Fitch Ratings adjusted the credit rating outlook for five major banks in terms of assets from negative to stable, aligning with the Philippines’ sovereign rating change.

Fitch raised BDO Unibank Inc.’s outlook from negative to stable, while affirming its BBB- credit rating, slightly lower than the Philippines’ BBB rating.

Considering BDO’s significant role as the country’s largest bank, with approximately 18 percent market share of system assets and deposits, and the moderate fiscal flexibility of the state, its investment grade rating was affirmed.

The debt evaluator adjusted the outlook for Ayala-led Bank of the Philippine Islands (BPI) from negative to stable, while affirming its credit rating of BBB-.

The assessment takes into consideration BPI’s significant systemic importance as one of the Philippines’ top three largest privately-owned banks, with a market share of approximately 12 percent in system deposits. It also considers the improving fiscal flexibility of the state, which is reflected in the stable revision of the sovereign rating outlook.

Fitch raised the outlook for Metropolitan Bank & Trust Co. (Metrobank) and maintained its investment grade credit rating of BBB-.

It is believed that the Stable Outlook on the sovereign rating indicates the state’s improving capacity to provide support to the bank during times of necessity. The long-term issuer default ratings and government support rating on Metrobank are positioned one notch below the sovereign rating, reflecting the bank’s significant systemic importance as one of the three largest private commercial banks in the Philippines, with a market share of approximately 12 percent in system assets and deposits.

As per Fitch’s assessment, the credit rating outlook of both state-run Land Bank of the Philippines and Development Bank of the Philippines was also adjusted from negative to stable.

The outlook for Landbank’s long-term issuer default rating was revised by the debt evaluator to stable from negative. It affirmed the bank’s BBB rating, which is supported by the expectation of state support, as indicated by its government support rating.

This takes into consideration the bank’s strategic and expanding policy roles, complete state ownership, and its systemic significance as the largest state-owned bank in the country, holding approximately 14 percent market share of system assets.

The credit rating agency stated that the assessment also takes into account the state’s enhanced capacity to provide support to the bank during times of necessity, as indicated by the stable revision of the sovereign rating outlook.

Details regarding the proposal to merge Landbank with the second-largest state-owned bank in the Philippines are currently uncertain. However, the expectation is that the state’s inclination to provide support to Landbank will persist during the interim period.

Furthermore, the outlook for the government-owned Development Bank of the Philippines (DBP) was improved from negative to stable. The bank’s BBB rating was also affirmed, reflecting a strong likelihood of state support during times of necessity.

The ratings consider the bank’s strategic role as the country’s infrastructure bank, complete state ownership, and the assessment of the state’s enhanced capacity to provide support to the bank.

Three of the five mentioned banks are publicly-listed companies on the Philippine Stock Exchange. Here’s the latest update regarding their performance on the Philippine stock market as of the time of writing this report:

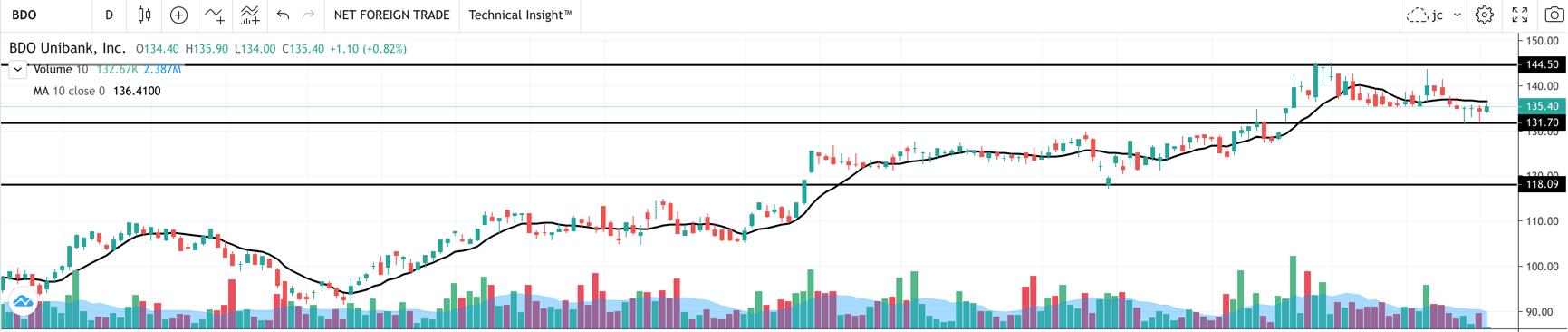

BDO Unibank (BDO)

BDO trades at P135.40 per share. Main support is at P131.70, while the immediate resistance is at P144.50.

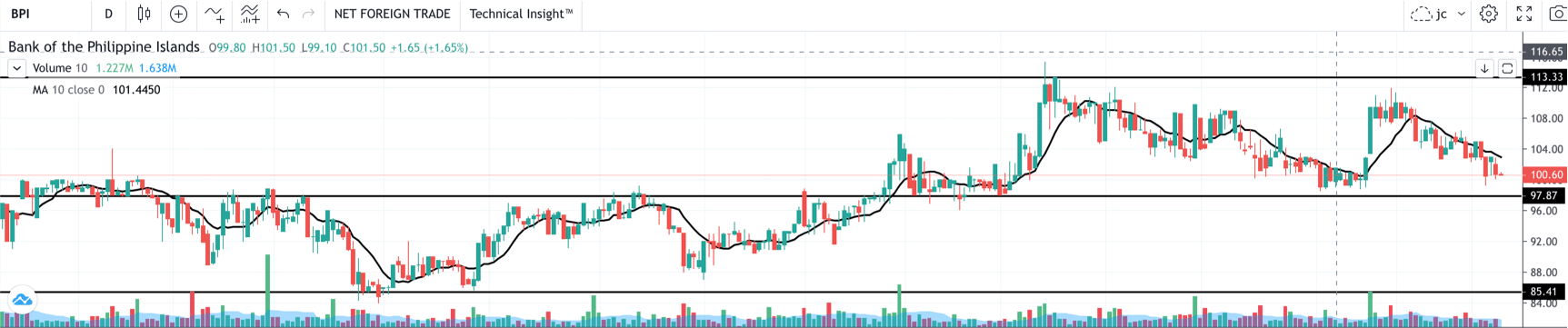

Bank of the Philippine Islands (BPI)

BPI trades at P100.60 per share. Main support is at P97.90, while the immediate resistance is at P113.30.

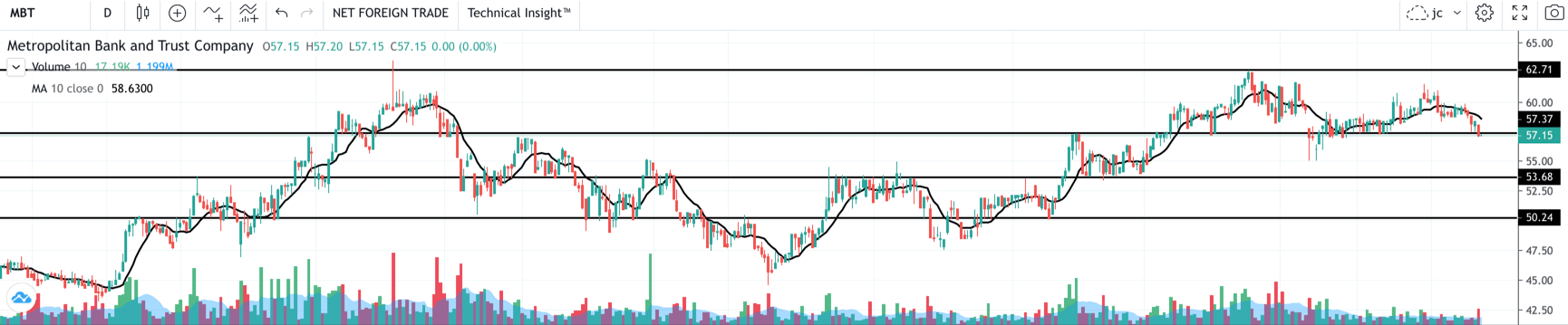

Metropolitan Bank and Trust Company (MBT)

MBT trades at P57.15 per share. Main support is at P53.70, while the immediate resistance is at P57.40.

In the dynamic world of stock market investing, staying ahead of the game is crucial. As Fitch Ratings impact the performance of specific stocks, it’s essential to have a reliable source of guidance. Equilyst Analytics offers a comprehensive stock market consultancy service that empowers traders and investors with the knowledge they need to make informed decisions. By availing of our services, you gain valuable insights that can help preserve your capital, protect your gains, and prevent devastating losses.

With Equilyst Analytics, you’ll learn how to navigate the intricacies of the market effectively, giving you a competitive edge. Take control of your investments and subscribe to Equilyst Analytics’ stock market consultancy service today. Together, we can unlock your investment potential and achieve your financial goals.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025