Technical Analysis on DITO CME Holdings Corp. (PSE:DITO)

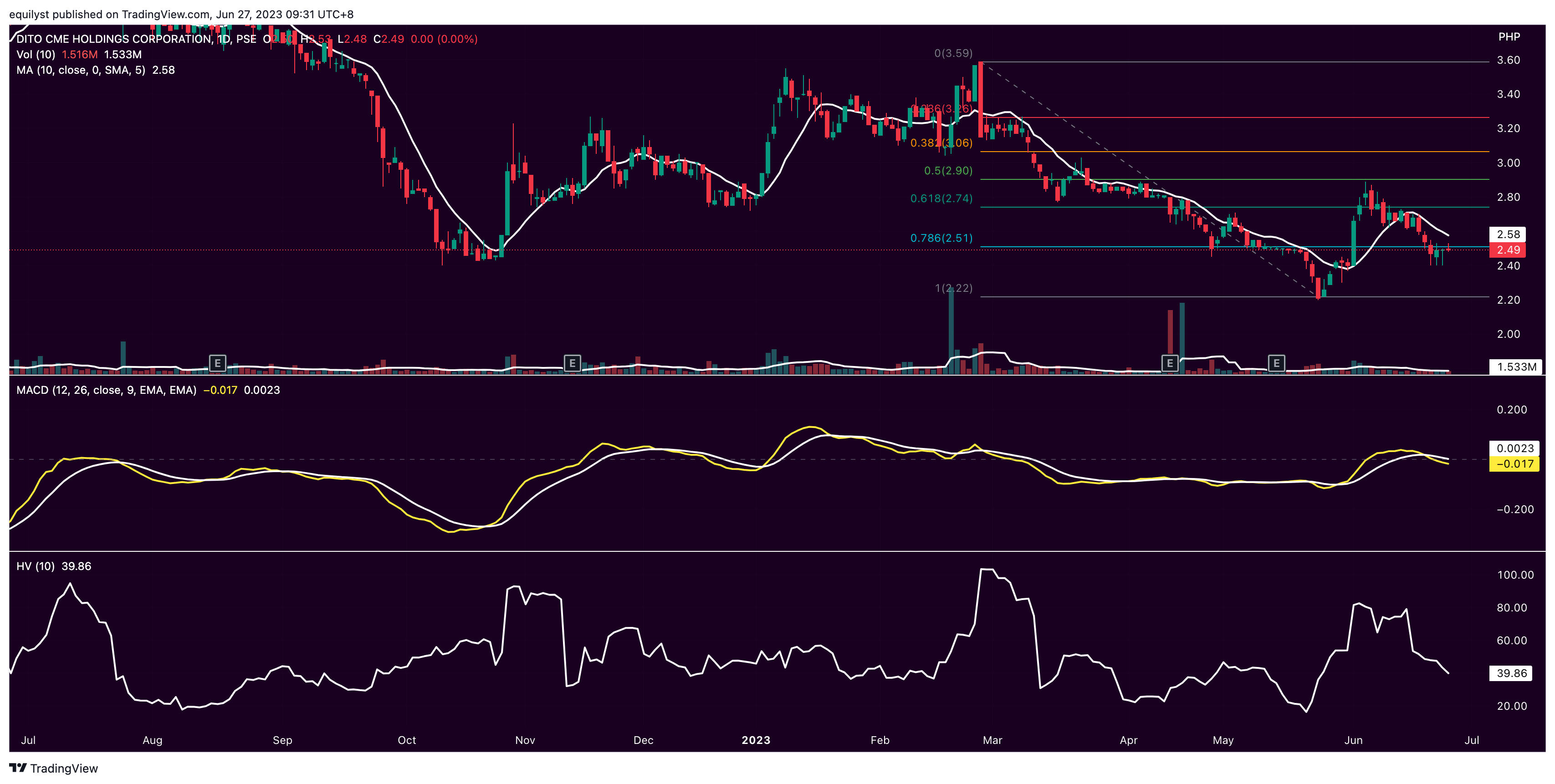

PSE:DITO trades at P2.49 per share at the time of this writing, unchanged from yesterday’s closing price.

However, it is down by 30.64% from its intra-year high of P3.59 and down by 10.75% year-to-date.

It has been trading below its 10-day simple moving average for eight consecutive trading days.

Support is at P2.20. Resistance is at P2.50, aligned with the 78.5% Fibonacci retracement. P2.74 is the secondary resistance, confluent with the 61.8% Fibonacci retracement.

Yesterday’s unchanged price was met with a red volume bar with a size above 100% of DITO’s 10-day volume average. Knowing that the price points with the biggest volume and highest number of trades yesterday were registered closer to the intraday low than the intraday high, DITO is at risk of closing in the red zone today.

DITO’s moving average convergence divergence (MACD) has been bearishly moving below its signal line for six consecutive trading days. I don’t see a bullish reversal formation on its MACD yet. This structure supports the idea that the price might continue to go south.

On the other hand, it’s a consolation that DITO’s erraticity level remains low based on its 10-day historical volatility score. It means no significant engulfing candlesticks and price gaps were spotted in the past 10 trading days. Having a low erraticity level is NOT a buy signal.

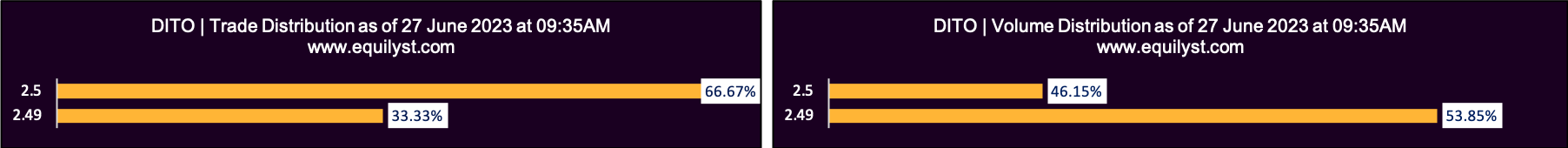

Trade and Volume Distribution Analysis

Dominant Range Index: BEARISH

Last Price: 2.49

VWAP: 2.49

Dominant Range: 2.49 – 2.5

DITO’s dominant price is closer to the intraday low than the intraday high at the time of this writing. The bears are dribbling the ball at their home court, so to speak.

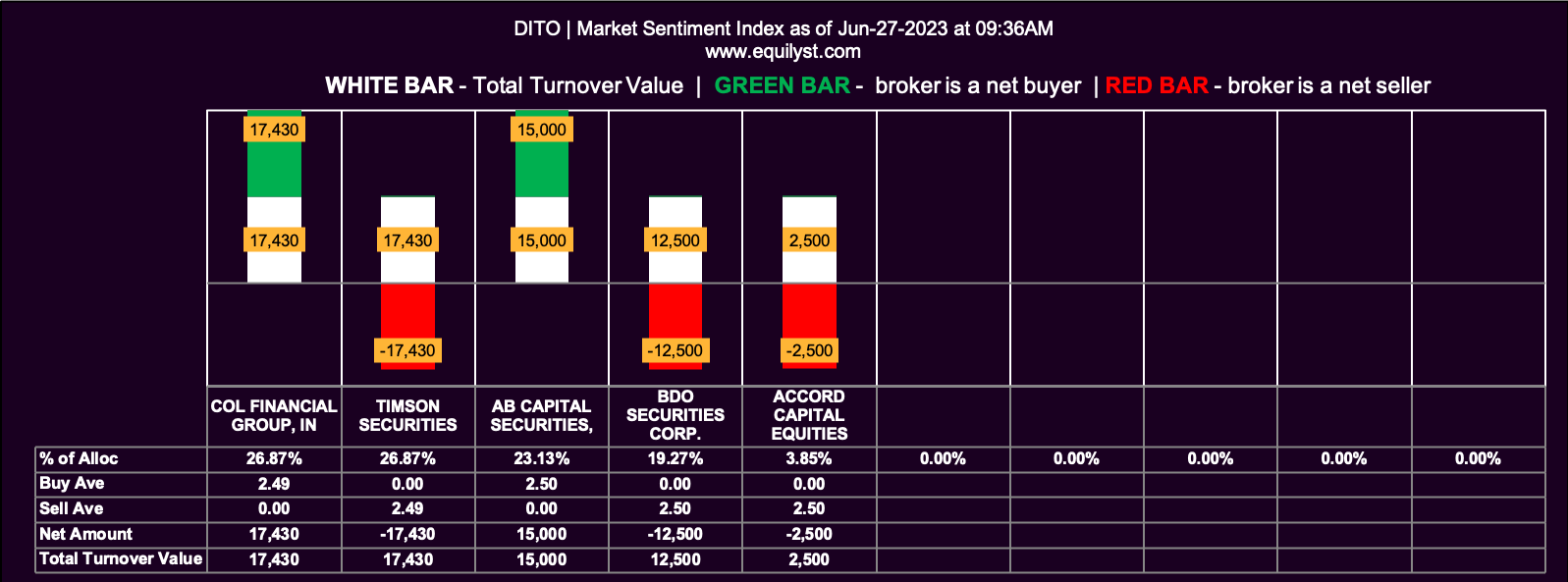

Market Sentiment Analysis

DITO’s market sentiment is also bearish at the time of this writing. The traders who had already decided to do nothing but sell at the opening bell outnumbered those who wanted to buy the dips.

Market Sentiment Index (June 27, 2023): BEARISH

2 of the 5 participating brokers, or 40.00% of all participants, registered a positive Net Amount

2 of the 5 participating brokers, or 40.00% of all participants, registered a higher Buying Average than Selling Average

5 Participating Brokers’ Buying Average: ₱2.49500

5 Participating Brokers’ Selling Average: ₱2.49667

2 out of 5 participants, or 40.00% of all participants, registered a 100% BUYING activity

3 out of 5 participants, or 60.00% of all participants, registered a 100% SELLING activity

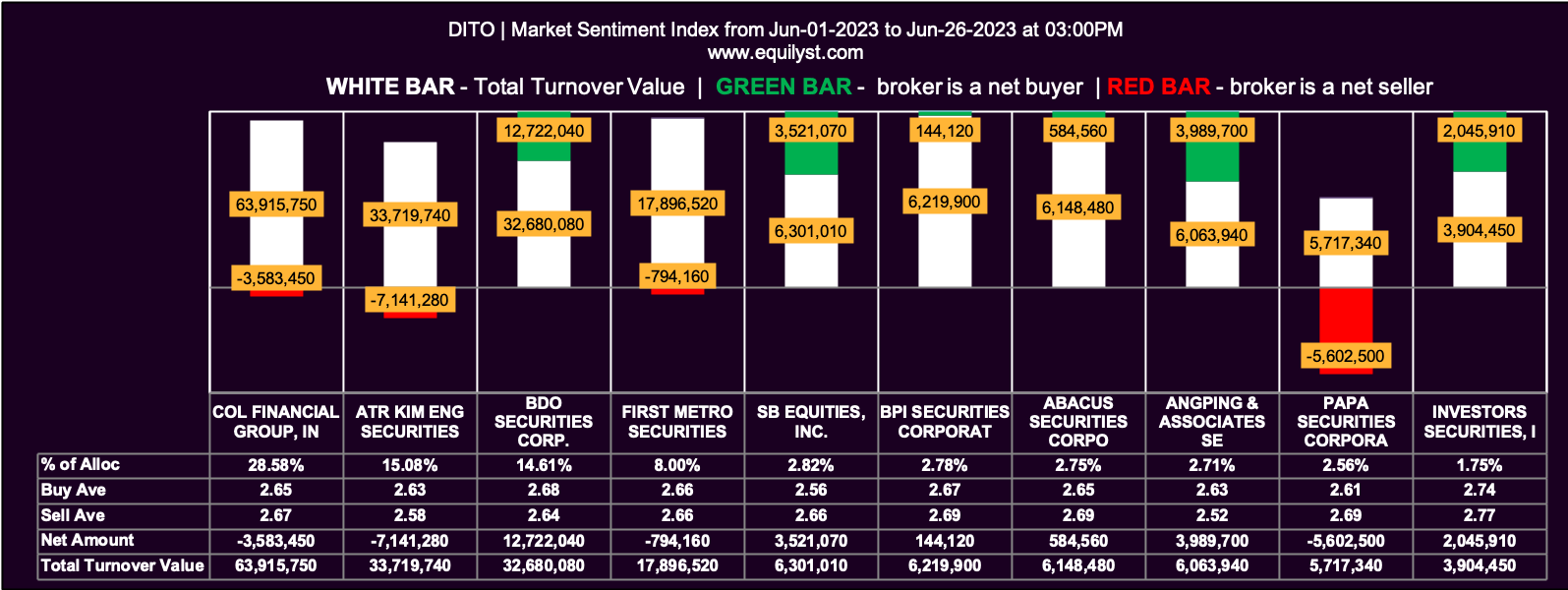

Did you know that only 3 out of 66 brokers who traded DITO from June 1 to 26 registered a 100% buying activity while early a quarter of the trade participants confidently registered a 100% selling activity within the same period?

I don’t need to post a survey on stock market-related Facebook Groups in the Philippines to temp-check the market. This Market Sentiment Index indicator of Equilyst Analytics paints the picture of the true market sentiment – not based on what you and I believe, feel, or think but on what ACTUALLY happened.

Market Sentiment Index (June 1, 2023 to June 26, 2023): BEARISH

26 of the 66 participating brokers, or 39.39% of all participants, registered a positive Net Amount

21 of the 66 participating brokers, or 31.82% of all participants, registered a higher Buying Average than Selling Average

66 Participating Brokers’ Buying Average: ₱2.64179

66 Participating Brokers’ Selling Average: ₱2.66884

3 out of 66 participants, or 4.55% of all participants, registered a 100% BUYING activity

15 out of 66 participants, or 22.73% of all participants, registered a 100% SELLING activity

Buy or Sell DITO?

You should already know the verdict after reading everything I’ve written above.

There’s no confirmed buy signal for DITO as of the timeframe of the data used in my analysis.

Know that it’s the last trading week of the month and of the second quarter or first half of 2023. Window dressing is in place already. Read my article below to know how window dressing affects price action and how you can make or lose money from it.

READ: Window Dressing Exposed: Behind the Scenes of Portfolio Manipulation in the Stock Market

Does that mean you should sell your position on DITO?

So many traders think you should be selling if you’re not buying. You got to be in action mode. You can’t be idle. That’s wrong. Holding your position if, and only if, your trailing stop is intact is an action, too.

So, if your trailing stop is intact, hold your position. If you’re a TITANIUM client of Equilyst Analytics, you can use your remaining credits to request our latest analysis on DITO. We’ll give you our recommendation, tailored to your entry price, average cost, and risk tolerance percentage. If there’s a buy signal, we’ll let you know where it is most optimal for you to buy. If there’s no buy signal, we’ll tell you the prices you must watch out for.

If you are planning to buy DITO shares, you should stay on the sidelines for now. Once our analysis shows a confirmed buy signal, you must first calculate your initial trailing stop and reward-to-risk ratio. Only when you’re satisfied with the reward-to-risk ratio should you buy within or near the dominant range of DITO. All our PLATINUM clients understand the principle behind this because they attended our one-on-one learning session via Zoom for our Masterclass on the Evergreen Strategy When Trading and Investing in the Philippine Stock Market.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025