Q2 2023: DMCI Holdings 9% Decline in Net Income Amidst Coal and Nickel Woes

DMCI Holdings, a diversified engineering conglomerate, saw a 9% decline in its consolidated net income during the second quarter, going from P9 billion to P8.2 billion. This drop was attributed to reduced contributions from the coal, nickel, and construction sectors.

Excluding a nonrecurring gain of P37 million in 2022 linked to DMCI’s land sale and a nonrecurring loss of P12 million this year due to Maynilad’s donations and net foreign exchange losses, the consolidated core net income decreased by 8%, going from P9 billion to P8.3 billion.

DMCI Holdings’ chairman and president, Isidro A. Consunji, noted that the strong rebound of their power and water businesses played a significant role in shoring up their bottom line. Despite double-digit drops in coal and nickel prices and a downtrend in construction volumes, the company achieved its second-highest Q2 performance ever.

In the first semester, DMCI Holdings reported a consolidated net income of P15.9 billion, marking a 22% decrease from the previous year’s P20.3 billion. This reduction was attributed to decreased coal, nickel, real estate, and construction division contributions. The company’s core net income aligned with its reported net income due to minimal nonrecurring items.

Breakdown of Contributions

During the April to June period, the net income contribution from Semirara Mining and Power Corporation dipped by 5%, moving from a record-setting P6.1 billion to P5.8 billion. This drop was primarily due to weaker coal prices, although it was somewhat offset by increased coal shipments, power generation, electricity sales, and average selling prices.

DMCI Homes’ contribution increased 8% from P1.3 billion to P1.4 billion, thanks to higher finance and other income.

Affiliate Maynilad experienced a 21% improvement in contribution, rising from P393 million to P474 million. This improvement resulted from the enhanced billed volume, favorable customer mix, and an average effective tariff.

Contribution from DMCI Mining declined by 51%, going from P510 million to P250 million. Lower selling prices, a foreign exchange gain, and higher costs primarily drove this decline.

DMCI Power’s contribution increased by 13%, from P205 million to P231 million, attributed to higher electricity sales and reduced fuel costs.

Contribution from D.M. Consunji, Inc. plummeted by 73%, falling from P516 million to P139 million due to slower construction achievements, a decrease in projects, and delays in major projects.

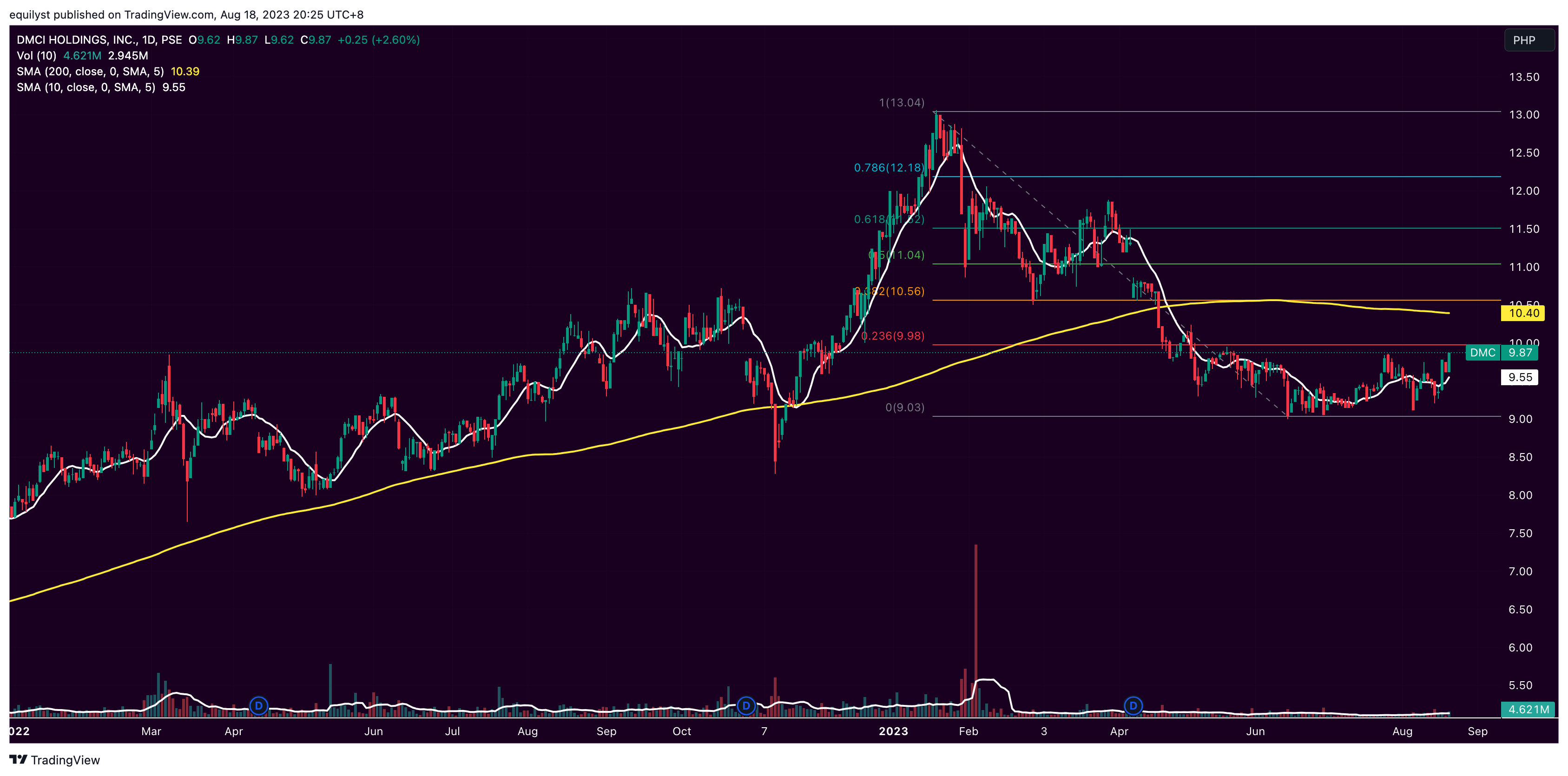

Analyzing DMC’s Price Action for Q2 2023 and August 18, 2023

DMC’s trading price dropped by 21.22% for Q2 2023 from its closing price of P11.50 on March 31, 2023 to its last price of P9.06 on June 30, 2023.

DMC’s trading price dropped by 21.22% for Q2 2023 from its closing price of P11.50 on March 31, 2023 to its last price of P9.06 on June 30, 2023.

DMC’s immediate support is pegged near P9.00, while its resistance is at P10.00. The resistance is aligned with the 23.6% Fibonacci retracement.

DMC is bullish in the short term since it trades above its 10-day simple moving average (SMA). However, it is regarded as bearish in the long term since it trades below its 200-day SMA

Breaking above DMC’s 200-day SMA at P10.60, which is also aligned with the 38.2% of the Fibonacci retracement, will put it in a bullish stance in the long-term perspective.

DMC positively closed the third trading week of August 2023 by 3.89% from August 11th’s P9.50 to August 18th’s P9.87.

August 18th’s green volume bar above 100% of DMC’s 10-day volume average supports the forecast for a potential breakout above the immediate resistance at P10.00 by next week.

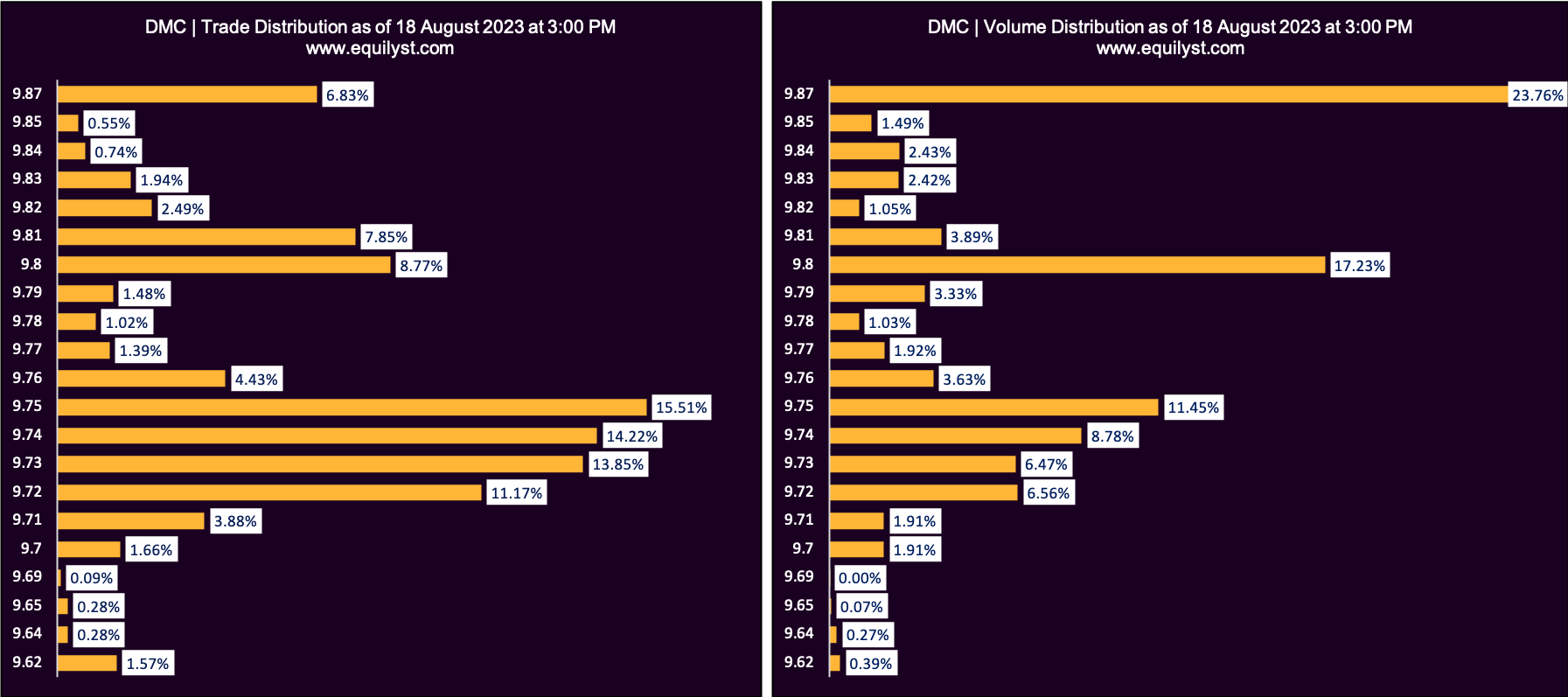

Meanwhile, August 18th’s dominant range between P9.75 and P9.87 boosts confidence for the bulls.

Meanwhile, August 18th’s dominant range between P9.75 and P9.87 boosts confidence for the bulls.

The dominant range refers to the price points with the biggest volume and highest number of trades.

DMC’s last price of P9.87 also soared higher than its volume-weighted average price (VWAP) of P9.79 on August 18. That phenomenon indicates that most investors were willing to buy DMC closer to its intraday high.

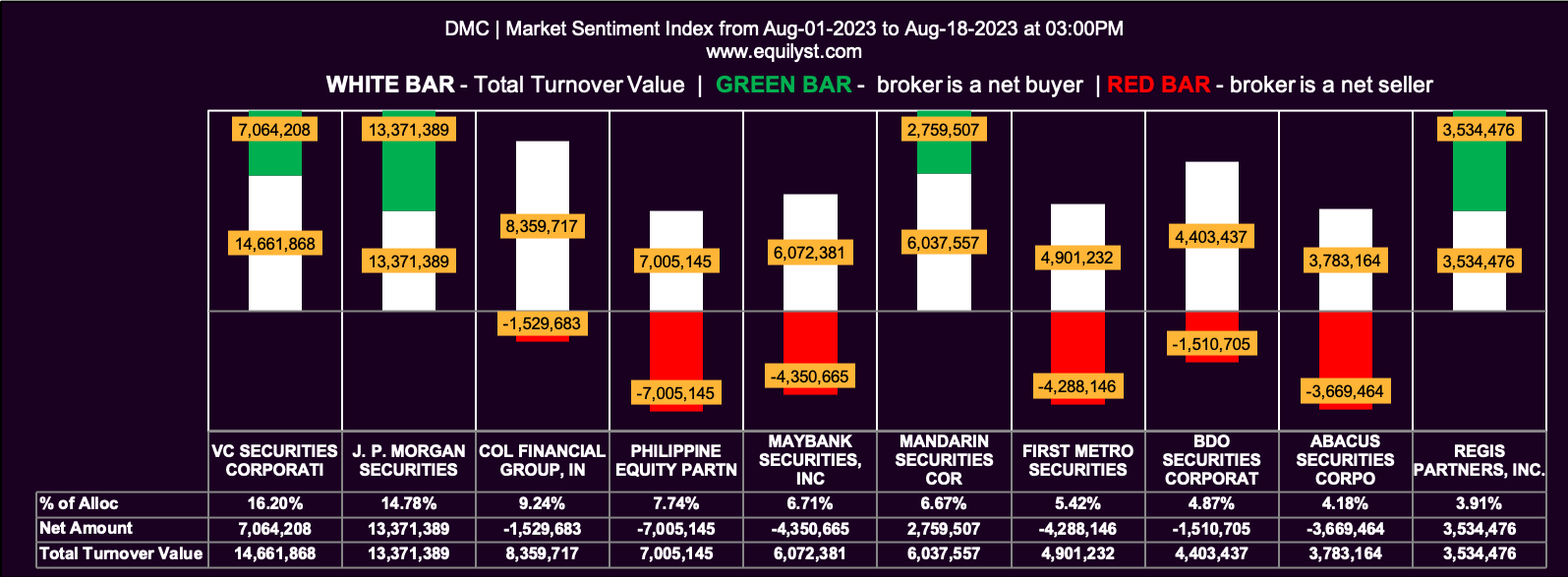

Despite all these positive sentiments from individual indicators, the Market Sentiment Index of DMC for August 18 begs to differ.

Despite all these positive sentiments from individual indicators, the Market Sentiment Index of DMC for August 18 begs to differ.

As of August 18, only 26.09% of the 46 participating brokers of DMC registered a positive net amount. Additionally, only 30.43% registered a higher buying average than the selling average.

The brokers’ transactions also show that the 46 brokers’ selling average of P9.80 is higher than their buying average of P9.77.

Lastly, 47.83% of the 46 participating brokers registered a 100% selling activity, while only 17.39% registered a 100% buying activity.

Summing it all up, the investors’ Market Sentiment Index for August 18 is bearish.

What Could Happen to DMC’s Price Next Week?

If DMC continues to register green volume bars that are at least higher than 50% of its prevailing 10-day volume average, it is likely to break the resistance at P10.00 on or before the end of the next trading week.

Suppose that forecast happens, DMC might draw closer to the median of P10.00 and P10.60 by the end of August.

However, if DMC inconsistently prints that daily volume, it might trade between P9.00 and P10.00.

I advise that you closely monitor your trailing stop, especially since none of the brokers in the Philippines have a trailing stop facility (just a stop loss).

You can use the good-till-canceled, good-till-week, or good-till-month feature, but all those features need a manual adjustment. A trailing stop is still the best way to maximize your potential profits, but it demands monitoring time.

If you have encountered the term “trailing stop” only now, you may use my trailing stop calculator so you will know if you should have sold a long time ago or if everything that has happened is still within your tolerable risk.

If you need further guidance from me, consider availing my stock market consultancy service.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025