SM Prime Holdings (SMPH) Achieves Impressive 38% Profit Increase in 1H 2023

SM Prime Holdings (SMPH), a major integrated property developer in Southeast Asia, reported a 49% rise in combined net earnings, reaching P10.0 billion in Q2 2023 compared to P6.7 billion in Q2 2022. This surge follows a 39% upswing in combined revenues, which amounted to P31.2 billion from P22.5 billion during the reviewed time frame. The total operational gain combined surged by 42% to P15.1 billion in Q2 2023 from P10.7 billion in Q2 2022.

In the first half of 2023, SM Prime Holdings’ (SMPH) consolidated net profit hit P19.4 billion, marking a 38% increase compared to P14.1 billion in 2022. This impressive gain was driven by a 29% surge in consolidated revenues, which reached P59.9 billion from P46.3 billion. In the same vein, combined operating income climbed by 36% to P29.0 billion in 1H 2023, up from P21.4 billion in 1H 2022.

In reference to the strong performance of SM Prime’s main business units in the first half of 2023, with a particular focus on its malls and primary residences, SM Prime Holdings (SMPH) President Jeffrey Lim emphasized the company’s commitment to acting as a driving force in the local property sector’s growth. He mentioned that the expansion of their presence and operations in various localities will persist as a strategic approach to furthering their contributions to growth and progress.

The second quarter of the year saw a 30% uptick in Philippine mall business revenues for SM Prime Holdings (SMPH), totaling P16.1 billion compared to P12.4 billion the previous year. Similarly, operating income for this segment rose by 27% quarter-over-quarter, reaching P8.8 billion from P6.9 billion.

In the first half of 2023, SM Prime Holdings’ (SMPH) local mall business generated P31.5 billion in revenue, a notable 53% increase from P20.6 billion in 2022. This segment accounted for 53% of the overall consolidated revenues. Rent income soared by 42% year-on-year to P26.3 billion from P18.6 billion, reflecting an improvement in tenant sales and foot traffic. Furthermore, SMPH’s local cinema, ticket sales, and other revenue streams surged to P5.2 billion in the first half of the year, marking a significant 156% growth from P2.0 billion in 2022. Meanwhile, the China mall business of SM Prime Holdings (SMPH) reported RMB398 million in revenue during the first six months of 2023, displaying slight progress from last year’s RMB385 million.

In Q2 2023, SM Prime Holdings’ (SMPH) primary residential business, under the leadership of SM Development Corp. (SMDC), experienced P9.9 billion in revenues, an impressive 82% surge compared to the same quarter in the previous year (P5.4 billion). Operating income for this sector surged by 83% quarter-on-quarter to P4.2 billion from P2.3 billion. Cumulative revenues for the first half of the year amounted to P17.6 billion.

For the latter half of 2023, SMDC’s reservation sales reached P68.5 billion, marking a 15% rise from last year’s P59.4 billion. This corresponds to a 17% growth in unit sales during 1H 2023. The improved market conditions empowered local and overseas Filipino buyers, enabling them to invest in SM Prime’s residential ventures.

Mr. Lim also conveyed that they maintain an optimistic perspective on the company’s performance throughout 2023, considering the enhanced market outlook. He added that SM Prime Holdings (SMPH) will continue its efforts to explore innovative and sustainable methods for engaging with customers, thereby offering them exceptional experiences and value within their projects.

The other business sectors of SM Prime Holdings (SMPH), encompassing offices, hotels, and convention centers, registered a 40% surge in revenue, totaling P6.2 billion in 1H 2023, a step up from P4.5 billion in 2022.

As a steadfast catalyst for economic growth, SM Prime Holdings (SMPH) remains dedicated to delivering innovative and sustainable lifestyle communities, thereby enhancing the quality of life for millions.

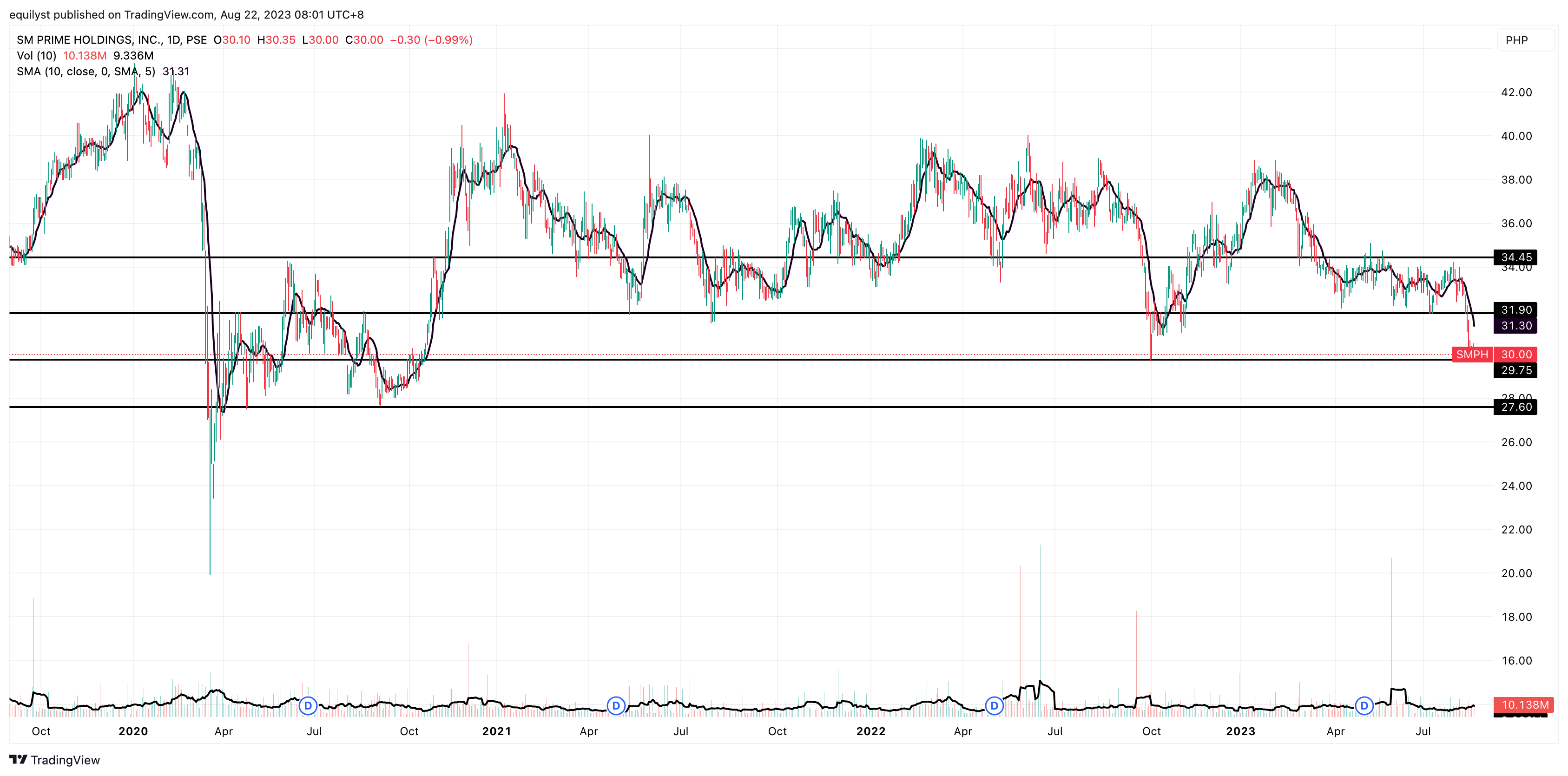

Technical Analysis: SMPH Stock Price Plunges 15.49% for H1 2023

Fundamental analysis shows that SM Prime Holdings (SMPH) continues to bring money for the company, but that good news doesn’t reflect the stock’s price performance for 1H 2023. SMPH dives by 15.49% for 1H 2023 from its closing price of P35.50 on December 29, 2023, to P30.00 on June 30, 2023. The stock is also performing poorly for August MTD as it plummets by 10.18% from P33.40 on July 31, 2023, to its last price of P30.00 as of August 18, 2023.

Fundamental analysis shows that SM Prime Holdings (SMPH) continues to bring money for the company, but that good news doesn’t reflect the stock’s price performance for 1H 2023. SMPH dives by 15.49% for 1H 2023 from its closing price of P35.50 on December 29, 2023, to P30.00 on June 30, 2023. The stock is also performing poorly for August MTD as it plummets by 10.18% from P33.40 on July 31, 2023, to its last price of P30.00 as of August 18, 2023.

SM Prime Holdings (SMPH) is still deeply buried in the bearish trend as its 200-day simple moving average hovers over the 10-day simple moving average. The last price of P30.00 is positioned below both moving averages.

The immediate support of SM Prime Holdings (SMPH) lies at P30.00, while the immediate resistance is pegged at P31.90. This event means SMPH is on the brink of breaking below its support toward the next support at P27.60.

The red volume on August 18 exceeded the 100% of SMPH’s 10-day volume average. It means there was a strong appetite for selling on Friday. By classical interpretation, the bearish price action of SM Prime Holdings (SMPH) will likely continue in the last trading week of August 2023 unless it respects the strength of the support at P30.00.

SM Prime Holdings (SMPH) is one of the few stocks in the Philippine Stock Exchange with no volatility issues. Almost all of its daily volumes exceed 50% of its 10-day volume average.

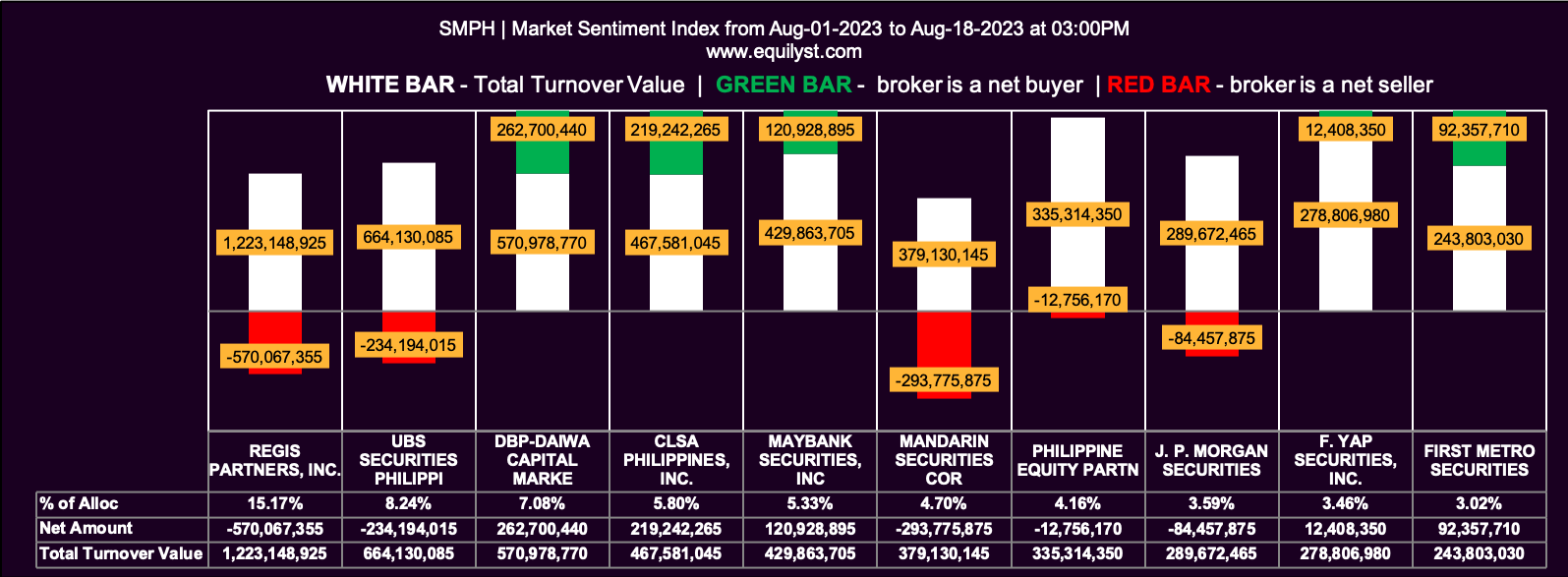

Meanwhile, of the 91 brokers that traded SM Prime Holdings (SMPH) from August 1 to 18, 71 out of 91, or 80.22%, recorded a positive net amount. Also, 19 out of 91, or 20.88%, registered a 100% buying activity, while only 1 out of 91, or 1.10%, registered a 100% selling activity.

On the other hand, 41 out of 91, or 45.05%, printed a higher buying than selling average. Also, all 91 brokers registered a higher selling average (P31.87) than their buying average (P31.27) within the stated period.

Synthesizing all of those numbers based on my proprietary algorithm, you get a bearish overall Market Sentiment Index rating for SM Prime Holdings (SMPH) from August 1 to 18.

Price Forecast for SM Prime Holdings (SMPH): August 22 to 25

My verdict for SM Prime Holdings (SMPH) this week is neutral, with a bearish bias.

It’s neutral because it might respect the support at P30.00. There’s no harm in adopting a wait-and-see approach as long as your trailing stop is intact.

If SM Prime Holdings (SMPH) breaks below P30.00 within the first 30 minutes of trading on August 22, the likelihood of this stock reaching the deeper support at P27.60 increases.

In essence, I will reanalyze the case of SM Prime Holdings (SMPH) each time I observe significant price action. Although my sentiment for SMPH remains “neutral with a bearish bias” based on the price action as of August 18, this doesn’t mean I should rigidly adhere to that interpretation in the face of evident changes on the stock chart. Loyalty to past analysis doesn’t generate profit; the ability to promptly respond to prevailing market sentiment does.

If you currently hold a position in SM Prime Holdings (SMPH) and are contemplating whether to average down or not, I will counter with a question: “Is your trailing stop intact?”

If your trailing stop has already been triggered, averaging down becomes impractical.

Avoid self-deception by saying, “Well, I won’t need this money for the next 5 or 10 years anyway.”

This isn’t about whether you’re wealthier than Elon Musk, Bernard Arnault, Jeff Bezos, Bill Gates, and Larry Ellison combined. It’s about whether your unrealized loss has exceeded your acceptable risk percentage.

No rational investor would simply disregard a growing loss percentage and remark, “Never mind. I don’t require that money for the next 10 years. I’m a billionaire. Duh!”

I have billionaire acquaintances. I’m informing you, their mindset isn’t that way. They continue to think as if they still need to strive for their next meal.

If you want a tailored-fit recommendation relative to the size of your portfolio and risk tolerance, please complete this form to avail yourself of my crypto and stock market consulting service.

Fill out this form if you want to hire me to write for your website in the blockchain, crypto, Web3, or stock market space.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025