Out of 28 Industrial stocks, only 9 of them currently exhibit bullish trends above their respective 200-day simple moving averages.

By classical interpretation, it is believed that a stock is bullish in the long-term if its last price trades above its 200-day simple moving average (SMA).

In this report, I will not only reveal the names of these nine Industrial stocks but also provide their month-to-date market sentiment data from September 1, 2023, to September 12, 2023.

Please note that the Market Sentiment Index indicator discussed in this report is my proprietary creation, and I am the sole authority on its methodology for determining bearish and bullish ratings, as well as the specific parameters it considers.

I have extensively explained my use of the Market Sentiment Index in decision-making in numerous articles on this website. You can easily access them by using the SEARCH box in the ANALYSES section and searching for “market sentiment.”

If you prefer a more tailored approach, you can take advantage of my stock investment consultancy service.

It’s important to clarify that this article about Industrial stocks is for informational purposes only, and I am not providing stock recommendations. I employ a proprietary methodology to identify confirmed buy signals, which I can further discuss if you are interested in gaining independent investment insights through my stock investment consultancy service.

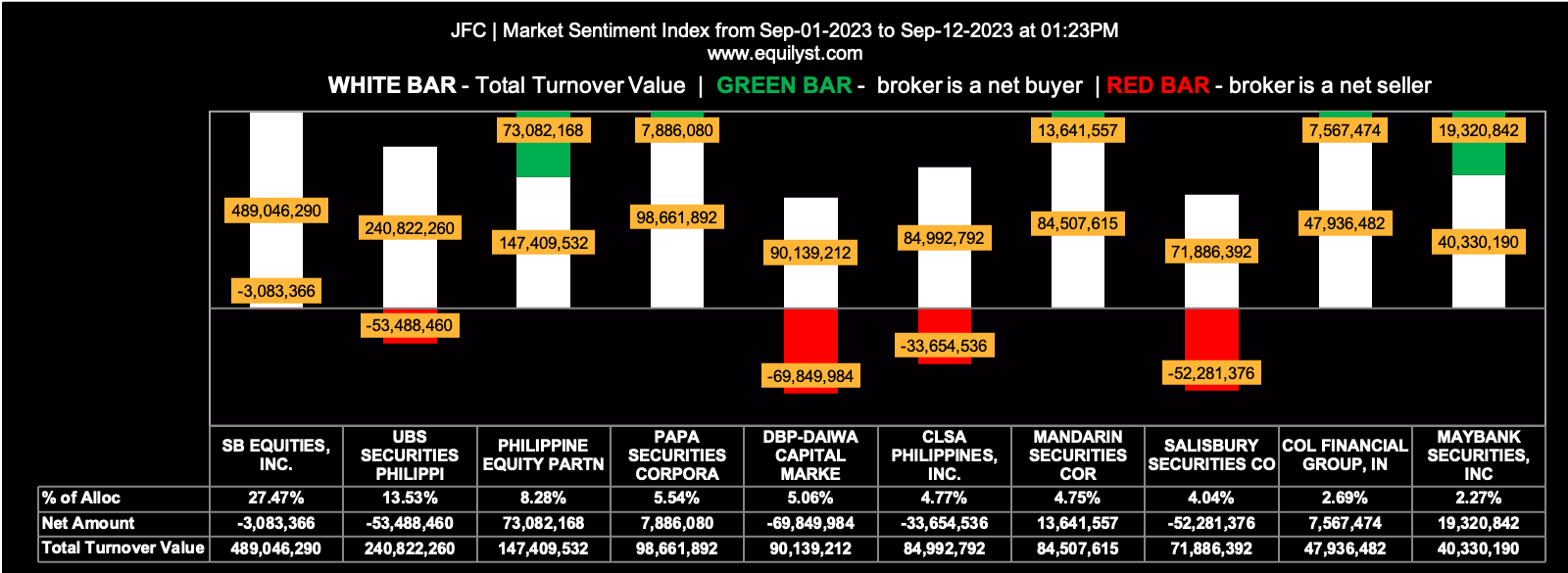

Jollibee Foods Corporation (JFC)

Last Price: P238.40

Distance of the Last Price Above the 200-day SMA: 0.46%

Market Sentiment Index: BULLISH

49 of the 69 participating brokers, or 71.01% of all participants, registered a positive Net Amount

40 of the 69 participating brokers, or 57.97% of all participants, registered a higher Buying Average than Selling Average

69 Participating Brokers’ Buying Average: ₱236.03451

69 Participating Brokers’ Selling Average: ₱236.51782

20 out of 69 participants, or 28.99% of all participants, registered a 100% BUYING activity

6 out of 69 participants, or 8.70% of all participants, registered a 100% SELLING activity

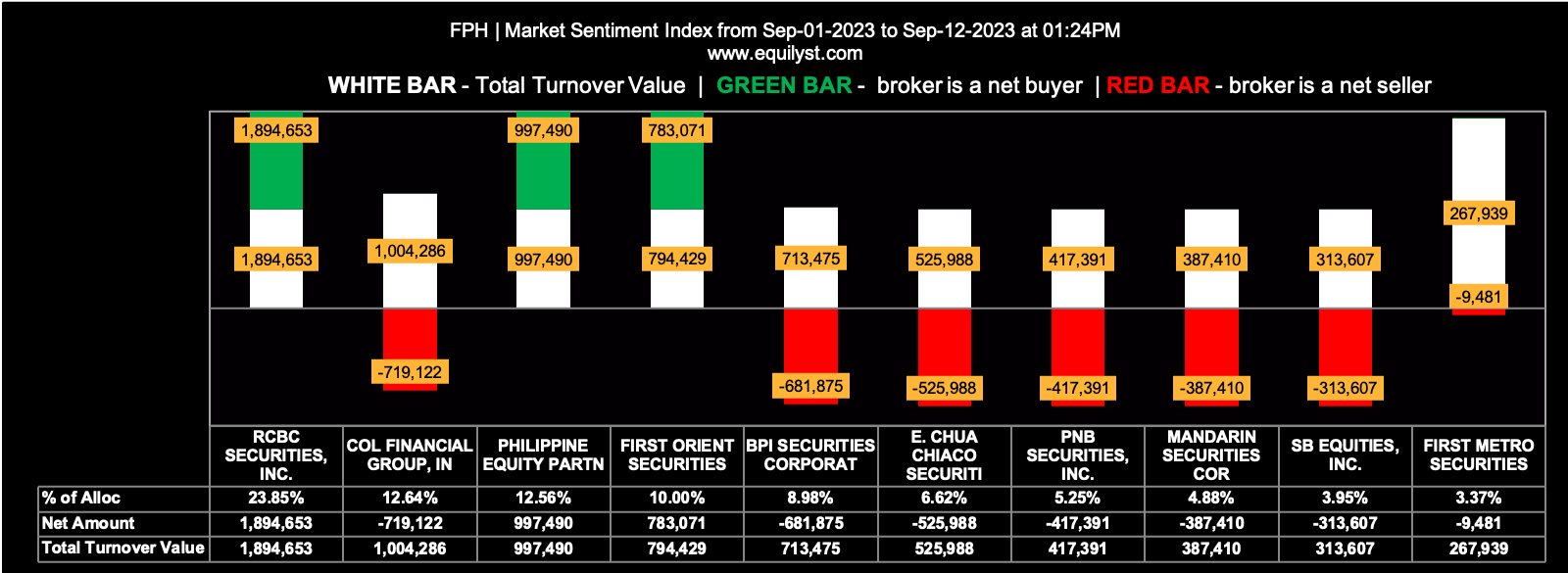

First Philippine Holdings Corporation (FPH)

Last Price: P63.10

Distance of the Last Price Above the 200-day SMA: 2%

Market Sentiment Index: BEARISH

4 of the 17 participating brokers, or 23.53% of all participants, registered a positive Net Amount

6 of the 17 participating brokers, or 35.29% of all participants, registered a higher Buying Average than Selling Average

17 Participating Brokers’ Buying Average: ₱63.08608

17 Participating Brokers’ Selling Average: ₱63.06594

3 out of 17 participants, or 17.65% of all participants, registered a 100% BUYING activity

9 out of 17 participants, or 52.94% of all participants, registered a 100% SELLING activity

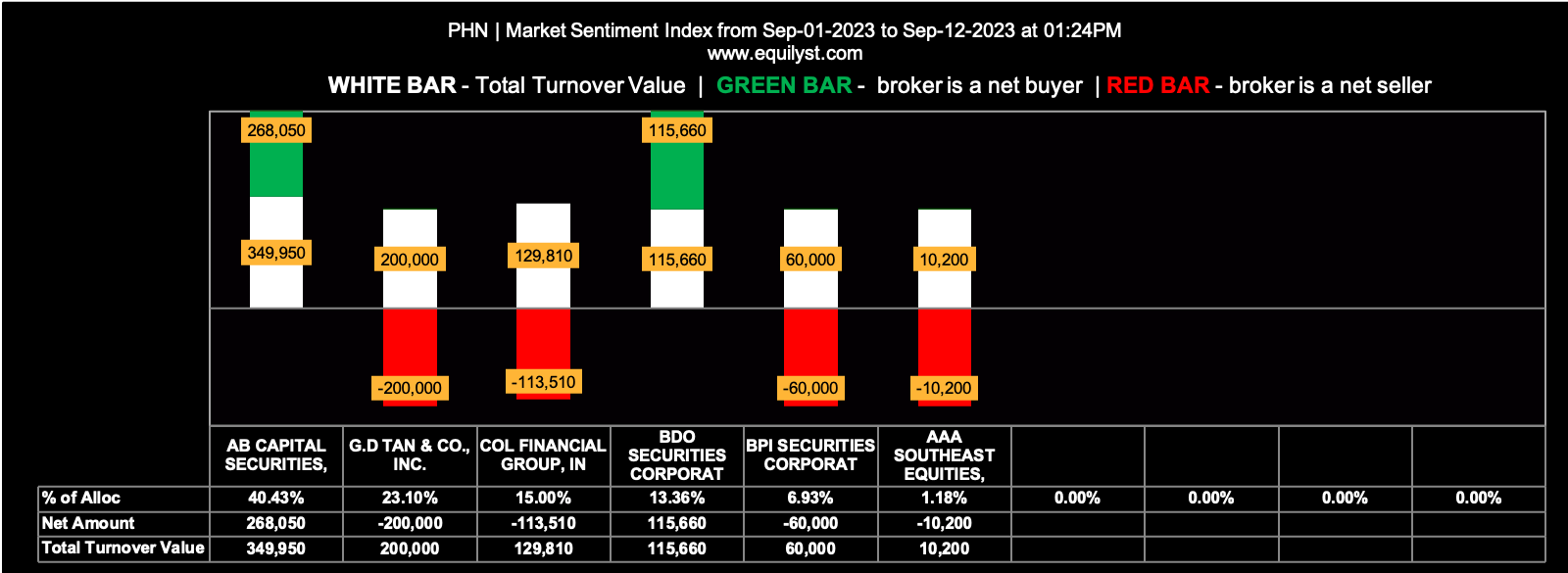

Phinma Corporation (PHN)

Last Price: P20.50

Distance of the Last Price Above the 200-day SMA: 5%

Market Sentiment Index: BEARISH

2 of the 6 participating brokers, or 33.33% of all participants, registered a positive Net Amount

2 of the 6 participating brokers, or 33.33% of all participants, registered a higher Buying Average than Selling Average

6 Participating Brokers’ Buying Average: ₱20.24293

6 Participating Brokers’ Selling Average: ₱20.23844

1 out of 6 participants, or 16.67% of all participants, registered a 100% BUYING activity

3 out of 6 participants, or 50.00% of all participants, registered a 100% SELLING activity

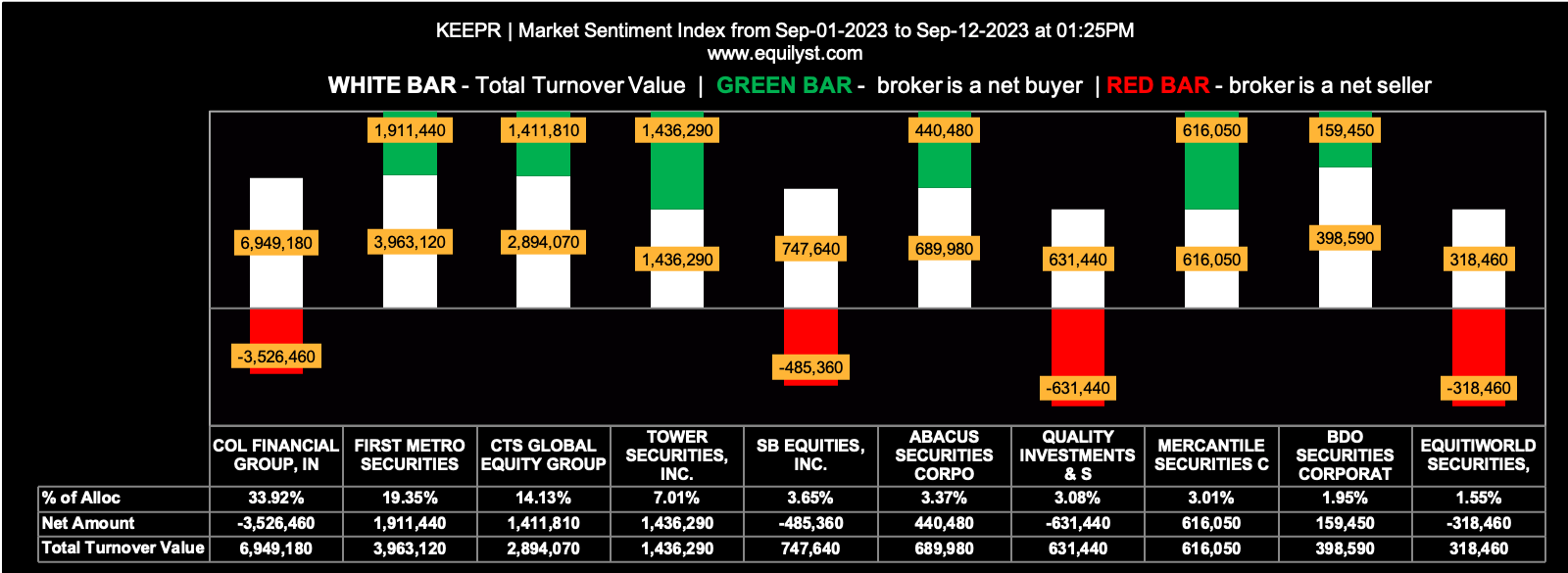

The Keepers Holdings (KEEPR)

Last Price: P1.60

Distance of the Last Price Above the 200-day SMA: 7%

Market Sentiment Index: BEARISH

9 of the 27 participating brokers, or 33.33% of all participants, registered a positive Net Amount

10 of the 27 participating brokers, or 37.04% of all participants, registered a higher Buying Average than Selling Average

27 Participating Brokers’ Buying Average: ₱1.56625

27 Participating Brokers’ Selling Average: ₱1.57345

5 out of 27 participants, or 18.52% of all participants, registered a 100% BUYING activity

10 out of 27 participants, or 37.04% of all participants, registered a 100% SELLING activity

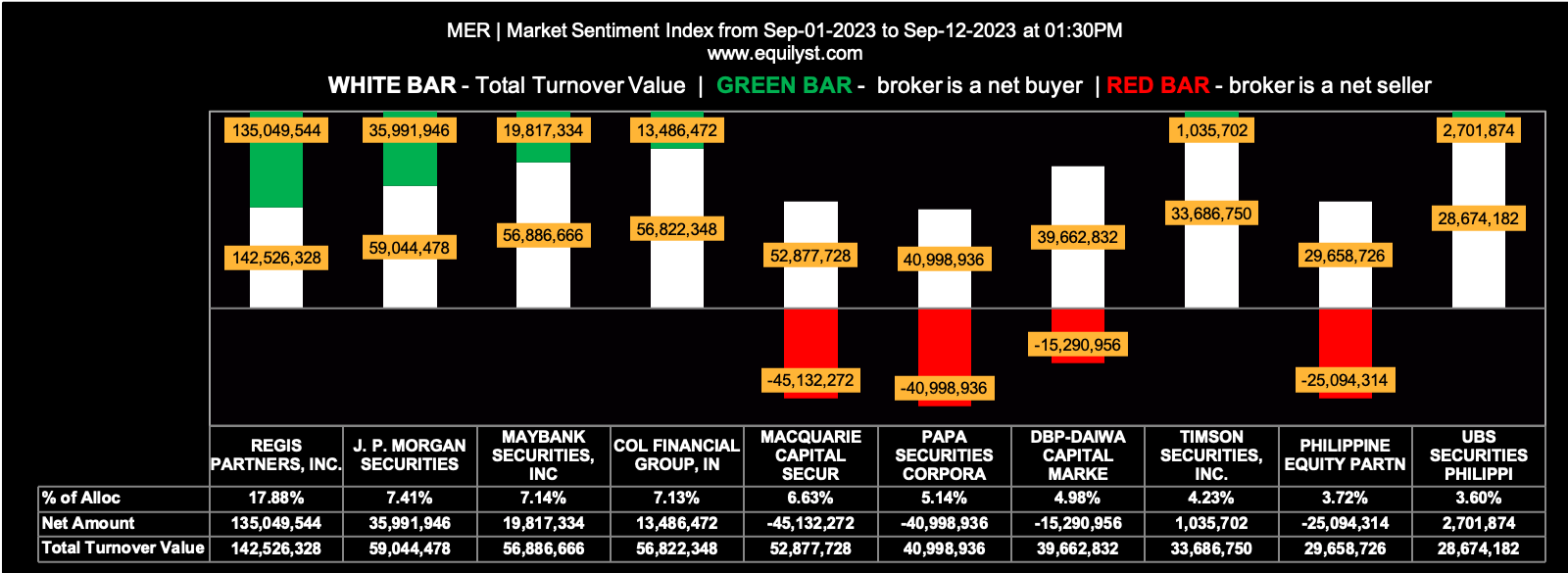

Manila Electric Company (MER)

Last Price: P356.60

Distance of the Last Price Above the 200-day SMA: 12%

Market Sentiment Index: BEARISH

18 of the 67 participating brokers, or 26.87% of all participants, registered a positive Net Amount

15 of the 67 participating brokers, or 22.39% of all participants, registered a higher Buying Average than Selling Average

67 Participating Brokers’ Buying Average: ₱349.91736

67 Participating Brokers’ Selling Average: ₱353.96760

5 out of 67 participants, or 7.46% of all participants, registered a 100% BUYING activity

20 out of 67 participants, or 29.85% of all participants, registered a 100% SELLING activity

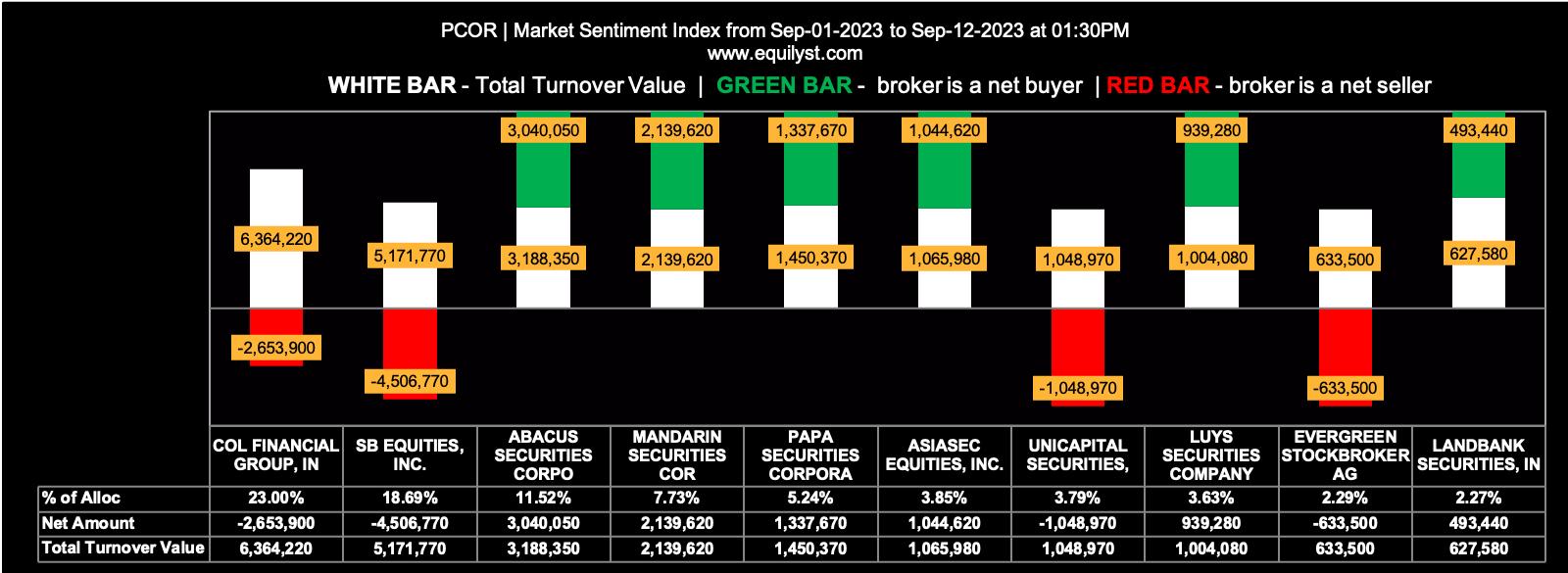

Petron Corporation (PCOR)

Last Price: P3.55

Distance of the Last Price Above the 200-day SMA: 12%

Market Sentiment Index: BEARISH

14 of the 38 participating brokers, or 36.84% of all participants, registered a positive Net Amount

17 of the 38 participating brokers, or 44.74% of all participants, registered a higher Buying Average than Selling Average

38 Participating Brokers’ Buying Average: ₱3.53192

38 Participating Brokers’ Selling Average: ₱3.53424

9 out of 38 participants, or 23.68% of all participants, registered a 100% BUYING activity

13 out of 38 participants, or 34.21% of all participants, registered a 100% SELLING activity

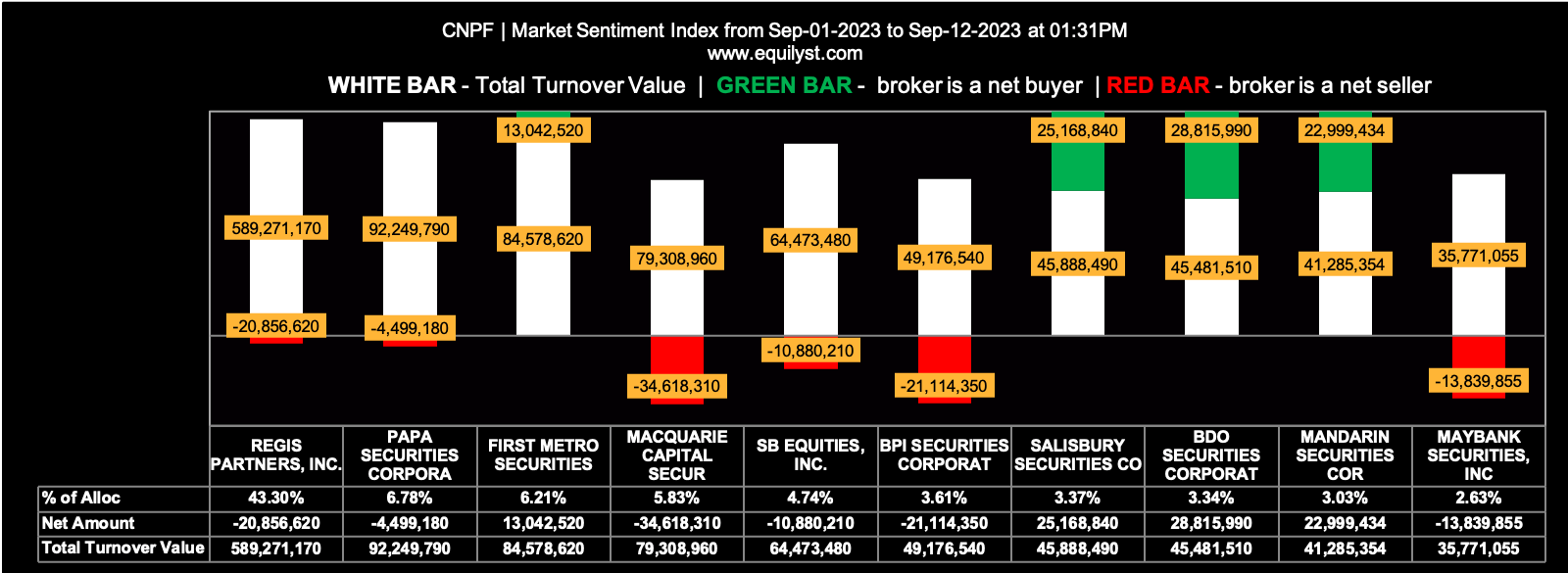

Century Pacific Food (CNPF)

Last Price: P29.00

Distance of the Last Price Above the 200-day SMA: 15%

Market Sentiment Index: BEARISH

21 of the 61 participating brokers, or 34.43% of all participants, registered a positive Net Amount

17 of the 61 participating brokers, or 27.87% of all participants, registered a higher Buying Average than Selling Average

61 Participating Brokers’ Buying Average: ₱28.70142

61 Participating Brokers’ Selling Average: ₱28.72070

5 out of 61 participants, or 8.20% of all participants, registered a 100% BUYING activity

23 out of 61 participants, or 37.70% of all participants, registered a 100% SELLING activity

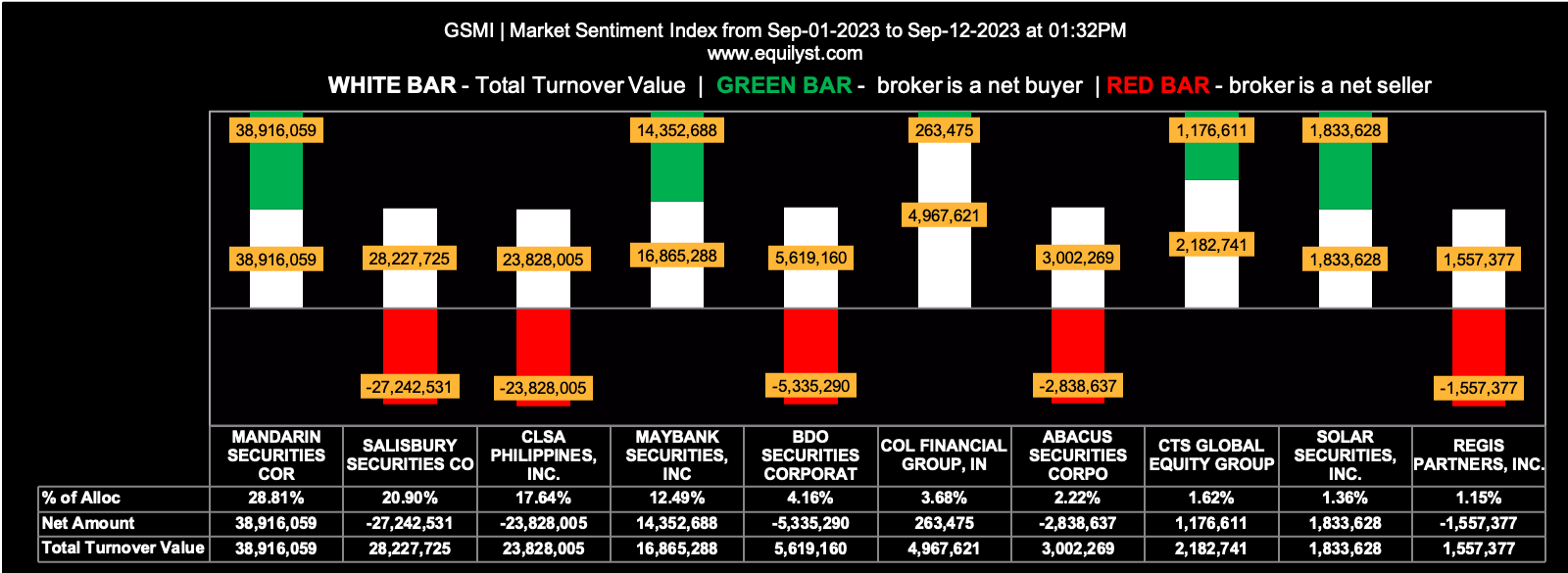

Ginebra San Miguel (GSMI)

Last Price: P167.00

Distance of the Last Price Above the 200-day SMA: 21%

Market Sentiment Index: BULLISH

19 of the 26 participating brokers, or 73.08% of all participants, registered a positive Net Amount

21 of the 26 participating brokers, or 80.77% of all participants, registered a higher Buying Average than Selling Average

26 Participating Brokers’ Buying Average: ₱167.76022

26 Participating Brokers’ Selling Average: ₱167.43271

11 out of 26 participants, or 42.31% of all participants, registered a 100% BUYING activity

2 out of 26 participants, or 7.69% of all participants, registered a 100% SELLING activity

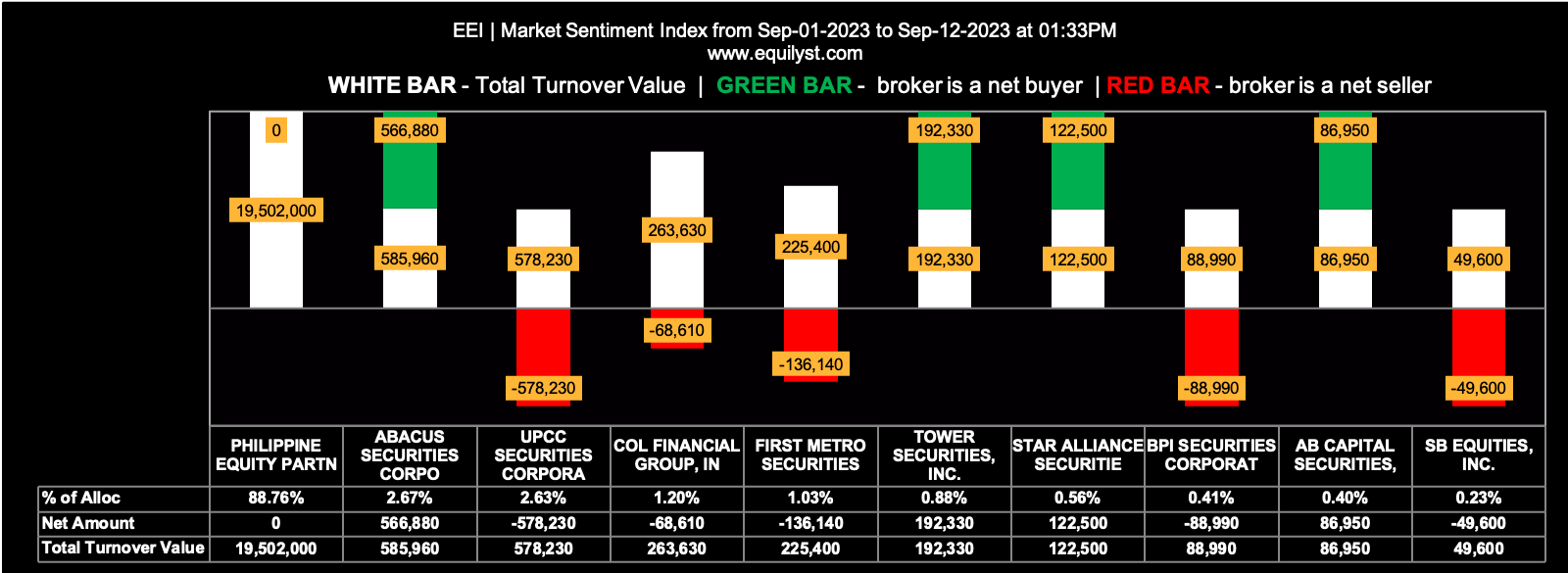

EEI Corporation (EEI)

Last Price: P4.86

Distance of the Last Price Above the 200-day SMA: 23%

Market Sentiment Index: BEARISH

8 of the 20 participating brokers, or 40.00% of all participants, registered a positive Net Amount

10 of the 20 participating brokers, or 50.00% of all participants, registered a higher Buying Average than Selling Average

20 Participating Brokers’ Buying Average: ₱4.86238

20 Participating Brokers’ Selling Average: ₱4.85913

7 out of 20 participants, or 35.00% of all participants, registered a 100% BUYING activity

9 out of 20 participants, or 45.00% of all participants, registered a 100% SELLING activity

Which of These 9 Industrial Stocks Do You Already Have?

What’s your decision now that you’ve known this information? Let me know in the comments.

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025