Globe, a leading platform for digital solutions, actively explores methods to enhance customer experience by incorporating artificial intelligence (AI) for automating routine tasks.

During a recent interview with Bloomberg Television, Ernest Cu, the president and CEO of Globe Group, disclosed that the company currently examines AI’s potential to reduce costs and enhance operational efficiency.

Cu acknowledged AI’s significant capabilities in tasks requiring human intelligence and discernment. While AI may not equal human proficiency across all areas, it demonstrates comparable performance in specific domains.

Motivated by this realization, Globe delves into leveraging AI to elevate customer service, with a primary focus on operations. AI has already showcased promising applications in outbound calling, customer care, and collection.

Cu expressed astonishment and admiration for the Globe team’s successful utilization of AI to conduct customer interactions in Tagalog. He marveled at the conversations’ striking similarity to human interaction and their potential effectiveness in achieving the company’s automation goals, cost reduction, and improved efficiency.

Internally, Globe harnesses technology to fortify its initiatives for employee well-being. Amid the global health pandemic, the company introduced the Digital Usher for Disasters and Emergencies (DUDE), a dedicated health monitor ensuring streamlined program delivery.

Additionally, Globe implemented Wanda, a recognition chatbot enabling employee-to-employee e-card exchanges. Moreover, the company offers EVA (Employee Virtual Assistant), an AI-powered chatbot addressing HR-related inquiries.

By embracing a blend of chatbots and other advanced technologies, Globe adopts a versatile approach to actively engage its workforce, enhancing their daily experiences.

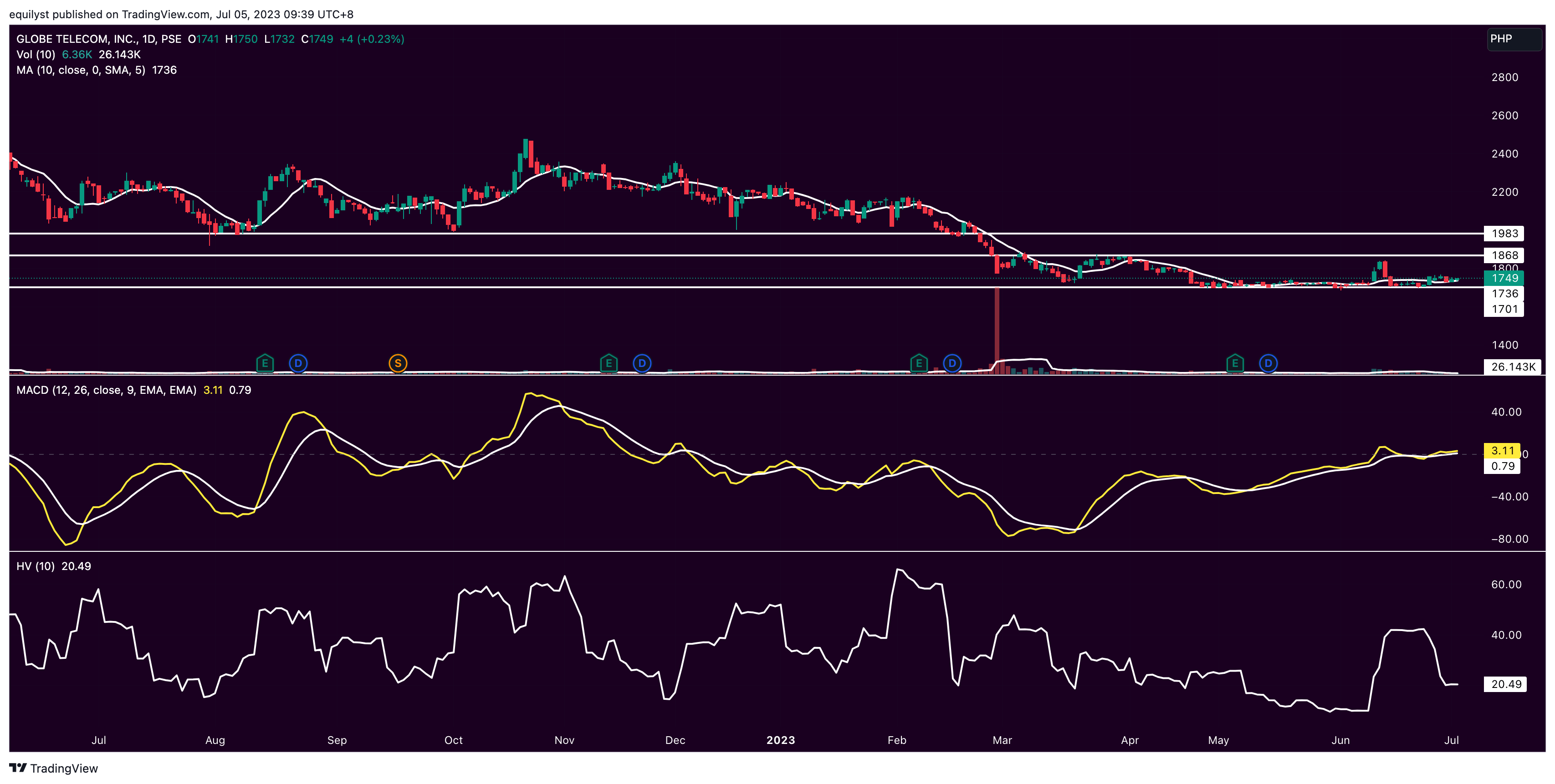

PSE:GLO closed on Tuesday, July 4, 2023, at P1,749.00 per share, up by 0.23% but down by 19.77% year-to-date.

Support is at P1,700 while resistance is at P1,870.

There have been many days with a relatively low volume (volume that’s lower than 50% of the stock’s 10-day volume average) since the last week of June 2023.

PSE:GLO needs to attract a heavier volume to influence the traders’ sentiment to push the price closer to the resistance.

While GLO’s moving average convergence divergence (MACD) is moving above its signal line, the gap between the two lines isn’t increasing. That’s expected since the price is moving sideways at the moment.

GLO’s risk level is low based on its 10-day historical volatility score due to the absence of engulfing candlesticks and price gaps for the past 10 trading days.

Do You Need Help Trading or Investing on the Stocks Mentioned in this Report?

Fix and rebalance your stock portfolio for optimal returns through our Stock Portfolio Rehabilitation Program.

Be a TITANIUM client to learn how to preserve capital, protect gains, and prevent unbearable losses when trading and investing in the Philippine stock market.

Be a PLATINUM client to request our in-depth technical analysis with recommendations tailored-it to your entry price, average cost, buy case, and risk tolerance.

Be a GOLD client to have a teleconsultation with us over the phone as trading happens.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025