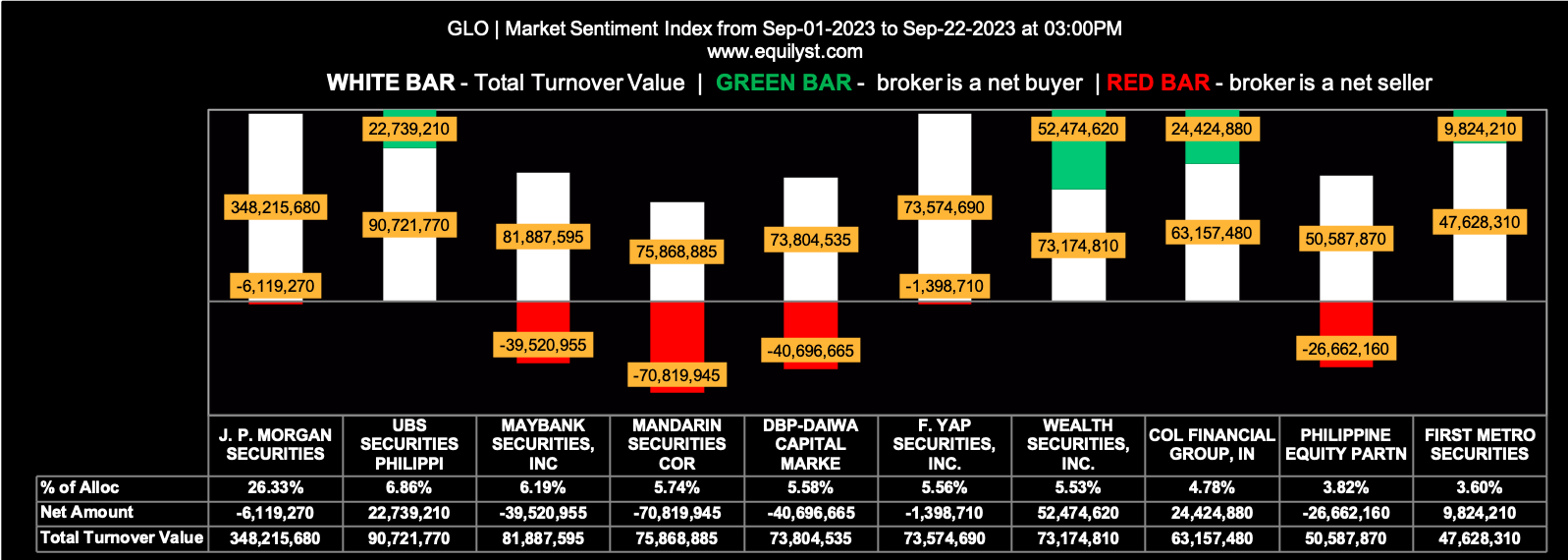

Globe Telecom (GLO)

Market Sentiment Index: BULLISH

56 of the 77 participating brokers, or 72.73% of all participants, registered a positive Net Amount

47 of the 77 participating brokers, or 61.04% of all participants, registered a higher Buying Average than Selling Average

77 Participating Brokers’ Buying Average: ₱1776.81783

77 Participating Brokers’ Selling Average: ₱1779.14397

22 out of 77 participants, or 28.57% of all participants, registered a 100% BUYING activity

2 out of 77 participants, or 2.60% of all participants, registered a 100% SELLING activity

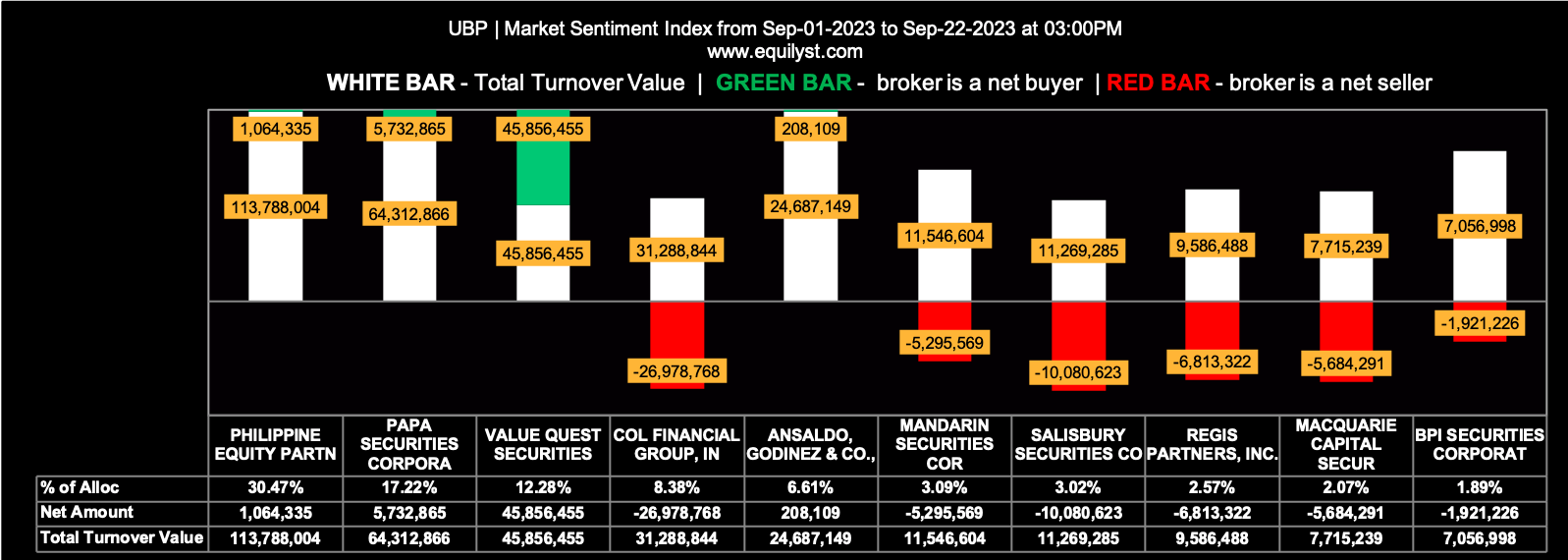

Union Bank of the Philippines (UBP)

Market Sentiment Index: BEARISH

25 of the 57 participating brokers, or 43.86% of all participants, registered a positive Net Amount

28 of the 57 participating brokers, or 49.12% of all participants, registered a higher Buying Average than Selling Average

57 Participating Brokers’ Buying Average: ₱69.35731

57 Participating Brokers’ Selling Average: ₱69.45766

14 out of 57 participants, or 24.56% of all participants, registered a 100% BUYING activity

14 out of 57 participants, or 24.56% of all participants, registered a 100% SELLING activity

At Equilyst Analytics, you can:

- hire me as your private stock investment consultant

- hire me as your crypto and stock investment content writer

- subscribe to my members-only stock analyses

- subscribe to my members-only stock screener so you’ll know which stocks I’m monitoring daily

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025