How’s Universal Robina Corp’s (URC) Financial Performance for 1H of 2023?

Universal Robina Corp. (PSE:URC) recorded a first-half net income of P7 billion, an increase of 8% compared to the previous year.

The sales for the initial six months, ending on June 30, amounted to P78.6 billion, representing an 11% rise from the same period last year.

According to URC President and CEO, Irwin Lee, despite facing higher input costs and inflationary pressures, the company managed to maintain its sales momentum and improve margins compared to the previous year.

He emphasized that URC’s primary focus would remain on achieving profitable growth by leveraging its strong brands and consistent operating discipline, all while ensuring consumer satisfaction with their diverse food choices.

Across the region, all business divisions experienced growth, reflecting robust consumer demand.

The Branded Consumer Foods (BCF) segment achieved sales of P54.1 billion during the first half.

In the Philippines alone, BCF witnessed a 7% increase in sales, generating revenues of P37.4 billion.

BCF International also saw a significant expansion, with sales growing by 7% to reach P16.8 billion. The growth was primarily driven by Vietnam, Malaysia, and Myanmar markets.

Meanwhile, the Agro-Industrial & Commodities (AIC) segment achieved sales of P23.8 billion, marking a notable 23% growth compared to the same period last year. This growth was attributed to increased sales in sugar and renewables, along with strong feeds sales by the Agro-Industrial Group.

URC’s Hong Kong subsidiary received recognition at an annual event honoring partner brands of Park ‘n Shop, a prominent supermarket chain in Hong Kong.

The Outstanding Advancement Brand Award was awarded to URC Hong Kong for its Jack ‘n Jill-branded Potato Chips, Roller Coaster, and Beef Crunchies, which significantly contributed to Park ‘n Shop’s 32% business growth.

Additionally, the company received the Exclusive Product Collaboration Award for its close collaboration with Park ‘n Shop, resulting in the development of custom-made flavors of Potato Chips under the Jack ‘n Jill brand, including Tom Yum and Black Truffle flavors, leading to substantial growth in 2022.

Where Will Universal Robina Corp (URC) Likely Go Next Week?

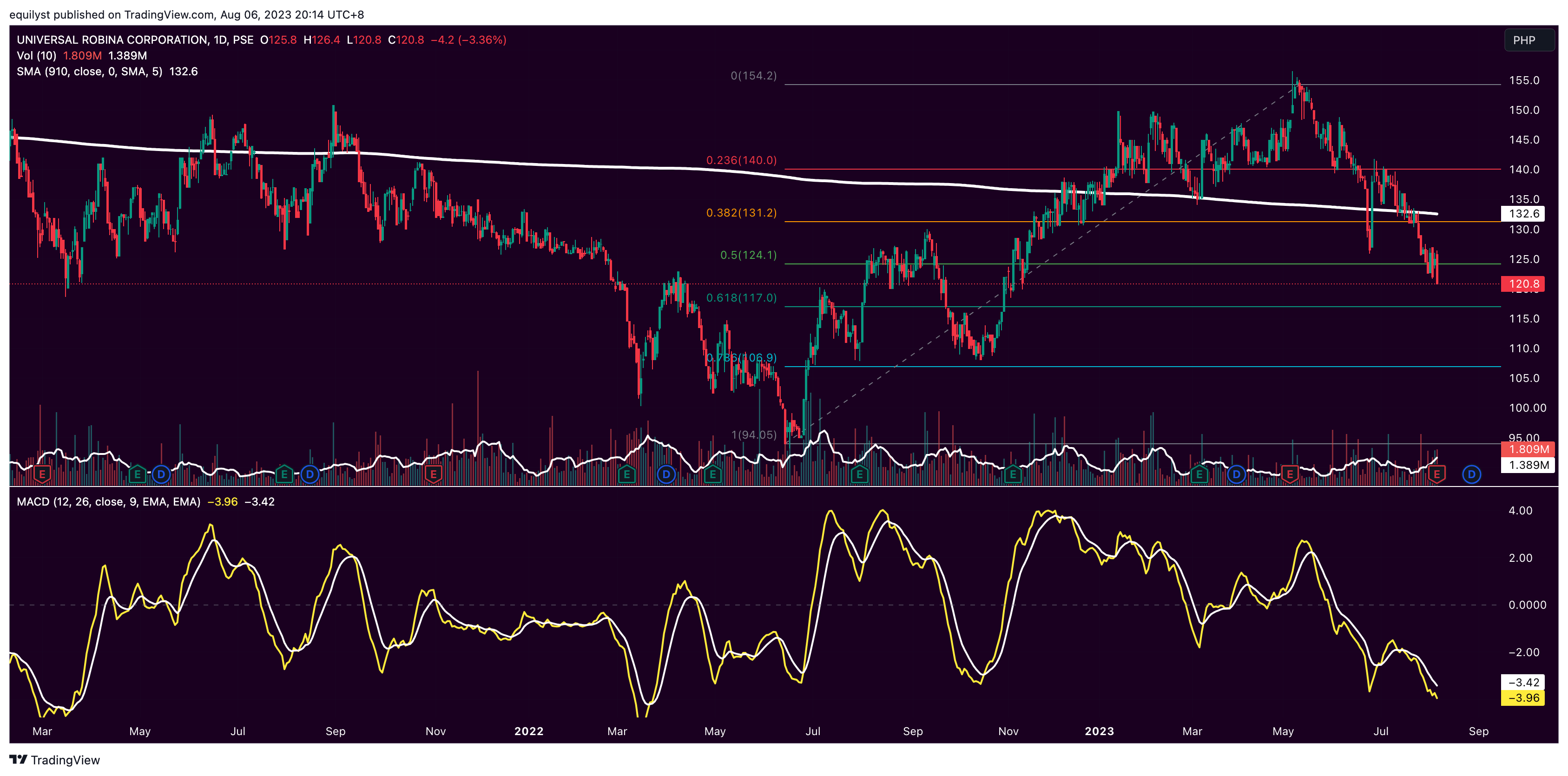

URC’s last price continues to bearishly distance itself away the 10-day simple moving average (SMA). It concluded Friday at P120.80 per share, down by 3.36%.

URC declines month-to-date and year-to-date, -2.97% and -11.18%, respectively.

Support is at P117.00, while resistance is at P124.10.

Last Friday’s bearish engulfing candlestick was supported with a bearish volume that is greater than the 100% of its 10-day volume average.

Given that volume, it’s likely for URC to test the strength of the support near P117 this coming week. If and when it touches and breaks below P117, the next support level will be P107. P117 is aligned with the golden ratio of the Fibonacci.

URC’s moving average convergence divergence (MACD) line also backs the bearish forecast this coming week. There’s no visible formation of a bullish reversal on the MACD’s histogram.

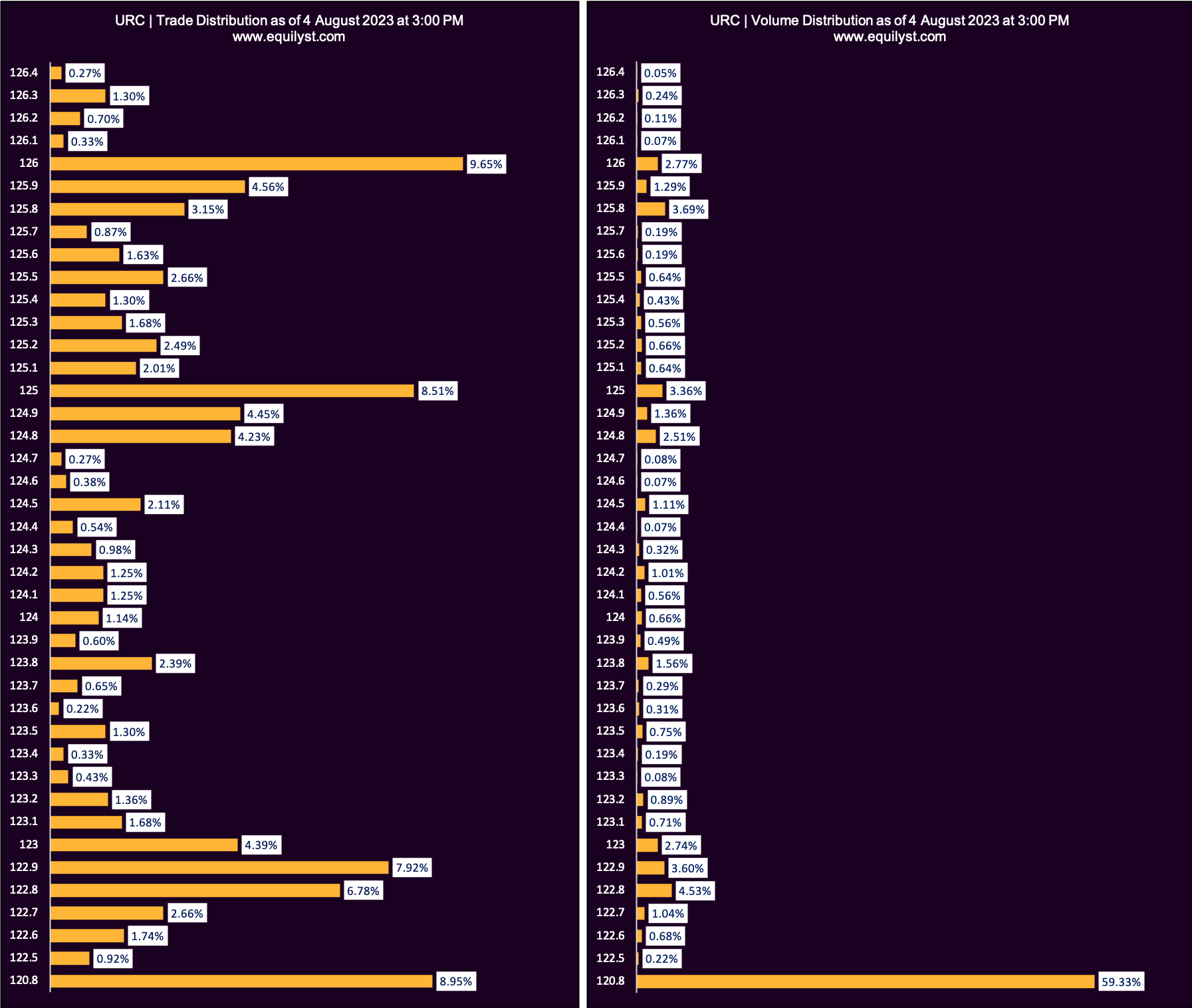

The dominant spot at P120.80 adds up to the bearish sentiment. That price is the intraday low itself. The volume-weighted average price of P122.21 is higher than the last price of P120.80, and that takes the side of the bears, too. For that, URC’s Dominant Range Index is bearish.

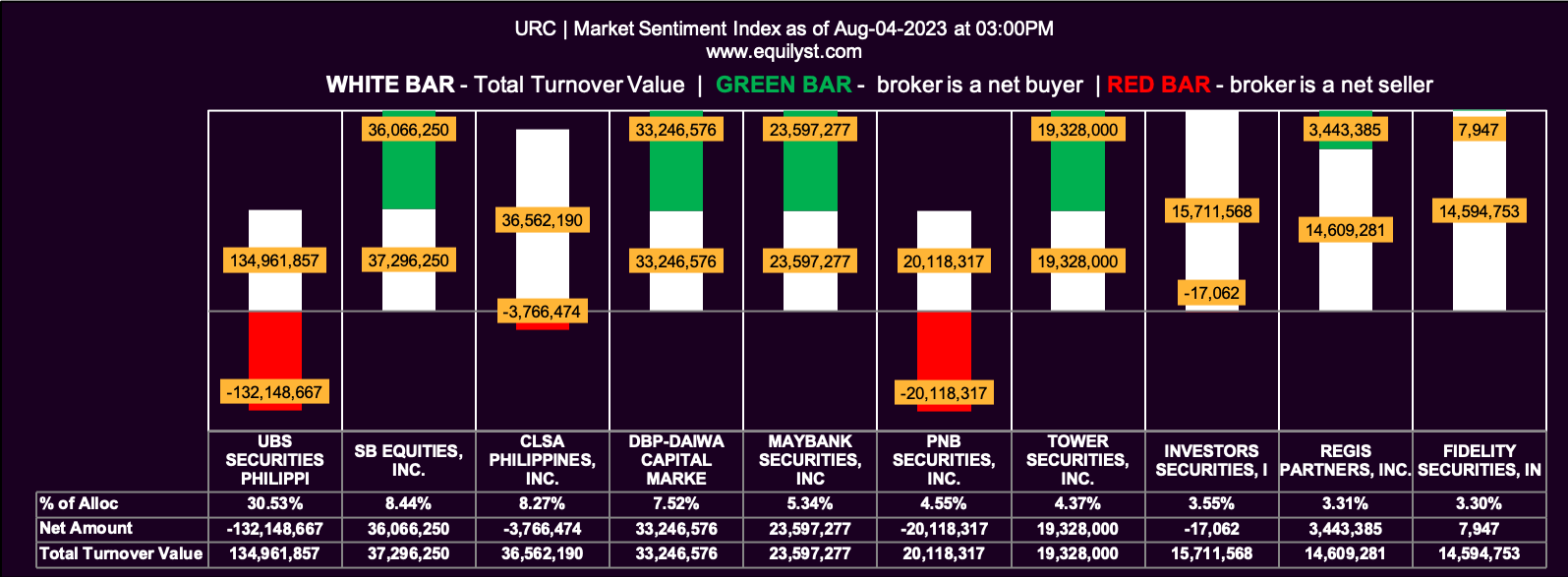

Now, here’s the indicator that new entrants and present holders have been waiting for – the bullish Market Sentiment Index. Apparently, bluechip investors bought the dips.

What makes it bullish? See the statistics below.

Market Sentiment Index: BULLISH

38 of the 50 participating brokers, or 76.00% of all participants, registered a positive Net Amount

33 of the 50 participating brokers, or 66.00% of all participants, registered a higher Buying Average than Selling Average

50 Participating Brokers’ Buying Average: ₱122.36790

50 Participating Brokers’ Selling Average: ₱123.67349

23 out of 50 participants, or 46.00% of all participants, registered a 100% BUYING activity

5 out of 50 participants, or 10.00% of all participants, registered a 100% SELLING activity

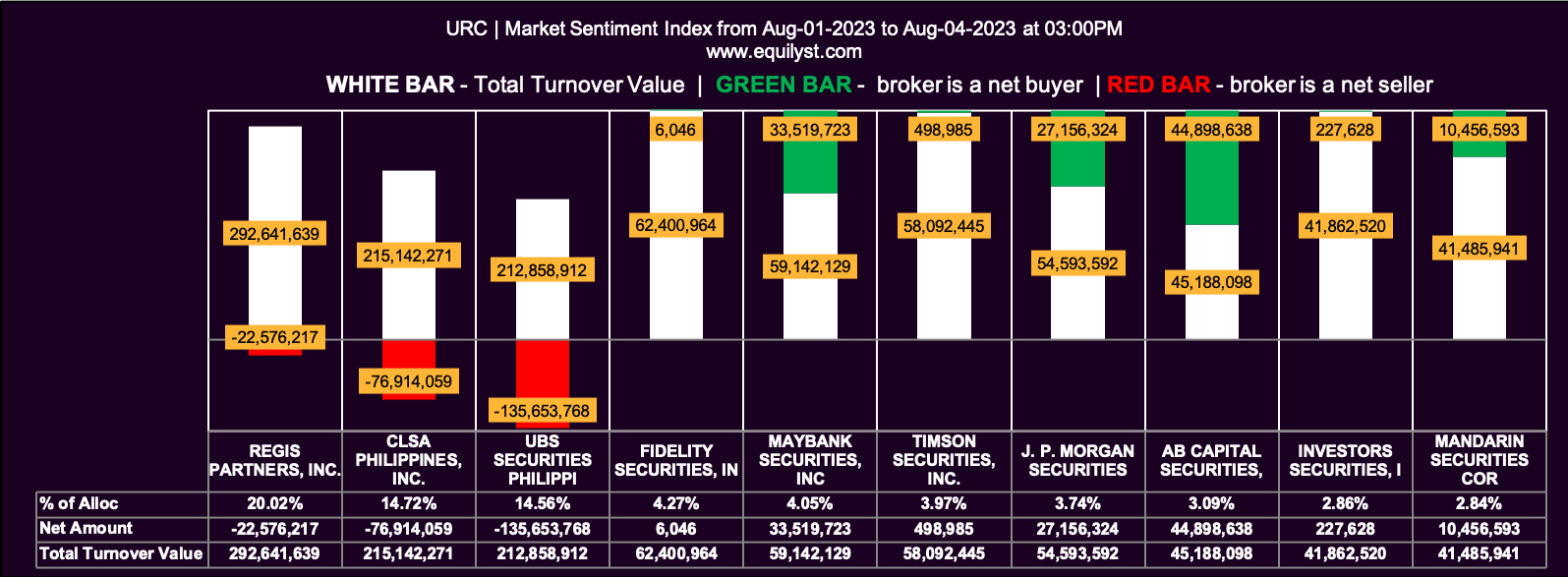

This contrarian sentiment didn’t only start on Friday. It’s actually a month-to-date sentiment also!

Market Sentiment Index: BULLISH

51 of the 67 participating brokers, or 76.12% of all participants, registered a positive Net Amount

37 of the 67 participating brokers, or 55.22% of all participants, registered a higher Buying Average than Selling Average

67 Participating Brokers’ Buying Average: ₱123.23691

67 Participating Brokers’ Selling Average: ₱124.40132

22 out of 67 participants, or 32.84% of all participants, registered a 100% BUYING activity

4 out of 67 participants, or 5.97% of all participants, registered a 100% SELLING activity

Wrapping It Altogether

If I have an available slot in my watchlist, I’ll definitely add URC.

Once all six parameters of my proprietary methodology turn bullish, I’m going to compute my initial trailing stop and reward-to-risk ratio using my calculators. Yes, you’re free to use them, too.

If the reward-to-risk ratio looks attractive, I’m going to test buy within or near the prevailing dominant range of this stock.

The dominant range is the price point or points with where at least 50% of the total trades and total volume are registered.

For now, I’ll just watch URC as it draws closer to P117. I’ll wait for signs of selling exhaustions. Judging it on last Friday’s volume, sellers aren’t done yet.

I don’t contradict your take if you bought the dips last Friday or if you plan to buy on Monday. You’re good as long as your decision is data-driven regardless of whether you do fundamental or technical analysis. You’ll be fine as long as you have an exit strategy that is relative to your tolerable risk percentage.

Need Help on How to Decide Based on your Risk Tolerance?

Optimize your stock portfolio for maximum returns with our Stock Portfolio Rehabilitation Program.

Become a TITANIUM client to gain knowledge on capital preservation, protecting gains, and minimizing losses while trading and investing in the Philippine stock market.

Become a PLATINUM client to receive comprehensive technical analysis and personalized recommendations based on your entry price, average cost, investment goals, and risk tolerance.

Become a GOLD client to engage in teleconsultations with our team while trading occurs, providing real-time guidance over the phone.

- Key Prices for PH Bluechip Stocks 30% Above 52-Week Low - June 4, 2024

- May 2024 Market Sentiment Rating of 30 PH Bluechip Stocks - June 3, 2024

- EquiTalks: ICT, BPI, AEV Updates – 5.29.2024 - May 29, 2024