What’s the Latest With PSE:CNVRG?

Converge ICT Solutions (PSE:CNVRG) is revising its capital expenditure guidance for 2023 to maximize its existing fiber line portfolio.

The company plans to cap its investments at a maximum of P10 billion in 2023, down from the initial estimate of spending between P12 billion and P15 billion, which was lower than the P22 billion invested in 2022.

According to Dennis Anthony Uy, CEO and co-founder of Converge, the company aims to reduce this year’s investment to below P10 billion.

Despite focusing on redundancy and expansion, their primary goal is to decrease capital expenditures.

As of March, Converge has installed a total of 8.34 million fiber ports nationwide, while having 1.92 million subscribers.

This leaves around six million unutilized ports, and Uy emphasizes the need to maximize these remaining lines.

Their approach is now more targeted, prioritizing increased take-up in most markets and selective spending for special-needs markets, moving away from a shotgun approach in infrastructure development.

During its early years in business, Converge invested heavily in asset expansion, providing the company with fiscal flexibility to reduce operational expenses moving forward.

Uy believes that despite the reduced spending, the company’s revenue will continue to improve, especially with the introduction of low-cost services.

Converge entered the prepaid market in June with its retail product, Surf2Sawa, designed to serve the broadband needs of low-income families.

Since its launch, Surf2Sawa has already gained more than 60,000 subscribers.

Converge plans to attract at least 120,000 customers for Surf2Sawa this year and has set a target of reaching one million subscribers by 2025.

The company is focused on expanding its services to some of the poorest areas, where families find it challenging to afford postpaid plans.

Is PSE:CNVRG About to Go More Bearish?

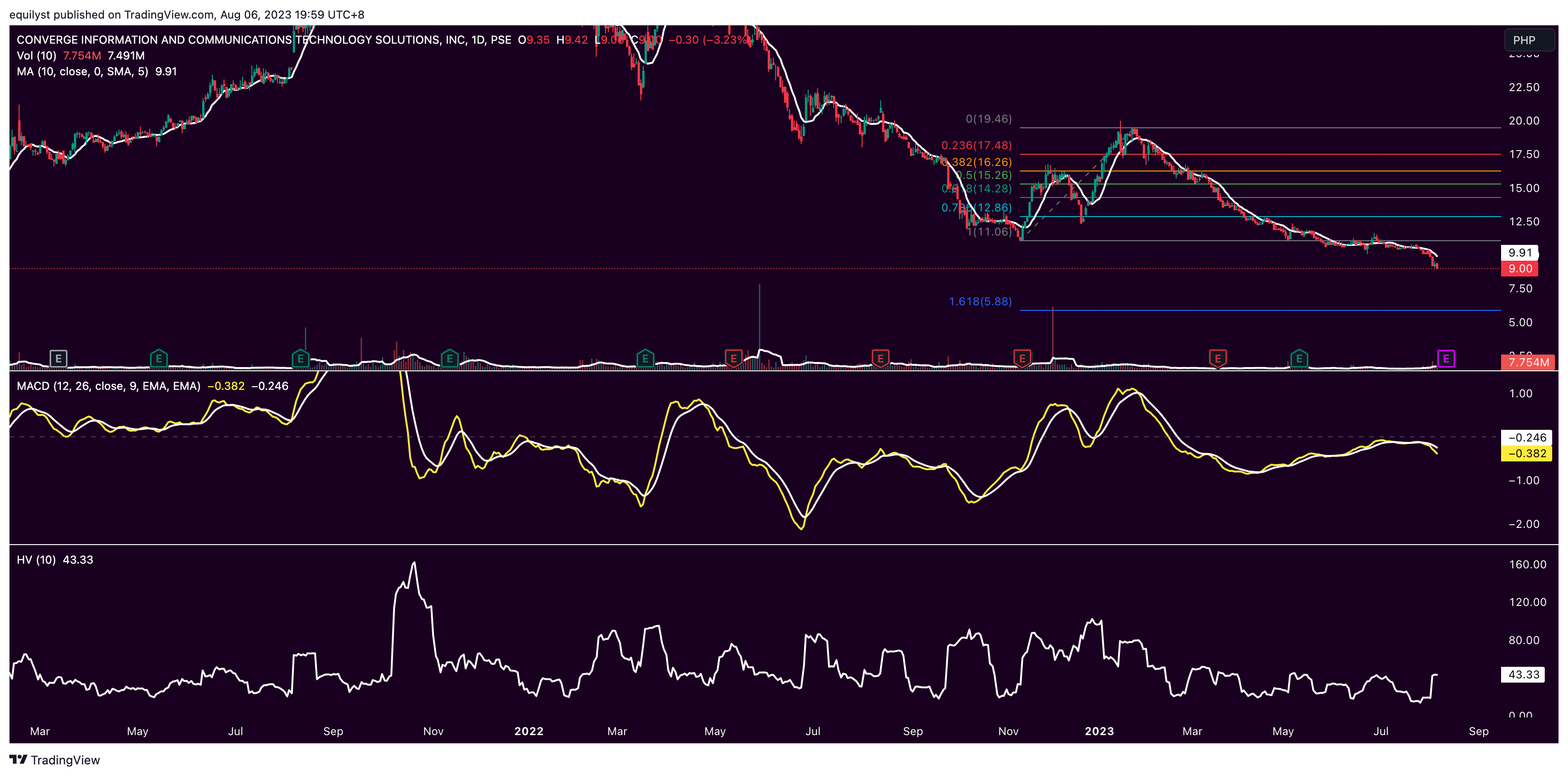

Meanwhile, PSE:CNVRG continues to dig as it registered its new all-time low on Friday at P9.00 per share, down by 3.23%.

Last Friday’s descent came with a volume bigger than 100% of its 10-day volume average. It means holders were decided to join the seller’s bandwagon.

If this bearishness continues, PSE:CNVRG might test the psychological support at P5.90, confluent with the 61.8% Down Fibonacci extension. Resistance is at P11.00.

I’ve seen so many screenshots of portfolios with CNVRG on stock market-related Facebook Groups lately. For the fear of getting bashed for letting their paper loss grow beyond unrealistically tolerable level, traders posted anonymously. It’ll never be a good idea to cling on sheer hope in times like this. You must have an exit strategy even before you buy the stock. Having a trailing stop is the answer. Give yourself a break from Warren Buffet’s quotes, people.

There are no signs of recovery on PSE:CNVRG. The bearish gap between its moving average convergence divergence (MACD) and its signal line keeps growing.

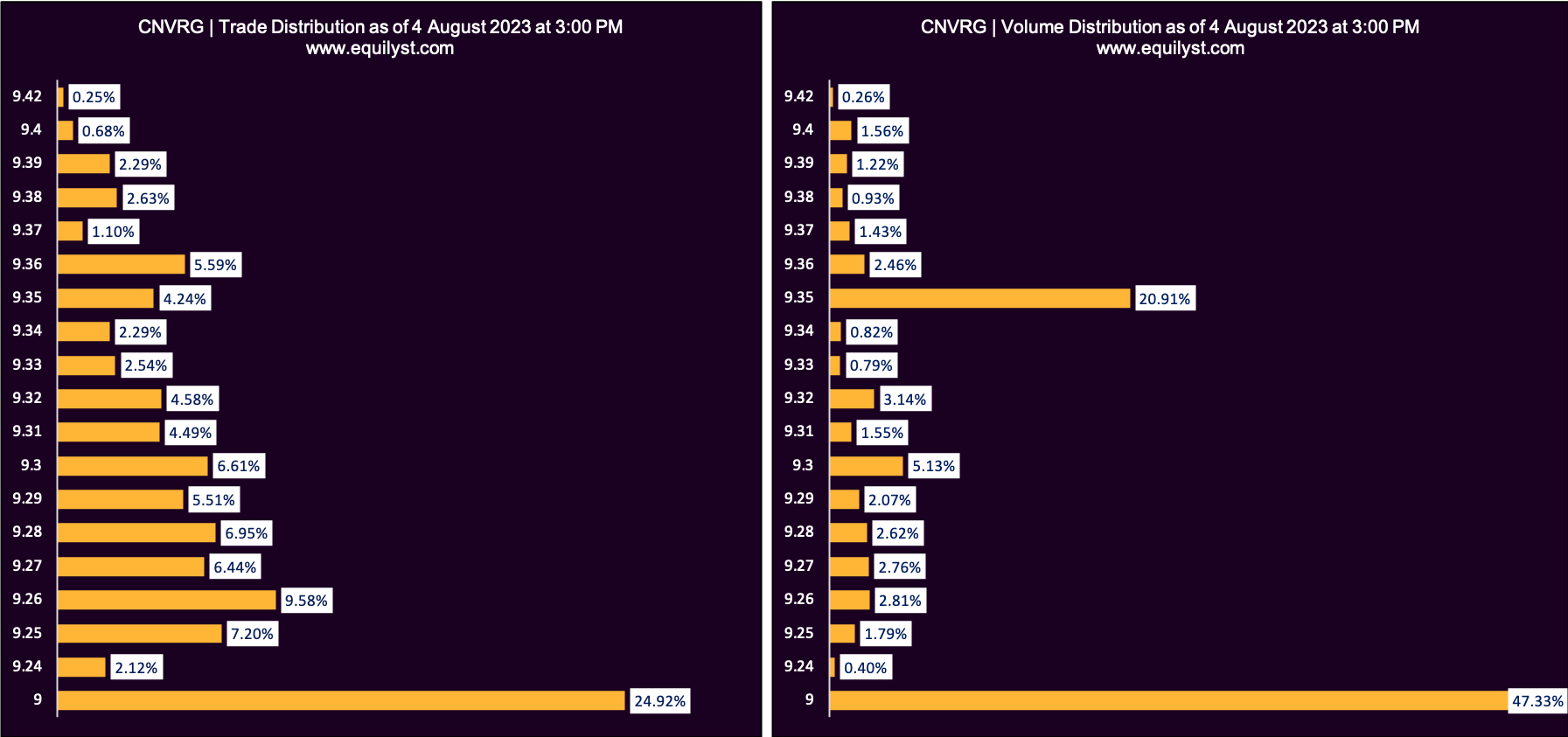

The Dominant Range Index of PSE:CNVRG continues to register a bearish sentiment as the price with the biggest volume and highest number of trades is parked closer to the intraday low than the intraday high. Besides, its volume-weighted average price (VWAP) that is higher than the closing price poses another bearish threat.

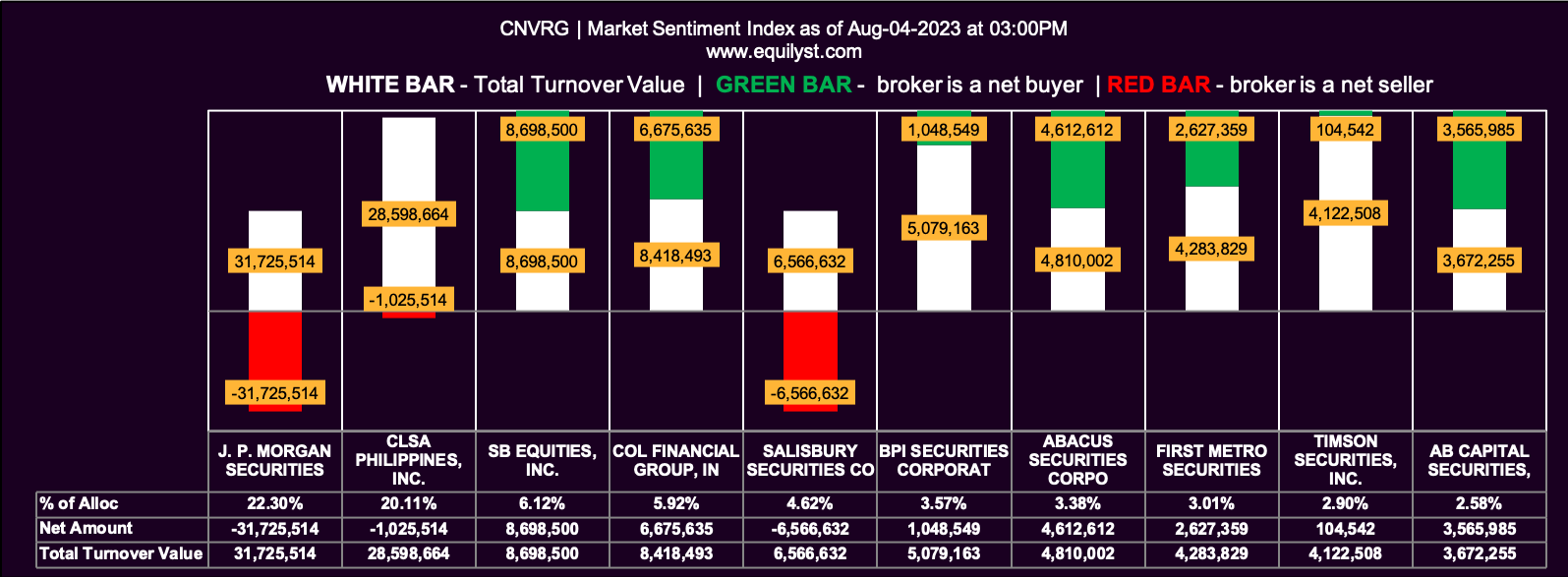

Many new entrants bought the dips last Friday, but their cumulative bullish transactions were no match with the bearish take of JP Morgan Securities and CLSA Philippines. If these two brokers registered a positive net amount last Friday, PSE:CNVRG would have printed a positive day change.

This bullish Market Sentiment Index is only beneficial for the new entrants. Individuals who find their paper losses distressing rather than reassuring shouldn’t treat last Friday’s bullish Market Sentiment Index as another alibi to keep adding Hail Marys and not logic in their strategy.

Market Sentiment Index: BULLISH

44 of the 56 participating brokers, or 78.57% of all participants, registered a positive Net Amount

35 of the 56 participating brokers, or 62.50% of all participants, registered a higher Buying Average than Selling Average

56 Participating Brokers’ Buying Average: ₱9.13228

56 Participating Brokers’ Selling Average: ₱9.26006

31 out of 56 participants, or 55.36% of all participants, registered a 100% BUYING activity

8 out of 56 participants, or 14.29% of all participants, registered a 100% SELLING activity

Wrapping It Altogether

At this point, I won’t dare speculate and enter a new position. I’ll stay on the sidelines and wait for signs of selling exhaustions before I do a test buy. There’s no sign of selling exhaustions yet. Last Friday’s huge bearish volume is proof that sellers can still sell some more if this bearishness continues next week. Why would you hurry in buying if sellers haven’t lain low yet?

If you’re fond of monitoring brokers’ transactions, I suggest you monitor the sentiments of Salisbury Securities, Macquarie, JP Morgan, and CLSA.

Need Help on How to Decide Based on your Risk Tolerance?

Optimize your stock portfolio for maximum returns with our Stock Portfolio Rehabilitation Program.

Become a TITANIUM client to gain knowledge on capital preservation, protecting gains, and minimizing losses while trading and investing in the Philippine stock market.

Become a PLATINUM client to receive comprehensive technical analysis and personalized recommendations based on your entry price, average cost, investment goals, and risk tolerance.

Become a GOLD client to engage in teleconsultations with our team while trading occurs, providing real-time guidance over the phone.

- Key Prices for PH Bluechip Stocks 30% Above 52-Week Low - June 4, 2024

- May 2024 Market Sentiment Rating of 30 PH Bluechip Stocks - June 3, 2024

- EquiTalks: ICT, BPI, AEV Updates – 5.29.2024 - May 29, 2024