Globe’s (GLO) Net Income Plunges 26% for H1 2023

Globe Telecom Inc. (GLO) observed a 26 percent decline in profits during the first half, which prompted a reassessment of its annual projections due to enduring macroeconomic challenges.

According to the company’s financial report, it noted that its earnings had decreased to P14.33 billion in the initial six months, with expenses surpassing the growth in earnings.

The revenue experienced a three percent increase, totaling P89.52 billion, driven by an eight percent surge in the non-service segment, accompanied by a two percent rise in the service category.

On the contrary, expenses went up by four percent to P77.99 billion, with a 10 percent rise in the cost of sales contributing to the reduction in profits. The company also attributed the profit decline to the absence of one-time gains achieved in the previous year from the sale of its data center business.

Going forward, Globe (GLO) adjusted its revenue forecast for the service category, anticipating growth in the mid to low single digits for the year. The telco, led by Ayala, admitted that its subscribers were grappling with price fluctuations, even as inflation had subsided since reaching its peak of 8.7 percent in January.

As explained by the telecom provider, the adjustment takes into account the prolonged inflationary environment that has weakened the purchasing power of Filipino consumers, along with the ongoing decline in their legacy broadband business.

Furthermore, Globe (GLO) reduced its capital expenditures by 25 percent to P37.69 billion in the first semester, compared to P50.49 billion during the same period the prior year. The company is cutting down its capital expenditure to $1.3 billion for this year from the record high of $1.9 billion in 2022.

In the face of a challenging economy, Ernest Cu, the President and CEO of Globe (GLO), maintains an optimistic stance that the mobile giant will achieve its financial targets for the year, especially as it transitions from being solely a telco provider to emerging as a technological innovator.

Cu mentioned that the company had consistently delivered revenue growth in its mobile and corporate data businesses and had notably outperformed the industry by showcasing an upbeat growth trajectory in its digital solutions platforms.

Technical Analysis on Globe (GLO) as of August 18, 2023

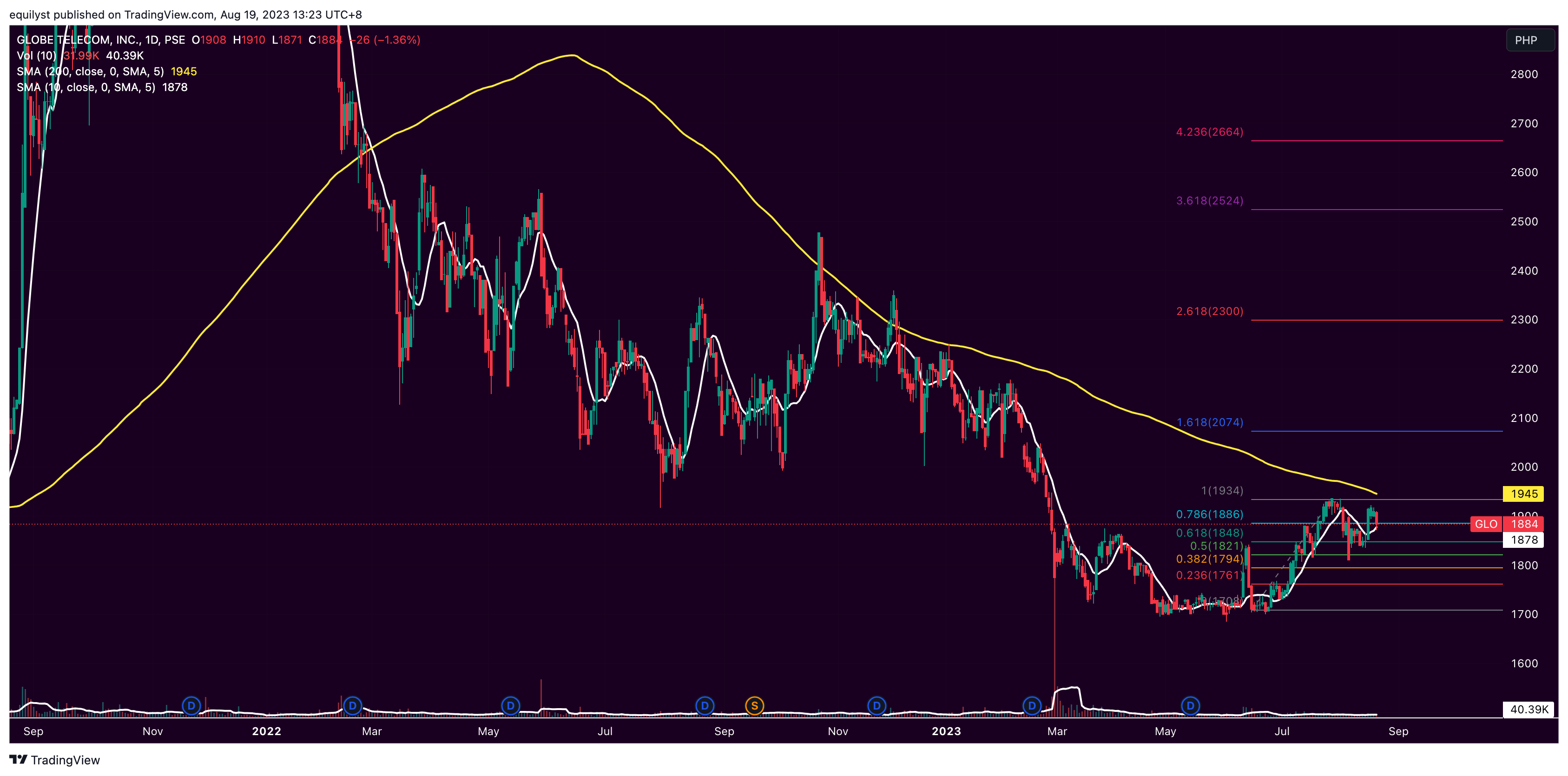

Globe’s (GLO) stock price went down by 20.60% from its December 29’s closing price of P2,180 to its June 30’s closing price of P1,731. On a wider scale, it is down by 13.58% year-to-date as of its closing price of P1,884 on August 18, 2023.

The bullishness of the short-term investors hangs by a thread as Globe’s (GLO) closing price is only P6.00 above its 10-day simple moving average. On the other hand, it is categorically bearish in the long-term since it trades below its 200-day simple moving average.

Globe’s (GLO) immediate support is near P1,820, aligned with the 50% Fibonacci retracement. Resistance is at P1,934. It must maintain its position above P1,848, aligned with its 61.8% Fibonacci retracement, to prevent the chances of breaking down below its immediate resistance.

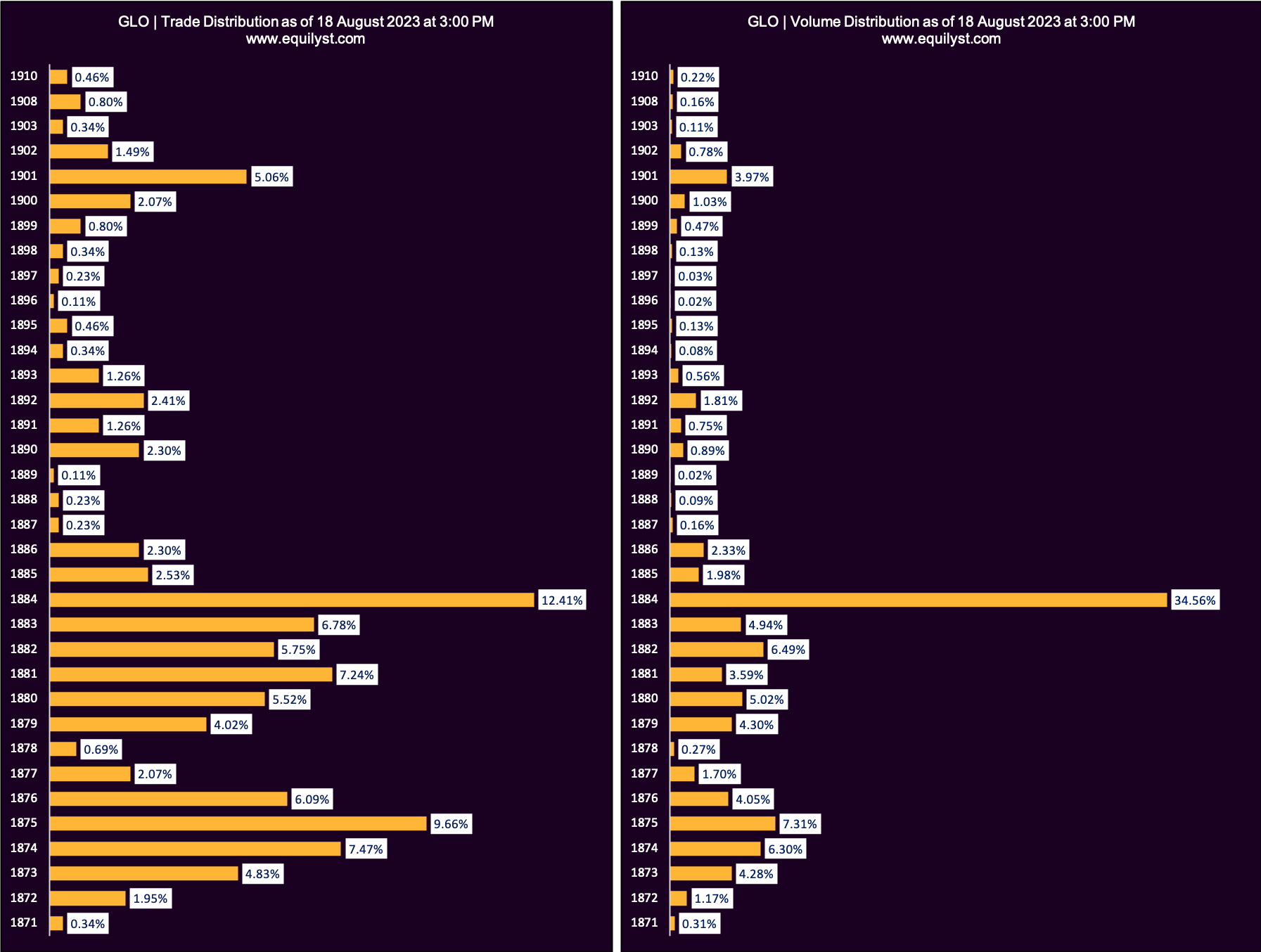

There’s no volatility issue on Globe (GLO) since the majority of its daily volume is higher than 50% of its 10-day volume average.

Meanwhile, the trade and volume distribution of Globe (GLO) on August 19, Friday, favors the bears. The price points with the biggest volume and highest number of trades are between P1,774 and P1,884. That range is closer to the intraday low than the intraday high.

Although Globe’s (GLO) volume-weighted average (VWAP) of P1,882.40 is below its last price, the bearishness of the dominant range supersedes the bullishness of the VWAP. This telecom stock ended with a bearish Dominant Range Index.

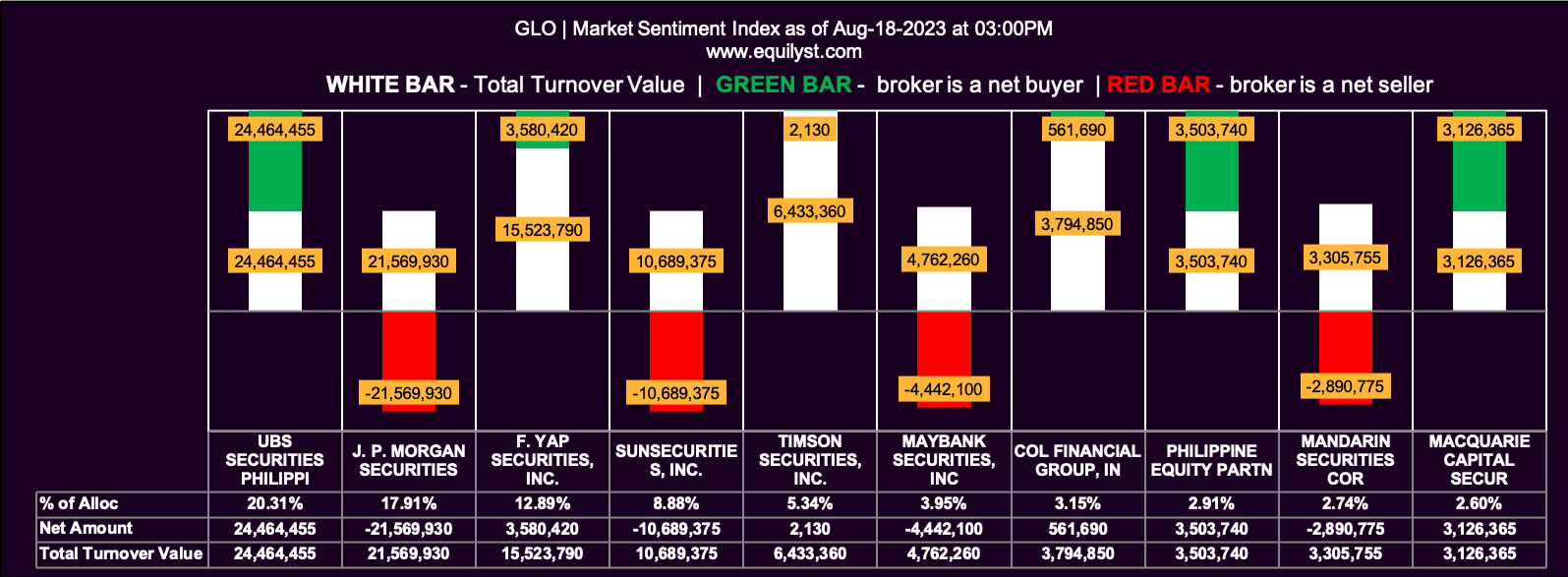

On the other hand, 62.85% of the 35 brokers that participated in trading Globe (GLO) on August 18 registered a positive net amount. Additionally, 60% recorded a higher buying than the selling average. Also, 34.29% printed a 100% buying activity, while only 11.43% transacted a 100% selling activity. Even though their cumulative selling average of P1,884.98 is slightly higher than their buying average of P1,884.95, GLO secured a bullish Market Sentiment Index.

Globe (GLO): Price Forecast for August 22 to 25

The disappointing financial report of Globe (GLO) for H1 2023 mirrors the unsatisfactory performance of its stock price for the same period.

However, it’s a relief for those who already hold this stock that its price decline stopped in June 2023 at the P1,700 level.

This stock needs to break several resistance levels to go back to its peak stock price in 2022.

My price forecast for Globe (GLO) from August 22 to 25 is that it might just continue trading the P1,800 to P1,900 range unless a sentiment-changing news will be printed by the press within the stated week.

If you have Globe (GLO) in your portfolio, check if your trailing stop is still lower than its current price. Otherwise, you should have sold your position already. Remember that your trailing stop is the symbol of the risk percentage that you can handle.

It is not logical to continue holding a bleeding position just because your inherited definition for long-term investing is “investing for five to ten years”.

What’s the point of being loyal to your definition of terms if in your heart of hearts you’re telling yourself you should have sold your position several days, weeks, months, or years ago?

You are welcome to use my stock trading calculators.

If you need my consulting service, you may contact me if your portfolio is worth at least P1 million.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025