LTG’s 1H 2023 Financial Report: P13B Net Income, Down 16% from 1H 2022

LT Group, Inc. (LTG) reported a net income of Php13.00 billion for the initial half of 2023, marking a 16% dip from the Php15.40 billion in the corresponding six months of 2022.

The tobacco sector constituted 45% of the total, while PNB’s contribution stood at 42%, with Tanduay contributing 5%, and Asia Brewery and Eton accounting for 3% and 2% respectively. Victorias Milling Company also chipped in 2%, and Other Income rounded out the picture with 1%.

A distinct cash dividend of Php0.30 per share, totaling Php3.25 billion, was announced in May and disbursed on June 13. Coupled with the dividends declared in March, the total year-to-date dividends reached Php0.60 per share, summing up to Php6.49 billion, reflecting a 25.8% payout rate.

By the end of June 2023, LTG’s Debt-to-Equity Ratio settled at 3.44:1 with the Bank, dropping to 0.13:1 without the Bank. The parent company had a cash reserve of Php1.39 billion.

Tobacco

The tobacco division’s net earnings for the initial half of 2023 closed at Php5.85 billion, marking a 25% decrease from 1H22’s Php7.77 billion. The sector’s volume observed a 20% YoY contraction in 1H23, standing at 21.3 billion sticks. This decrease was predominantly linked to the industry-wide price hike in 1Q23, coupled with heightened incidences of illicit trade and shifts in inventory.

The Government’s anti-illicit trade endeavors remained vigorous, with 359 enforcements in 1H23, a significant rise from the mere 123 in 1H22.

Philippine National Bank (PNB)

PNB’s net earnings using the pooling method registered Php9.76 billion in 1H23, showing a 12% decline compared to the Php11.15 billion recorded in 1H22. The earnings for 1H23 encompassed a Php2.93 billion gain stemming from the asset repossession sale, as opposed to Php5.25 billion in 1H22.

While loans and receivables maintained a steady stance, Net Interest Margin exhibited improvement. Service Fee and Commission Income also demonstrated a positive trajectory.

Provisions for credit losses tallied Php1.57 billion in 1H23, in contrast to a net reversal of Php3.16 billion in 1H22.

Tanduay Distillers, Inc. (TDI)

TDI’s earnings for 1H23 amassed Php626 million, showcasing an 11% increment over the Php564 million disclosed in 1H22.

Both the liquor and bioethanol volumes reported a YoY decline, reaching 14% and 35% respectively. This latter figure was attributed to the shutdown of Asian Alcohol Corporation in October 2022. Despite the 14% volume drop, liquor revenues only slipped by 4% YoY to Php10.96 billion, aided by an Php84 per case price hike in November 2022.

As of June 2023, TDI’s nationwide distilled spirits market share stood at 28.9%, marking a marginal improvement from the 28.5% recorded in June 2022. The Visayas and Mindanao regions, responsible for the bulk of TDI’s sales, saw market shares of 72.2% and 78.1% respectively, compared to 70.3% and 73.8% as of June 2022.

Asia Brewery, Inc. (ABI)

ABI’s earnings for the inaugural half of 2023 notched Php340 million, signifying a 16% surge from the Php294 million in 1H22.

Revenues enjoyed a 3% uptick, rising to Php8.41 billion from Php8.14 billion, attributed to heightened sales volumes of Cobra energy drink and bottled water. Cobra energy drink retained its prominent position with a commanding market share of 58.9%, while Absolute and Summit, the bottled water brands, collectively held the third-largest share at 18.5%.

Eton Properties Philippines, Inc. (Eton)

Eton’s earnings for the initial half of 2023 stood at Php206 million, marking a 20% decrease from the equivalent period in 2022. Leasing revenues, on the other hand, experienced an 8% upswing, amounting to Php960 million compared to Php886 million.

Eton’s current leasing portfolio encompasses approximately 287,600 square meters, with almost 192,000 square meters allocated for office space.

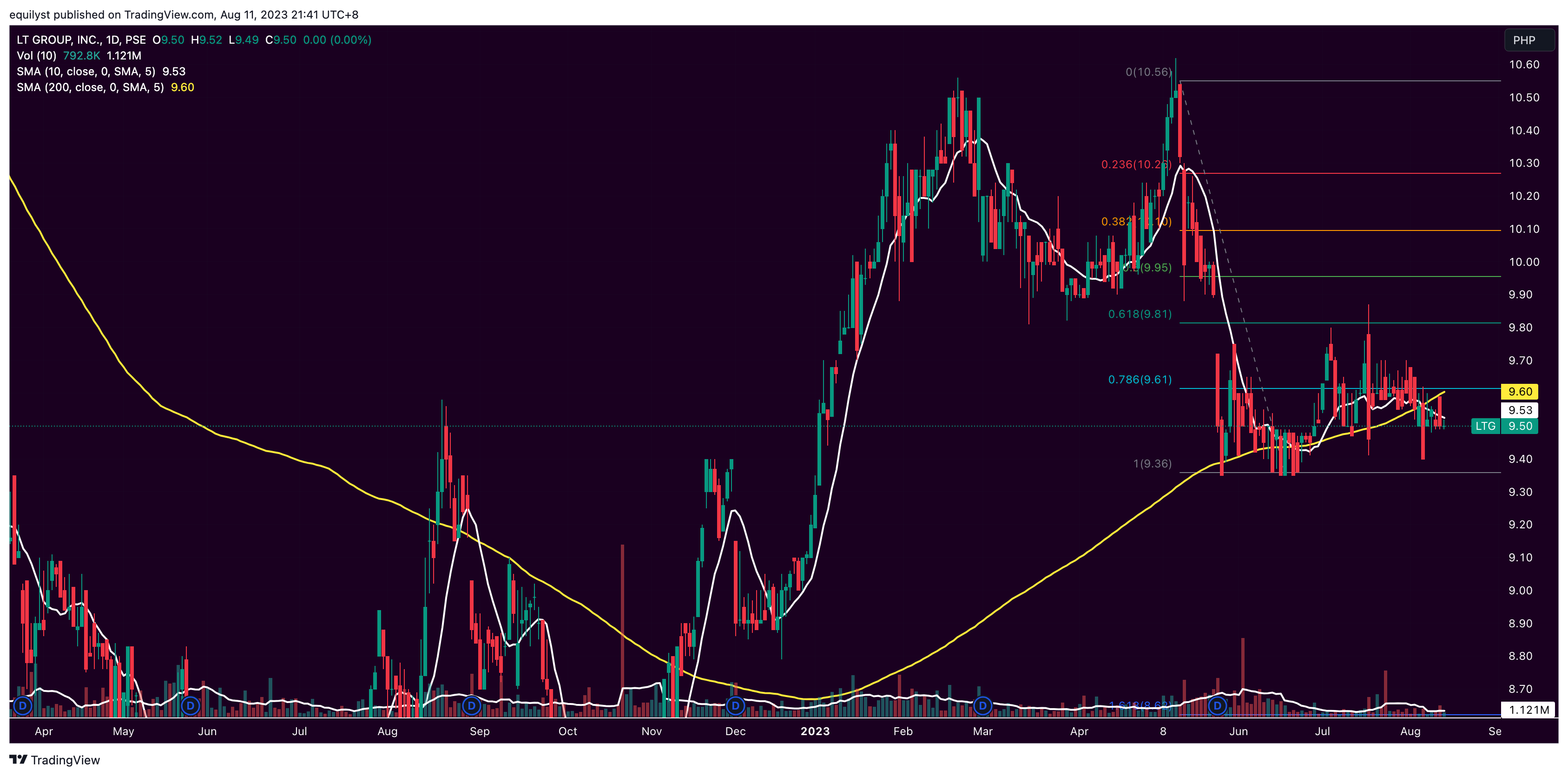

Technical Analysis on LTG as of August 11, 2023

The performance of LTG shows a 1.04% decrease from its closing price of P9.60 on July 31, 2023 to its closing price of P9.50 on August 11, 2023.

Taking a broader perspective, LTG has gained 3.26% from its closing price of P9.20 on December 29, 2022 to its closing price on August 11, 2023.

As an investor, I understand that this 3.26% increase might be considered insignificant, given the relatively high costs of trading on the Philippine Stock Exchange.

Out of this 3.25% increase, approximately 2% remains after accounting for taxes and trading fees.

Imagine speaking to an experienced businessman and asking if a profit of P20,000 from an initial capital of P1 million in eight months would satisfy them.

For me, and perhaps for you as well, a 2% gain doesn’t hold much significance.

The daily chart for LTG reveals that resistance aligns with the 78.6% Fibonacci retracement at P9.60, which coincides with its 200-day simple moving average, representing the long-term trend.

The closing price on August 11, 2023, remains consistent with the previous trading day’s, and its volume is below 100% of LTG’s 10-day volume average. This does not contribute positively to a bullish outlook on LTG.

Compounding the bearish signals, LTG’s volume-weighted average price (VWAP) is tied to the closing price of P9.50 today, further emphasizing a bearish sentiment.

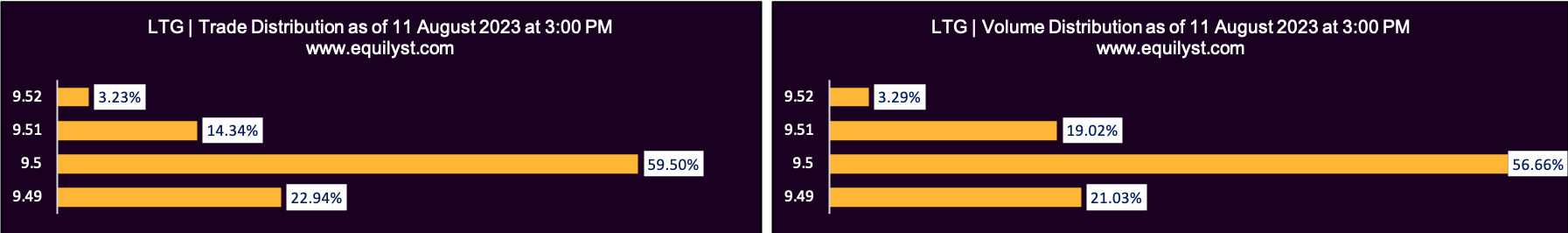

Now, observe the Trade-Volume Distribution chart I shared earlier. Where do you notice the highest volume and the most trades occurring?

These instances are closer to the intraday low than the intraday high, leading to a bearish Dominant Range Index.

Curious about the implications? This points toward a probable continuation of the downtrend.

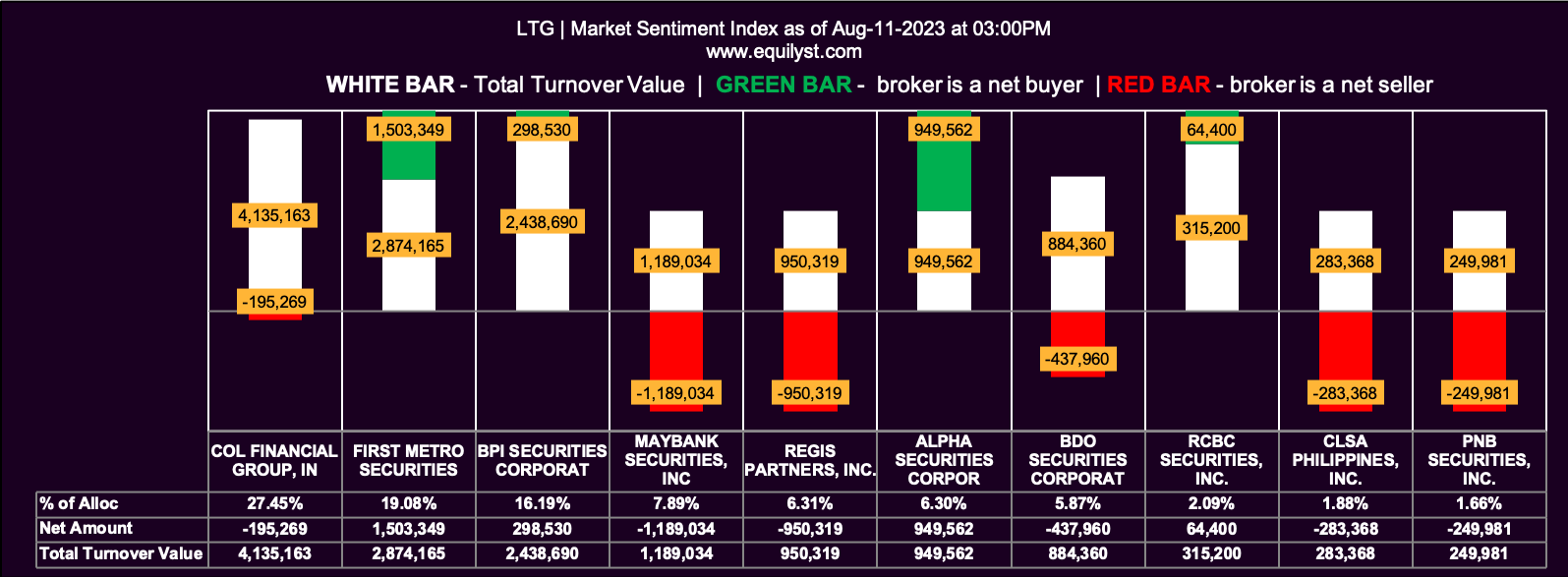

Will today’s market sentiment lean in favor of the bears as well? Let’s explore that.

Twenty brokers engaged in LTG trading today. Among them, 60% registered a positive net amount.

On an individual basis, 50% of these brokers demonstrated a higher buying average compared to their selling average. Collectively, the 20 brokers held a selling average of P9.50046, exceeding their buying average of P9.49885.

In the meantime, 35% of these brokers recorded a 100% buying activity, while 30% engaged in a 100% selling activity.

Overall, the Market Sentiment Index for August 11, 2023 is indicative of a bullish sentiment.

For a detailed discussion of LTG’s overall Market Sentiment Index for the month, I reserve that information for my clients.

Wrapping It Up

Drawing from LTG’s financial report for the first half of 2023, I haven’t identified any fundamentally alarming concerns regarding the key metrics.

However, does this assurance translate to a definitive decision to purchase? Not necessarily. I must also factor in my technical analysis.

Considering my analysis and personal risk threshold, I currently don’t envision increasing my position or initiating a new one with LTG.

Once LTG reaches or surpasses the P9.60 mark, I’ll undertake a fresh evaluation to ascertain whether my proprietary methodology signals a buying opportunity.

Should a buy signal emerge, I’ll proceed to assess the reward-to-risk ratio. If I find the ratio satisfactory, I’ll opt to purchase within or near the dominant range. The process remains straightforward.

In the event that reality doesn’t align with my analysis, I’ve established an exit strategy through my trailing stop.

Would You Like to Hire Me as Your Stock Investment Consultant?

Read my five to ten stock analyses on this website first for you to get a good feel of my analytical skills and investment psychology. Hire me as your equity investment consultant if you like how I analyze. I’ve been an equity investment consultant since 2012. Message me here.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025