Shakey’s Pizza Asia Ventures Inc. (PSE:PIZZA), a restaurant chain and food service group listed in the Philippines, anticipates at least 20 percent growth in its profits and revenues this year as the economy reopens.

As stated by Christopher Po, the company’s chairman, the positive outlook stems from Shakey’s expansion across its diverse range of brands.

Following the annual stockholders’ meeting, Po emphasized their heavy reliance on market reopening and expansion, foreseeing a more than 20 percent increase in revenues and profits for the year.

Vicente Gregorio, Shakey’s president, acknowledged the challenge of inflation and mentioned ongoing efforts to enhance operational efficiency and mitigate cost and price pressures.

While expressing confidence in the company’s Philippine business, Gregorio highlighted the persistent inflation issue.

Concerning expansion plans, Gregorio identified the Visayas and Mindanao regions as having growth potential.

Po highlighted that certain areas beyond Metro Manila have emerged as robust markets for Shakey’s brands due to the rise of remote work arrangements, resulting in consumers relocating to areas in

Luzon outside the capital to provide services to their employers abroad.

During the stockholders’ meeting, Gregorio reported consecutive years of double-digit growth in revenues and profits for Shakey’s.

In the previous year, Shakey’s achieved a net income of P874 million, surpassing its pre-pandemic income of P865 million in 2019.

The company’s systemwide sales soared to P14.1 billion, doubling the figures from 2021 and exceeding pre-pandemic sales by 36 percent.

Gregorio elaborated that Shakey’s entered the pandemic with its main brand, Shakey’s, and an emerging brand, Peri-Peri.

However, they emerged from the pandemic with a diverse portfolio of brands,

including Shakey’s, Potato Corner, Peri-Peri Charcoal Chicken and Saucebar, and incubating brands R&B Milk Tea and Project Pie.

Each brand plays a distinct role in the company’s portfolio.

As of the end of 2022, Shakey’s proudly operated a global network of 347 stores catering to casual dining and emerging brands, alongside 1,425 outlets of its newly introduced brand, Potato Corner.

Peri-Peri expanded its operations by introducing 16 new stores last year.

Since its acquisition in 2019, the charcoal chicken chain has tripled its network to 68 stores.

R&B also embarked on store openings, culminating in nine independent stores by the end of 2022.

Potato Corner experienced a rapid expansion of its global store network by 153 outlets in the previous year.

Potato Corner triumphantly established its presence in various countries, such as the UK, UAE, China, Thailand, and Singapore. At the same time, Shakey’s ventured into new markets by opening stores in Singapore and Dubai.

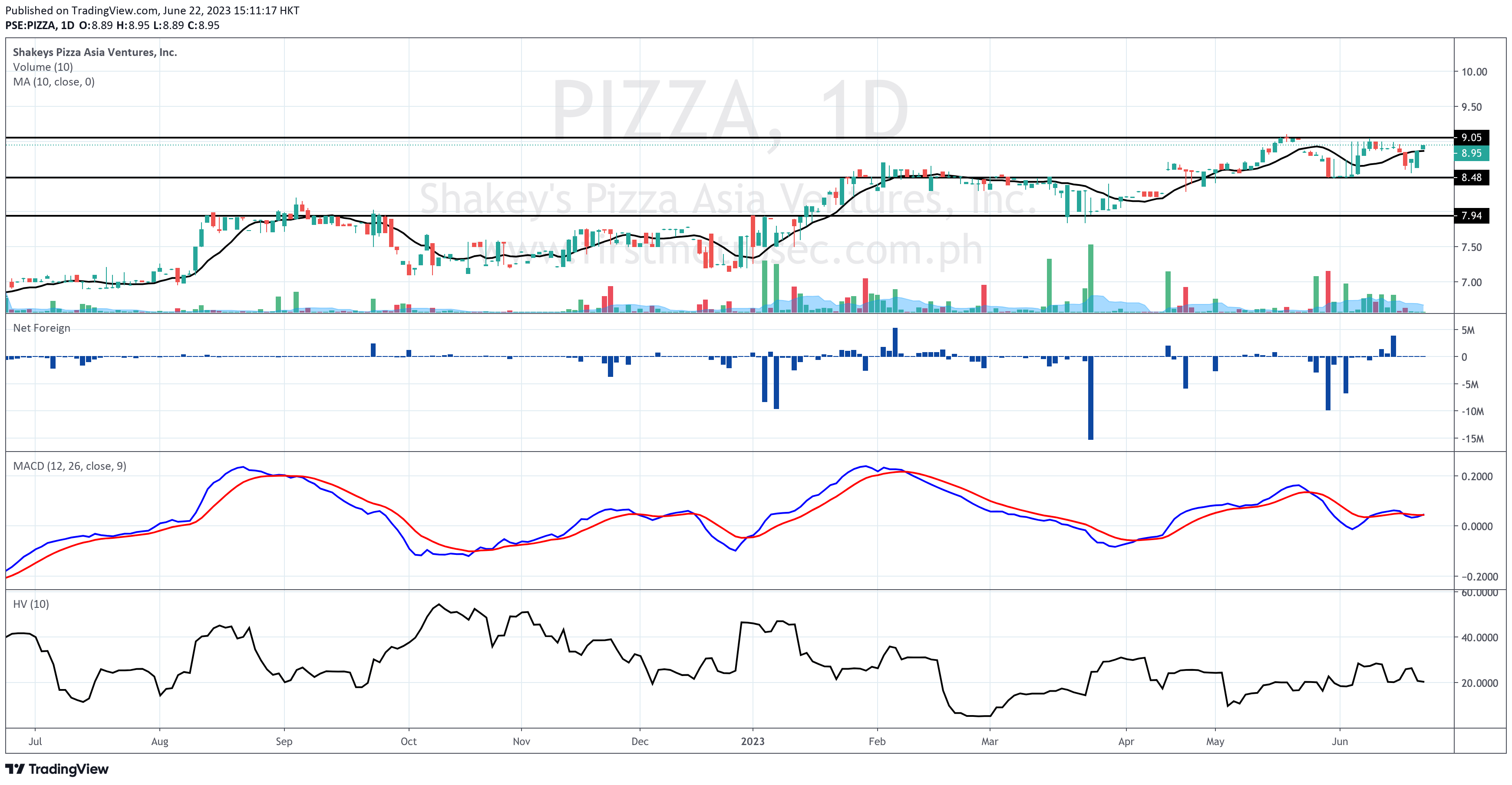

PSE:PIZZA trades at P8.95 per share as of closing of Thursday trading, June 22, 2023, up by 0.90%.

Support is near P8.48, while resistance is at P9.05.

Dominant Range Index: BULLISH

Last Price: 8.95

VWAP: 8.92

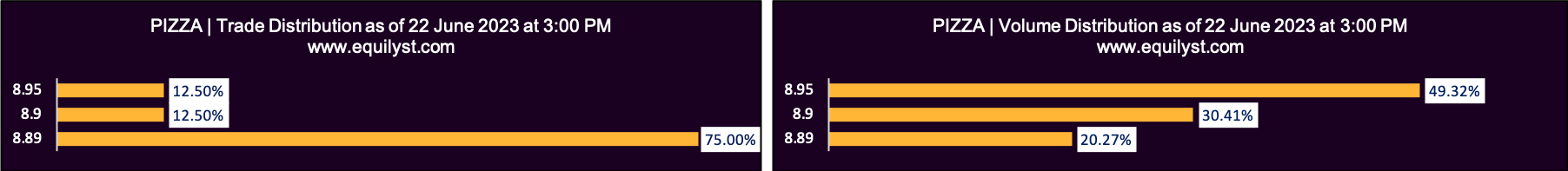

Dominant Range: 8.89 – 8.95

The positioning of the dominant range closer to the intraday high than the intraday low helped a lot in getting a bullish Dominant Range Index rating. Add to that the last price that is higher than the volume-weighted average price (VWAP) of P8.92.

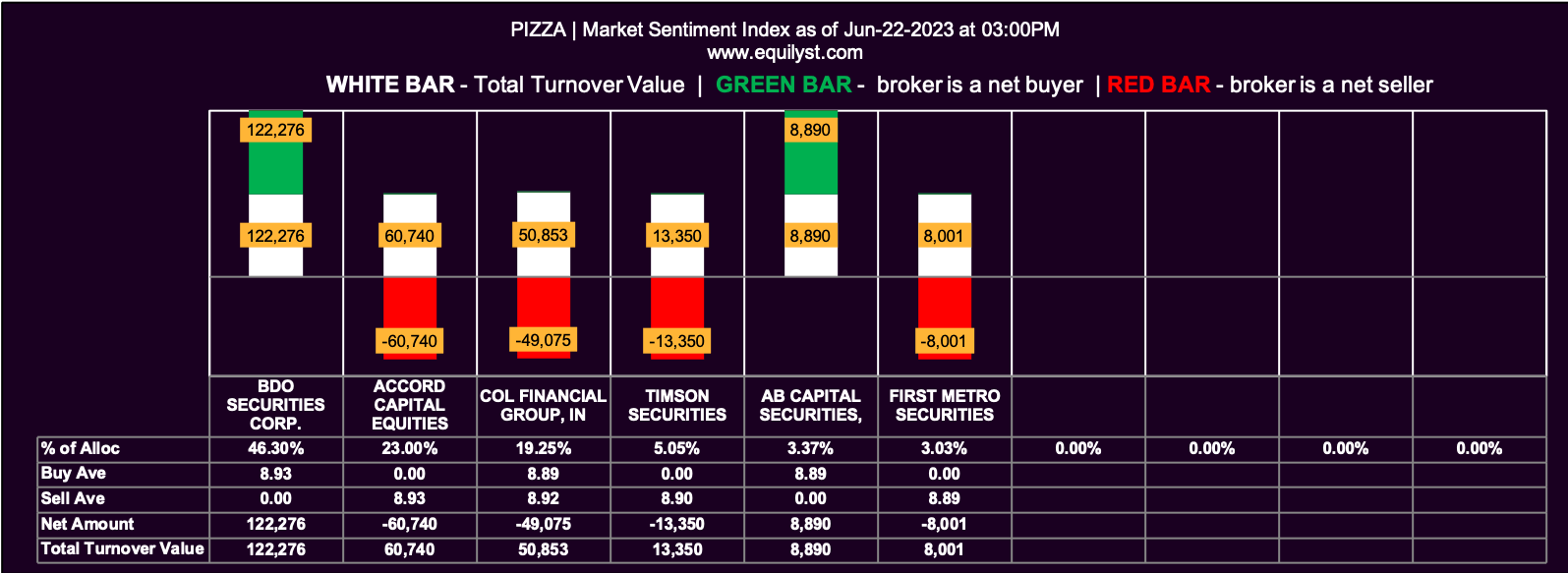

Market Sentiment Index: BEARISH

2 of the 6 participating brokers, or 33.33% of all participants, registered a positive Net Amount

2 of the 6 participating brokers, or 33.33% of all participants, registered a higher Buying Average than Selling Average

6 Participating Brokers’ Buying Average: ₱8.90177

6 Participating Brokers’ Selling Average: ₱8.91113

2 out of 6 participants, or 33.33% of all participants, registered a 100% BUYING activity

3 out of 6 participants, or 50.00% of all participants, registered a 100% SELLING activity

On the other hand, it seems that early buyers have started to lock in profits as 50% of all brokers who traded PSE:PIZZA today had a 100% selling activity.

The total turnover value for PSE:PIZZA is very slim. This means investors are on an eavesdropping mode, waiting for others to initiate a significant buying activity.

Consider one of the packages of Equilyst Analytics’ stock market consultancy service to get assistance on how to manage your existing position on PSE:PIZZA.

- Key Prices for PH Bluechip Stocks 30% Above 52-Week Low - June 4, 2024

- May 2024 Market Sentiment Rating of 30 PH Bluechip Stocks - June 3, 2024

- EquiTalks: ICT, BPI, AEV Updates – 5.29.2024 - May 29, 2024