The shelf registration of up to P50 billion worth of bonds has been approved by the Securities and Exchange Commission (SEC), the regulatory body for corporations.

Ayala Land Inc. (ALI) received approval for its offering during a meeting on June 6.

The offering, which can be issued in multiple tranches for three years, will include up to P12.25 billion of five-year and 10-year bonds.

Additionally, there is an oversubscription option of up to P5 billion for the initial tranche.

ALI’s current P50-billion debt securities program, approved by the SEC in 2021, includes an allocation of P4.75 billion for the fourth and final tranche.

If fully exercised, the company plans to use the funds from the oversubscription option to refinance short-term loans and support capital expenditures.

According to the latest timetable submitted to the SEC, the bonds will be offered to the public at face value from June 14 to 20. Subsequently, they will be listed on the Philippine Dealing and Exchange Trust Inc. on June 27.

For the offer, Ayala Land has chosen BDO Capital and Investment Corp., BPI Capital Corp., China Bank Capital Corp., East West Banking Corp., First Metro Investment Corp., RCBC Capital Corp., and SB Capital Corp. as joint lead underwriters and bookrunners.

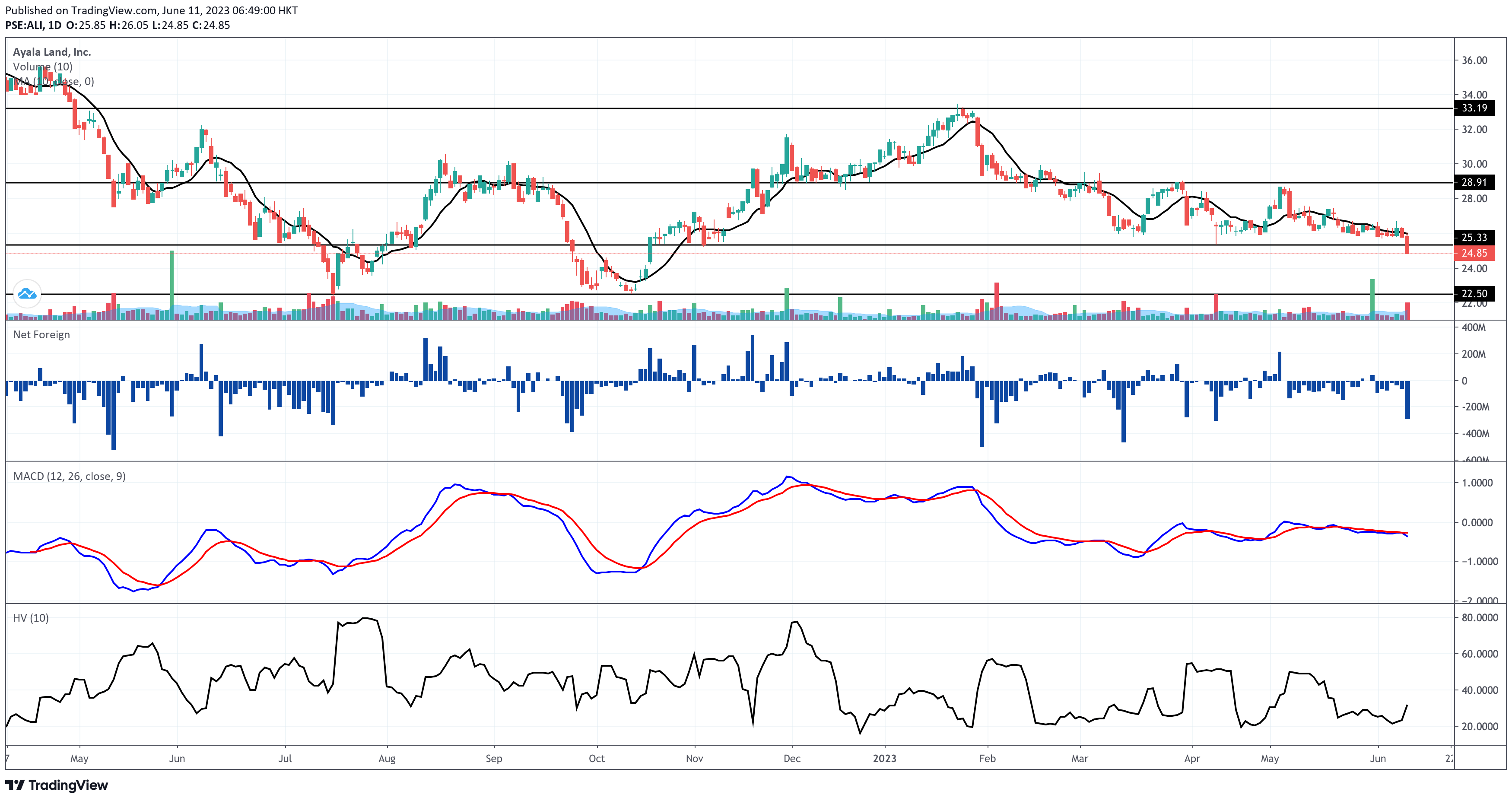

Meanwhile, ALI closed at P24.85 on June 9, 2023, down by 3.68%, breaking below its previous support at P25.30, which is now its immediate resistance. The new support sits at P22.50.

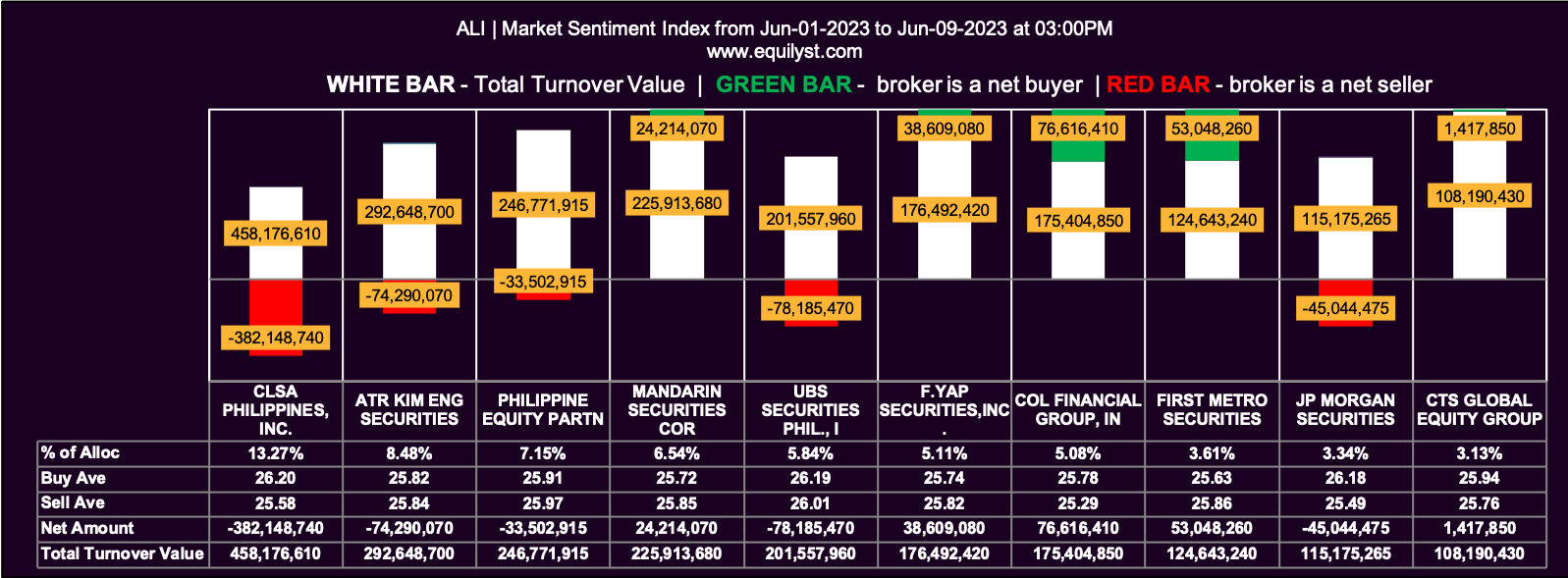

Foreign investors show a lackluster sentiment for buying the dips as they remain net sellers month-to-date and year-to-date on ALI.

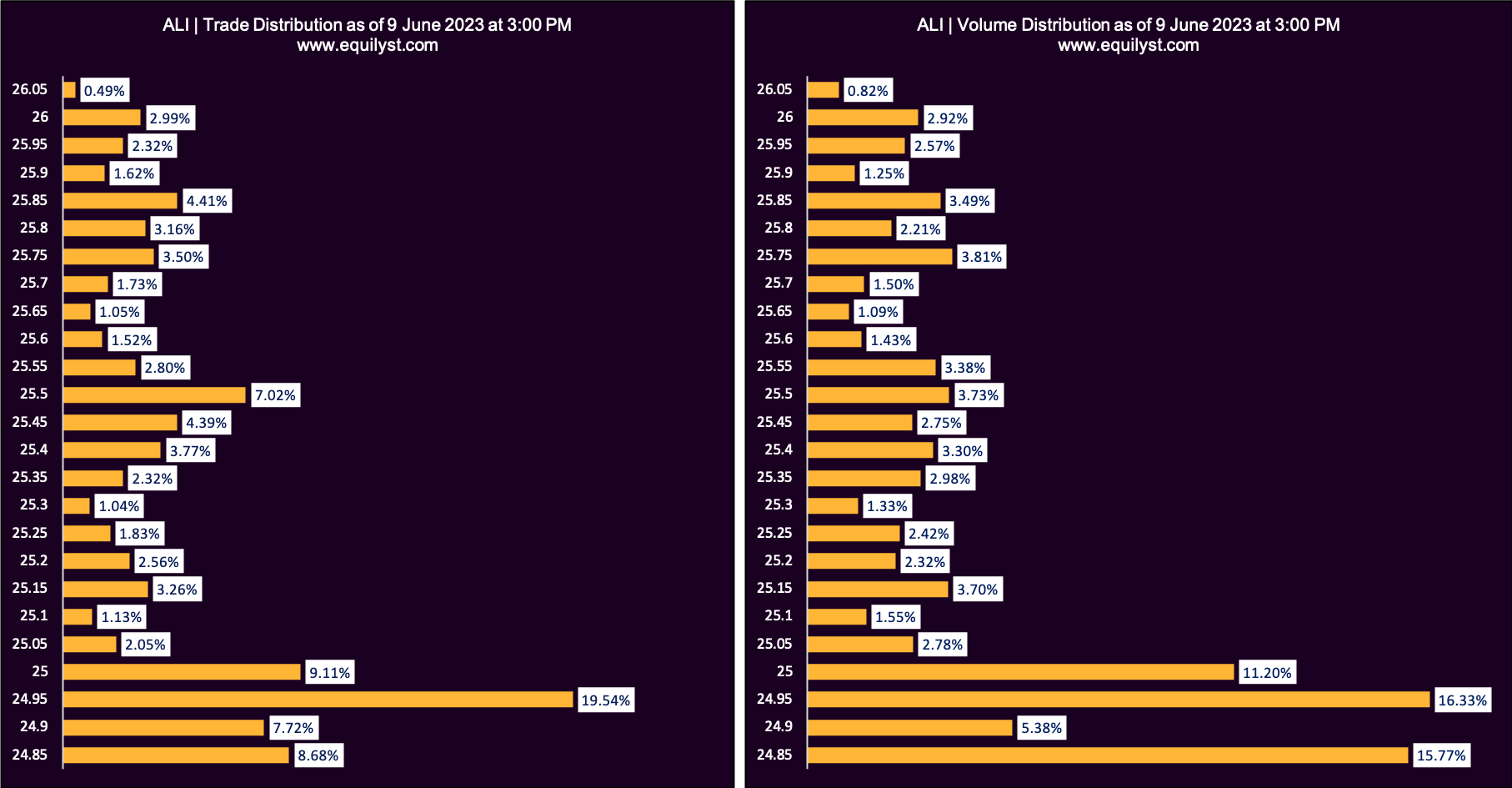

While our trade-volume distribution analysis for June 9, 2023 shows a bearish rating, our end-of-day and month-to-date market sentiment analyses show bullish scores.

Those bullish market sentiment ratings for two different periods show that the overall sentiment is attuned to buying the dips, probably because this is a bluechip stock with no pressing concerns on its financial statements according to fundamental analysts.

Trade-Volume Distribution Analysis

Dominant Range Index: BEARISH

Last Price: 24.85

VWAP: 25.23

Dominant Range: 24.95 – 24.95

EOD Market Sentiment Analysis

Market Sentiment Index: BULLISH

77 of the 92 participating brokers, or 83.70% of all participants, registered a positive Net Amount

68 of the 92 participating brokers, or 73.91% of all participants, registered a higher Buying Average than Selling Average

92 Participating Brokers’ Buying Average: ₱25.17994

92 Participating Brokers’ Selling Average: ₱25.31154

52 out of 92 participants, or 56.52% of all participants, registered a 100% BUYING activity

3 out of 92 participants, or 3.26% of all participants, registered a 100% SELLING activity

MTD Market Sentiment Analysis

Market Sentiment Index: BULLISH

81 of the 98 participating brokers, or 82.65% of all participants, registered a positive Net Amount

53 of the 98 participating brokers, or 54.08% of all participants, registered a higher Buying Average than Selling Average

98 Participating Brokers’ Buying Average: ₱25.56250

98 Participating Brokers’ Selling Average: ₱25.90005

32 out of 98 participants, or 32.65% of all participants, registered a 100% BUYING activity

1 out of 98 participants, or 1.02% of all participants, registered a 100% SELLING activity

At the end of the day, we advise short-term traders and long-term investors, to make decision based on a data-oriented reference, personal risk tolerance, and investment horizon.

If you’re looking to hire a personal stock market consultant, please click here to check our options for you.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025