The Only 2 Holdings Stocks That Beat the 2023 Average Philippine Inflation Rate

I computed the dividend yield of all the Philippine holdings stocks within 12 trailing months (TTM) to see how many of them beat the year-to-date Philippine inflation rate of 6.63% this 2023.

There are 13 stocks in the Holdings sector namely AABA, AC, AEV, AGI, COSCO, DMC, GTCAP, JGS, LPZ, LTG, MPI, SM, and SMC.

Of the 13 Holdings stocks, only 11 issued cash dividends within 12 trailing months as of end of August 2023.

From those 11 stocks, only two have a dividend yield (TTM) higher than our country’s average inflation rate of 6.63% for 2023.

Let it be known that sharing my research with you is not the same as recommending these two Holdings stocks. I do not give stock recommendations.

Those two stocks with higher than 6.63% TTM dividend yield are LTG and DMC.

As for the remaining Holdings stocks, 15.39% have a 3-4% dividend yield, 30.70% have a 1-2.5% dividend yield, 23.08% have less than 1% dividend yield, and the remaining 15.39% have zero dividend yield for the past 12 trailing months.

Additionally, I’d like to share with you the month-to-date market sentiment score and the intraday dominant range of LTG and DMC.

This way, I help you make a data-driven decision in case these two Holdings stocks are in your watchlist or you’re planning to top up on your existing position.

Again, this is not a recommendation to buy these two stocks.

PS: I don’t like repeating myself, but I am compelled to reiterate things because non-like-minded people stumble upon my website sometimes.

Related Article: 13 Philippine Stocks Yielding Over 10% Dividends (8.25.2023)

Intraday Dominant Range and Month-to-Date Market Sentiment for the 2 Holdings Stocks

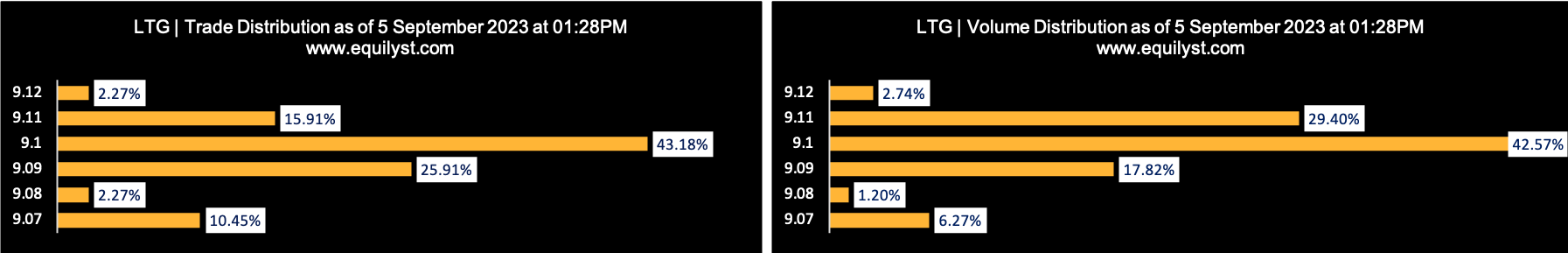

LTG

TTM Cash Dividend: P1.40

TTM Dividend Yield: 15.40%

Dominant Range Index: BULLISH

Last Price: 9.10

VWAP: 9.10

Dominant Range: 9.09 – 9.11

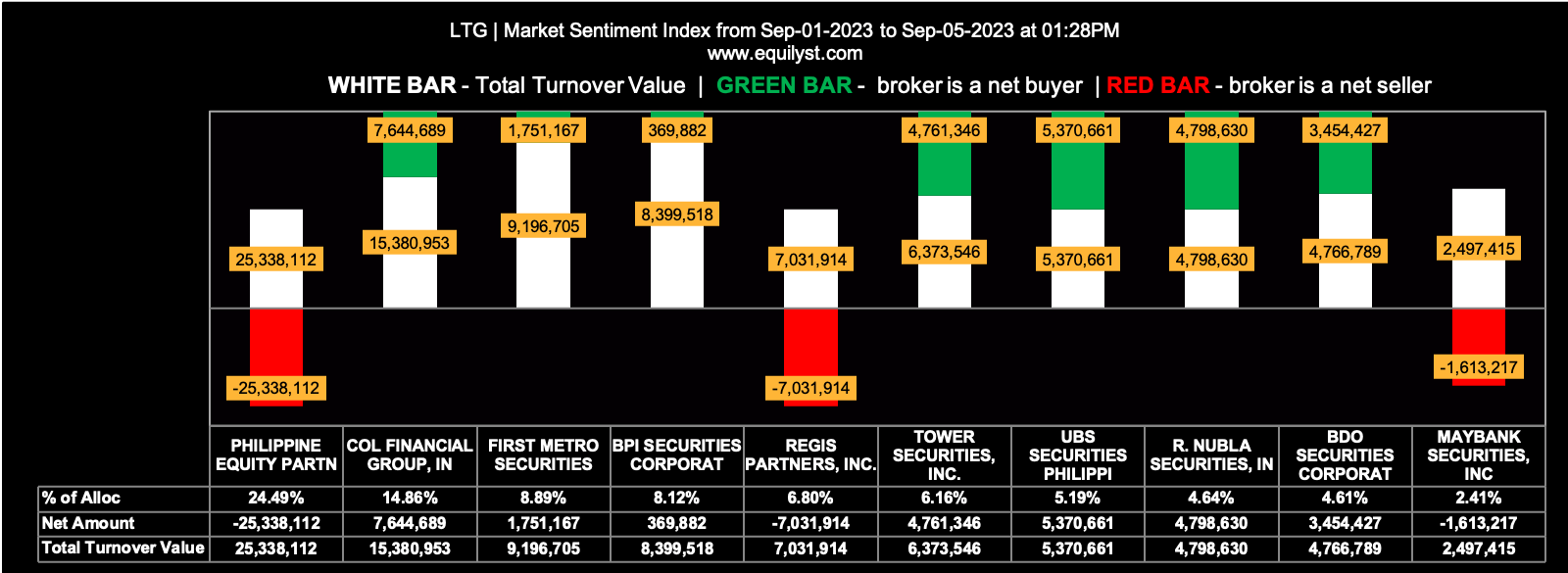

Market Sentiment Index: BULLISH

35 of the 50 participating brokers, or 70.00% of all participants, registered a positive Net Amount

29 of the 50 participating brokers, or 58.00% of all participants, registered a higher Buying Average than Selling Average

50 Participating Brokers’ Buying Average: ₱8.98656

50 Participating Brokers’ Selling Average: ₱9.01193

22 out of 50 participants, or 44.00% of all participants, registered a 100% BUYING activity

7 out of 50 participants, or 14.00% of all participants, registered a 100% SELLING activity

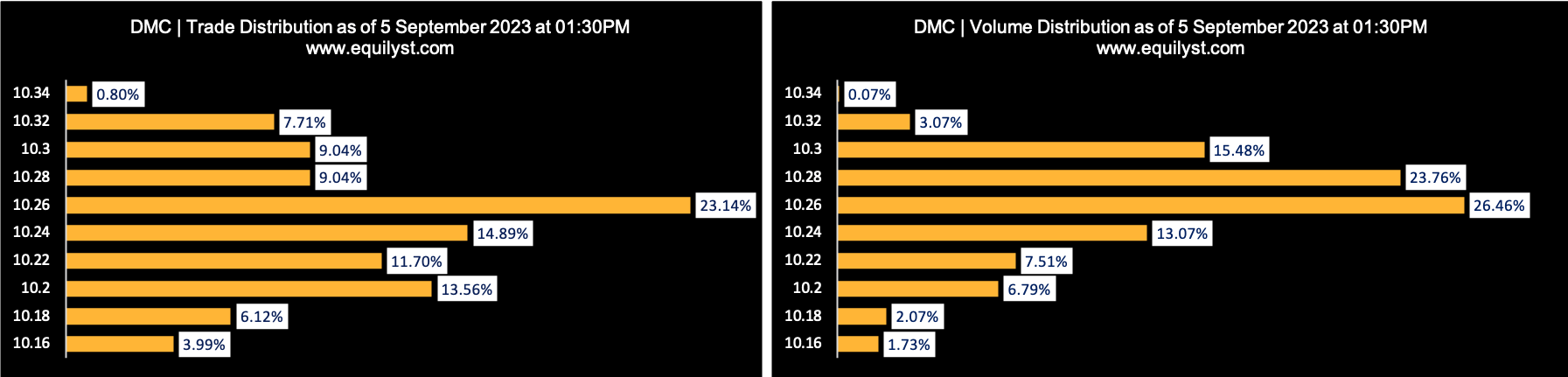

DMC

TTM Cash Dividend: P1.44

TTM Dividend Yield: 14.04%

Dominant Range Index: BULLISH

Last Price: 10.24

VWAP: 10.26

Dominant Range: 10.20 – 10.30

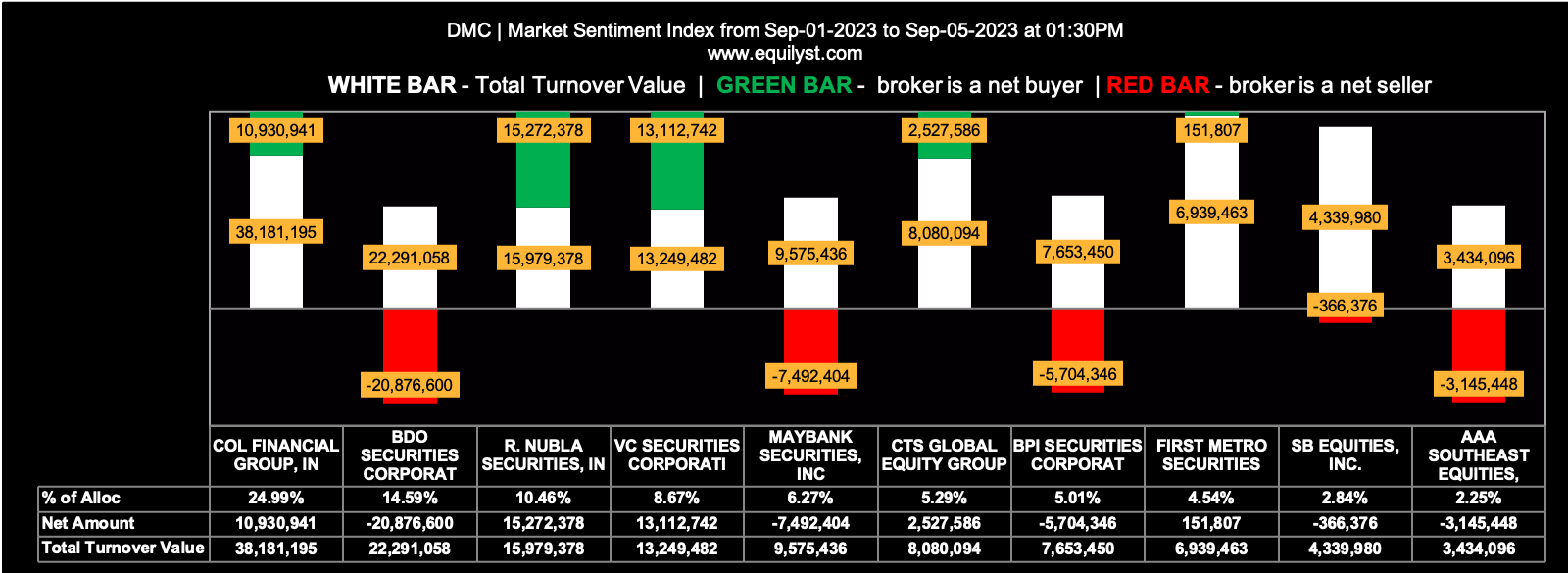

Market Sentiment Index: BEARISH

17 of the 59 participating brokers, or 28.81% of all participants, registered a positive Net Amount

22 of the 59 participating brokers, or 37.29% of all participants, registered a higher Buying Average than Selling Average

59 Participating Brokers’ Buying Average: ₱10.11242

59 Participating Brokers’ Selling Average: ₱10.10460

6 out of 59 participants, or 10.17% of all participants, registered a 100% BUYING activity

22 out of 59 participants, or 37.29% of all participants, registered a 100% SELLING activity

What Are Your Plans With These 2 Holdings Stocks?

Do you already have LTG and DMC in your portfolio? If yes, do you plan to top up?

If they’re not yet in your portfolio, do you plan to add them in your watchlist?

Let me know in the comments.

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- Key Prices for PH Bluechip Stocks 30% Above 52-Week Low - June 4, 2024

- May 2024 Market Sentiment Rating of 30 PH Bluechip Stocks - June 3, 2024

- EquiTalks: ICT, BPI, AEV Updates – 5.29.2024 - May 29, 2024