Semirara Q2 Profit Slides 5%, But H1 Sees Strong Earnings

Semirara Mining and Power Corporation (SMPC), an integrated energy company, has reported a net income of P10.2 billion in the second quarter, marking a 5% decrease from its record high of P10.8 billion in the previous year.

Despite facing significant corrections in global coal index prices and the impact of a high base effect, SMPC managed to achieve strong financial results. This was attributed to increased coal shipments, improved plant availability, and higher electricity sales at elevated prices.

Comparing the second quarter of 2023 to the first quarter of the same year, Semirara’s net income saw a growth of 13%, reaching P9 billion. However, over the first six months of the year, Semirara’s earnings experienced a decline of 26%, dropping from P25.8 billion to P19.2 billion. This decline was primarily due to the influence of the high base effect and the normalization of coal indices.

Between January and June, the average Newcastle price witnessed a steep 54% decrease, plummeting from US$320.3 to US$148.9. Simultaneously, the average ICI4 price decreased by 17%, from US$85.7 to US$71.

Maria Cristina C. Gotianun, the President and COO of SMPC, noted that despite lower coal prices, the company delivered its second-best first half results. She attributed this success to the recovery in China’s demand and the improved performance of Sem-Calaca Power Corporation (SCPC) Unit 2. Gotianun expressed anticipation of challenges in the second half due to the rainy season and planned shutdown of power plants. However, she remained optimistic, citing the company’s high starting inventory and strategic shift to the spot market.

Coal Operating Results

In the second quarter alone, total shipments witnessed a 22% increase, rising from 3.7 million metric tons (MMT) to 4.5 MMT. This growth was driven by higher deliveries to China and South Korea. Shipments to China surged by 75%, from 0.8 MMT to 1.4 MMT, while shipments to South Korea increased by 21%, from 0.8 MMT to 1.0 MMT.

Domestic sales remained steady at 1.9 MMT, as a 33% decrease in demand from cement factories and a 50% decrease from other industrial plants offset the 14% increase in sales to SMPC-owned plants.

During the same period, the average selling price (ASP) of Semirara coal dropped by 23%, declining from its record high of P5,399 per metric ton (MT) to P4,151 per MT. This decline was attributed to multiple factors including the onset of rains and ongoing stripping activities.

Power Operating Results

From April to June, the overall plant availability experienced a substantial increase of 25%, rising from 64% to 80%. This improvement was attributed to the enhanced availability of SCPC Unit 2, which commenced commercial operation on October 9, 2022. This development led to a 35% increase in the total average capacity, from 509 megawatts (MW) to 685 MW.

As a result, total gross generation saw a growth of 27%, rising from 956 gigawatt hours (GWh) to 1,212 GWh. Consequently, total power sales increased by 22%, reaching 1,097 GWh from the previous 900 GWh. The majority (66%) of these sales were directed to the spot market.

Benefitting from higher uncontracted capacity and robust demand due to warm temperatures, spot sales surged by 42%, climbing from 507 GWh to 720 GWh. In contrast, bilateral contract sales experienced a slight decline of 4%, decreasing from 393 GWh to 377 GWh, as SMPC continued to prioritize the spot market.

The overall average selling price (ASP) observed a 17% increase, rising from P5.30/kilowatt hour (kWh) to P6.22/kWh. This increase was primarily influenced by higher spot sales, a 3% uptick in average spot prices, and a 40% uptrend in average bilateral contract prices.

As the second quarter came to a close, only 27% of the 710MW dependable capacity of SCPC and SLPGC were contracted. After accounting for station service, which varies periodically, the power segment had 462.6MW available for sale to the spot market.

Semirara Analysis: Red Numbers, Green Candles, and Bored Holders

If you purchased Semirara between August and October of 2022 and are still holding your position, while you’re telling me, with a cringy facial expression, that you’re content with that 28% to 33% paper loss, I have two words for you: “Humor me.”

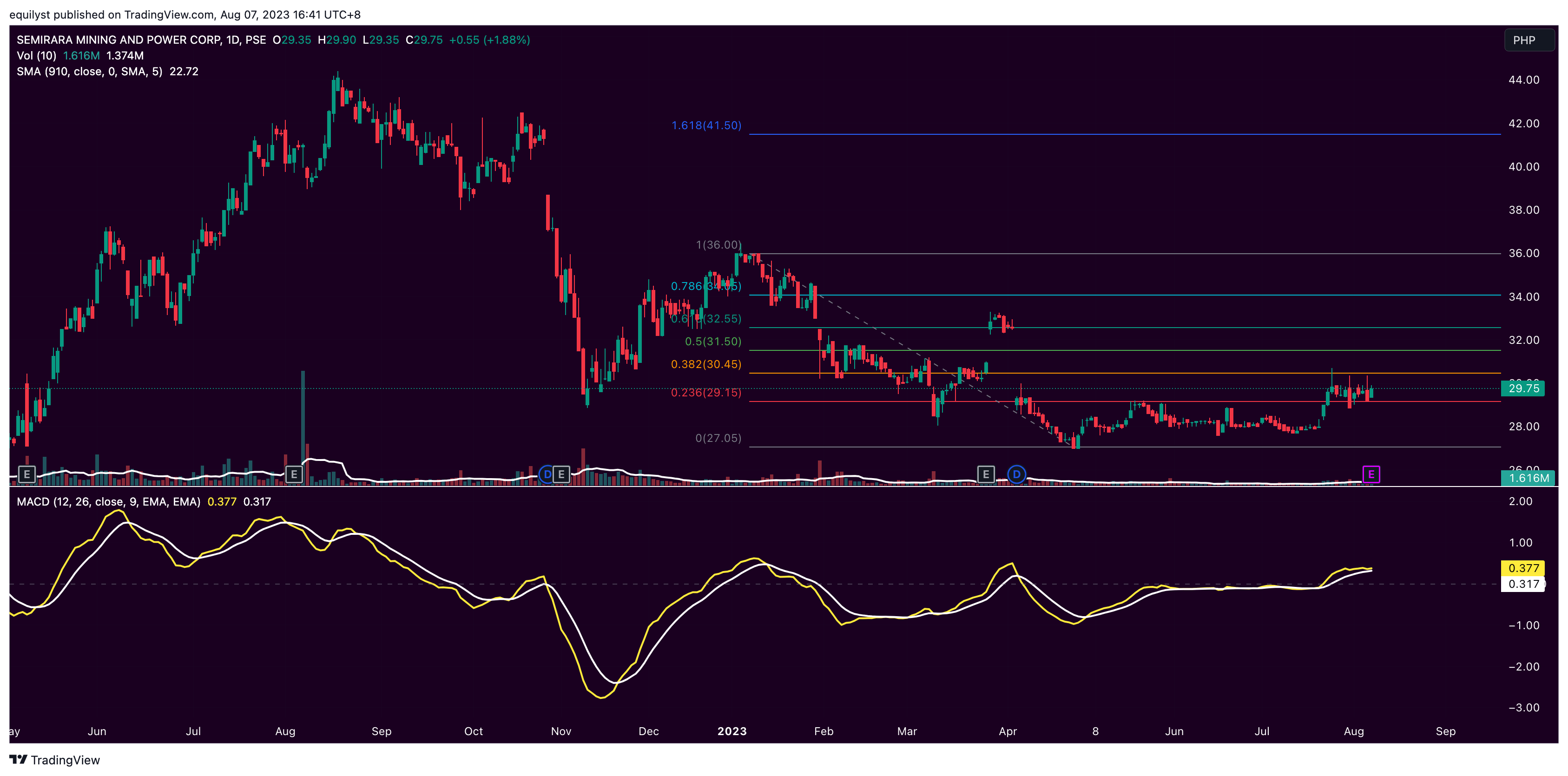

Semirara has experienced an almost 14% decline year-to-date. Although it closed positively on Monday by 1.88% at P29.75 per share, this increase wasn’t sufficient to bring it closer to its resistance at P30.45 compared to its support at P29.15.

Today’s positive change is supported by bullish volume exceeding 100% of its 10-day volume average. Should Semirara form a green candlestick with a volume surpassing 100% of its 10-day volume average, there’s a possibility of breaking the resistance within this trading week. However, if the green candlesticks are matched by a volume just slightly above 50% of the 10-day volume average, Semirara might move sideways.

A breach of the support level would potentially lead to a test of a deeper support at P27.

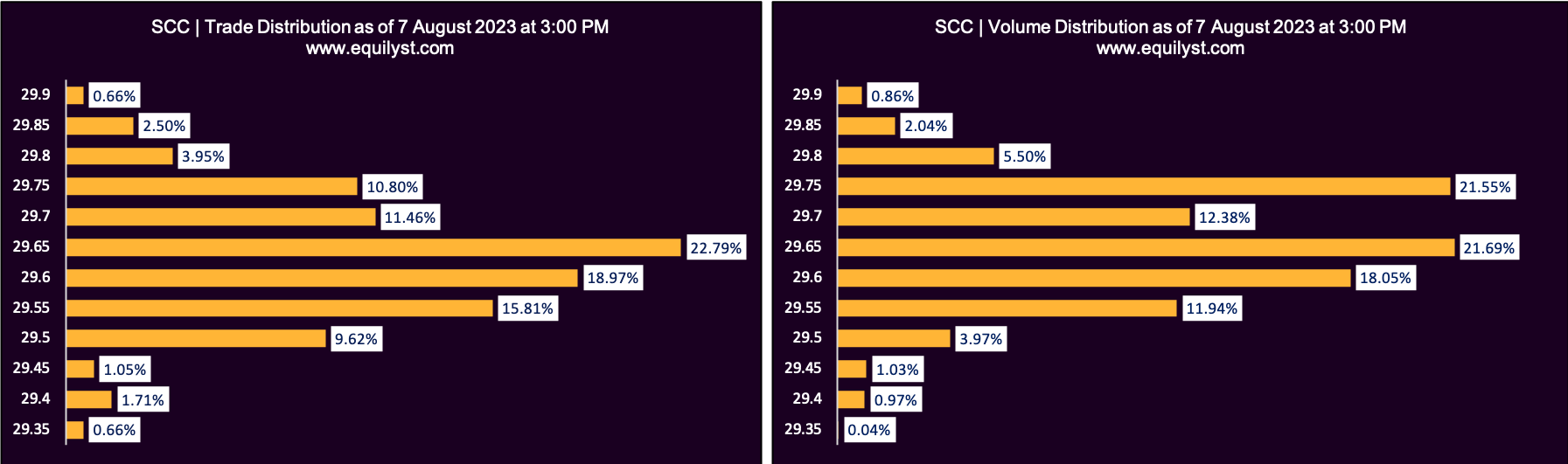

Meanwhile, my Dominant Range Index has assigned a bullish rating to Semirara. The dominant range, spanning from P29.50 to P29.75, is closer to the intraday high than the intraday low. This range boasts the highest volume and the greatest number of trades. Moreover, the fact that the last price exceeds the volume-weighted average price (VWAP) of P29.66 adds to its positive attributes.

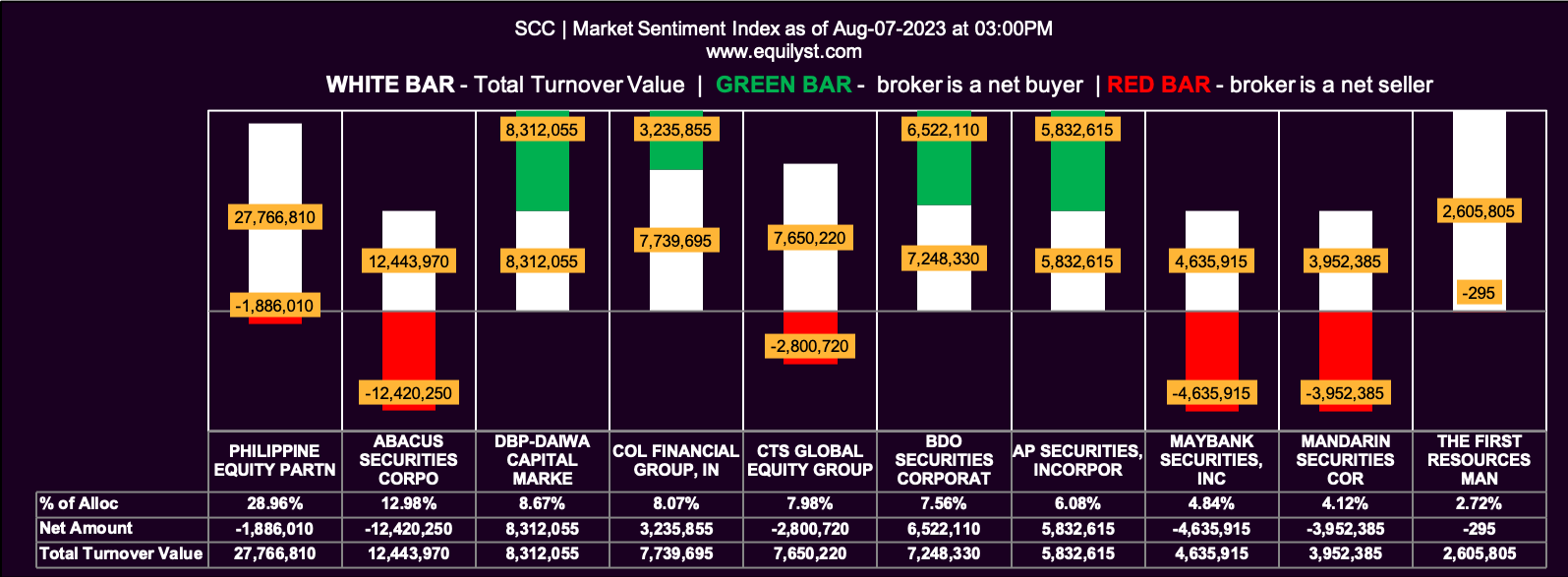

All the factors mentioned above suggest short-term bullishness for Semirara. However, today’s Market Sentiment Index contradicts this for the stock. Evaluating it based on the average selling of the 28 trade participants, it seems that some traders have viewed today’s green candlestick as an opportunity to sell on strength. It’s possible that these traders are bored holders who have maintained their positions longer than necessary.

Market Sentiment Index: BEARISH

Out of the 28 participating brokers, 14, or 50.00% of all participants, have registered a positive Net Amount.

Similarly, 13 of the 28 participating brokers, or 46.43% of all participants, have recorded a higher Buying Average compared to the Selling Average.

Buying Average of 28 Participating Brokers: ₱29.65681

Selling Average of 28 Participating Brokers: ₱29.65161

Among the participants, 7 out of 28, or 25.00%, have engaged in 100% BUYING activity, whereas 8 out of 28 participants, or 28.57%, have participated in 100% SELLING activity.

Wrapping It Altogether

Will I increase my position in Semirara if I have it? Not at this point. I intend to wait until its Market Sentiment Index turns bullish. I plan to continue observing until Tuesday or Wednesday, ensuring that I’m adding more funds to a stock that won’t merely move sideways for the week or month ahead.

However, the status of my trailing stop is more important than that question. It wouldn’t be logical to consider buying more if my trailing stop has already been triggered. My non-negotiable rule is to sell once my trailing stop gets hit.

For those who don’t yet hold Semirara, my strategy remains consistent: remain on the sidelines and keep monitoring.

If Semirara continues to rise, and I haven’t entered at the range of P29.50 to P29.75, I won’t be distressed. While I appreciate earning from trading, I’m not in a desperate rush. I prioritize mental peace over monetary profit.

Hire Me as Your Consultant

Read my five to ten stock analyses on this website first for you to get a good feel of my analytical skills and investment psychology. Hire me as your equity investment consultant if you like how I think. I’ve been a stock trading and investing consultant since 2012. Message me here.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025