Bloomberry Resorts Corporation Technical Analysis

Bloomberry Resorts Corporation (BLOOM) currently trades at P9.00 apiece as of 1:10PM GMT+8 on January 9, 2023. Its total turnover value is worth over P124 million as of the time of writing this report.

Its net foreign buying is worth P38 million. Bloomberry Resorts Corporation has been on a daily net foreign buying status for more than three trading weeks; 17 trading days to be exact.

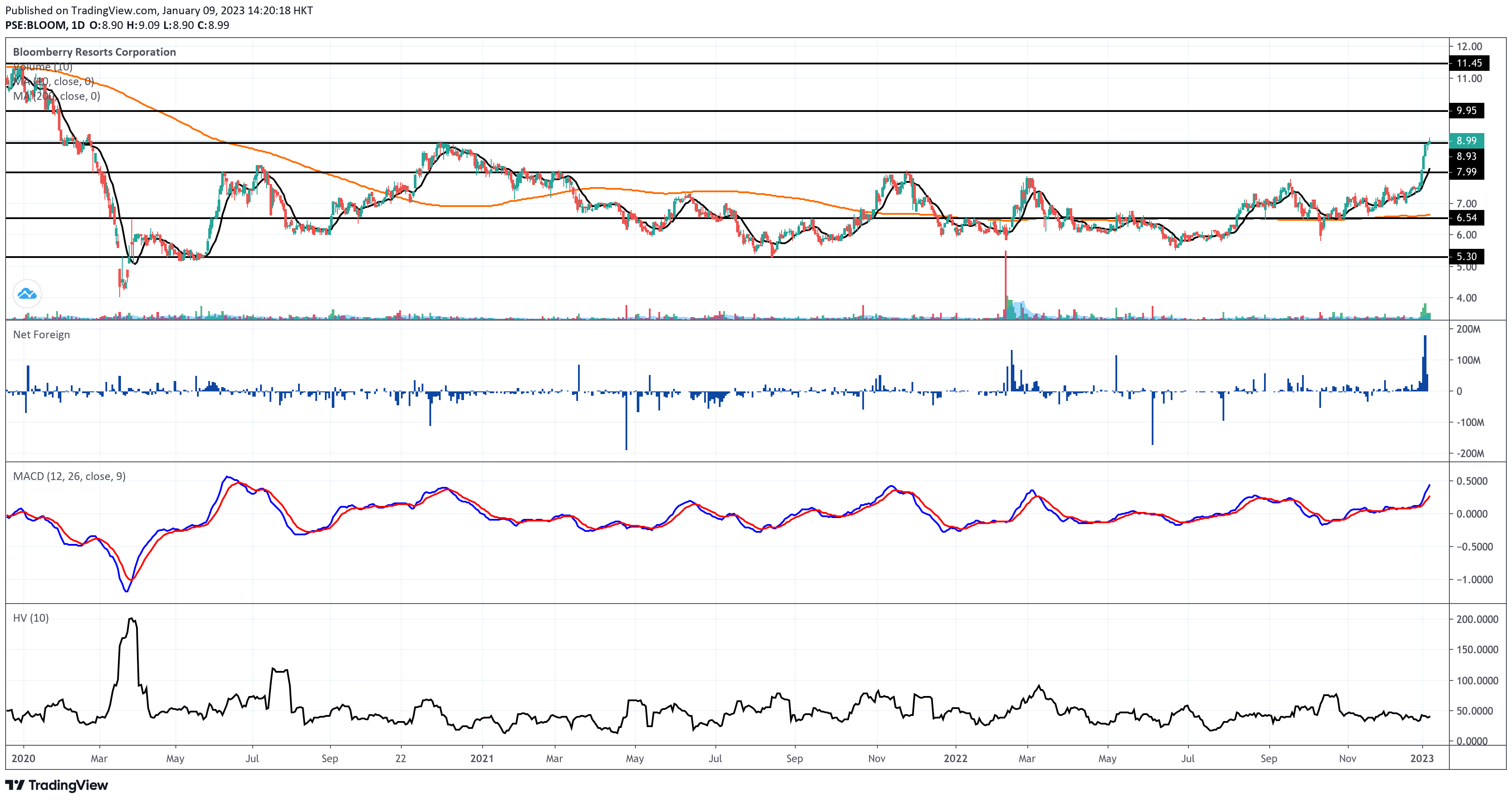

It’s bullish in the short- and long-term scales as the last price is trading above the 10-day and 200-day simple moving averages (SMAs).

The immediate support is near P8.90, while the immediate resistance is parked near P9.95. The lower support and higher resistance levels can be found on the chart above.

BLOOM’s moving average converge divergence (MACD) is bullish. There’s no formation of a bearish convergence between the MACD and signal lines.

BLOOM’s erraticity level remains low below the 50 percent level of its 10-day historical volatility score. This means no engulfing sticks and no gaps were registered on its price’s histogram for the past 10 trading days. Although this makes BLOOM a newbie-friendly stock, it doesn’t mean you should buy the stock blindly. By erraticity, I am referring to the fluctuation level of the stock and not its buyability.

BLOOM’s daily volume for the past five trading days, including today’s, are all higher than 100 percent of BLOOM’s 10-day volume average on each given day. That means the price’s ascent was supported by a good buying appetite as manifested by the size of the daily volume relative to the position of BLOOM’s 10-day volume average.

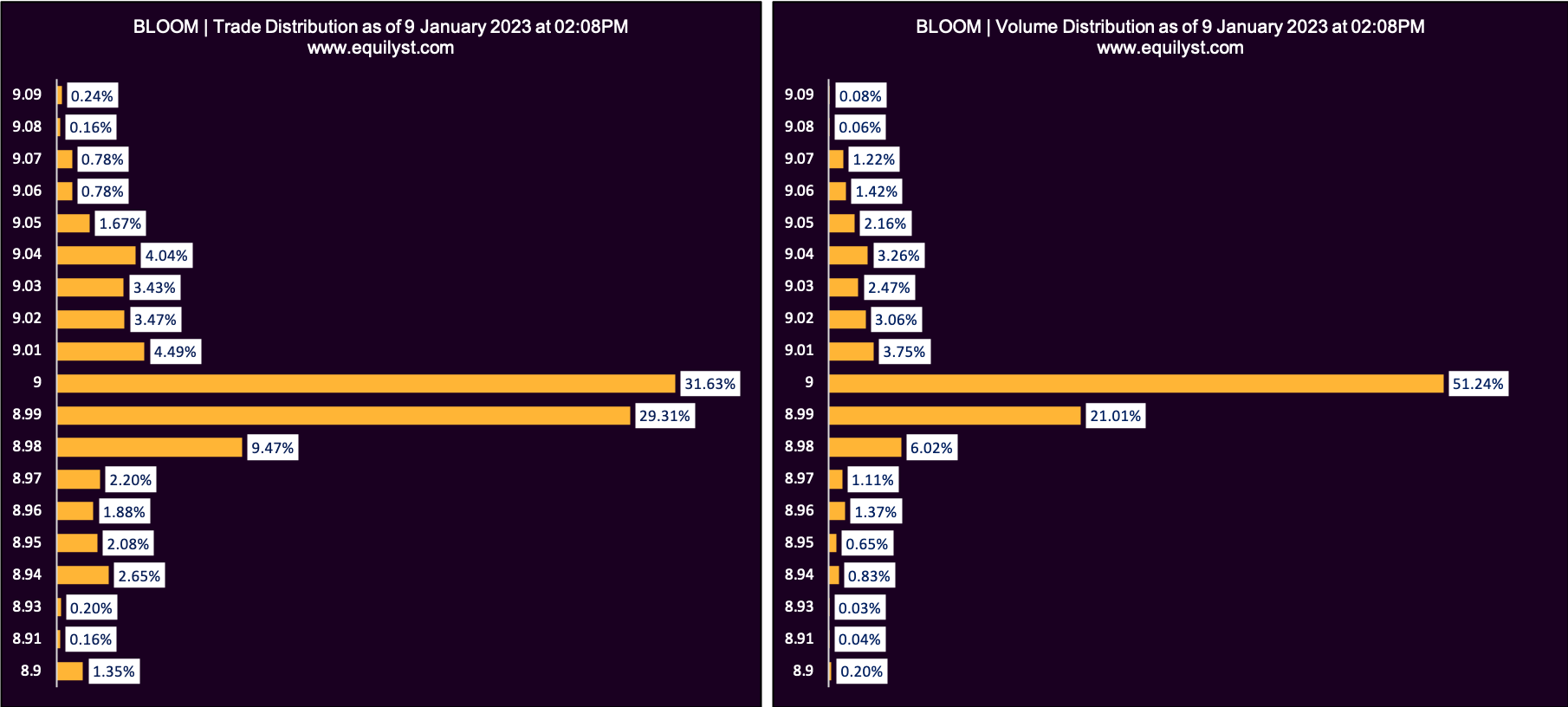

Dominant Range Index: BULLISH

Last Price: 9.0

VWAP: 9.0

Dominant Range: 9 – 9

It’s a bullish signal for me when the current or last price is equal to or higher than the volume-weighted average price (VWAP). It’s also a bullish signal for me when the dominant range is closer to the intraday high than the intraday low. The Dominant Range Index of BLOOM is bullish because those two criteria I mentioned were met.

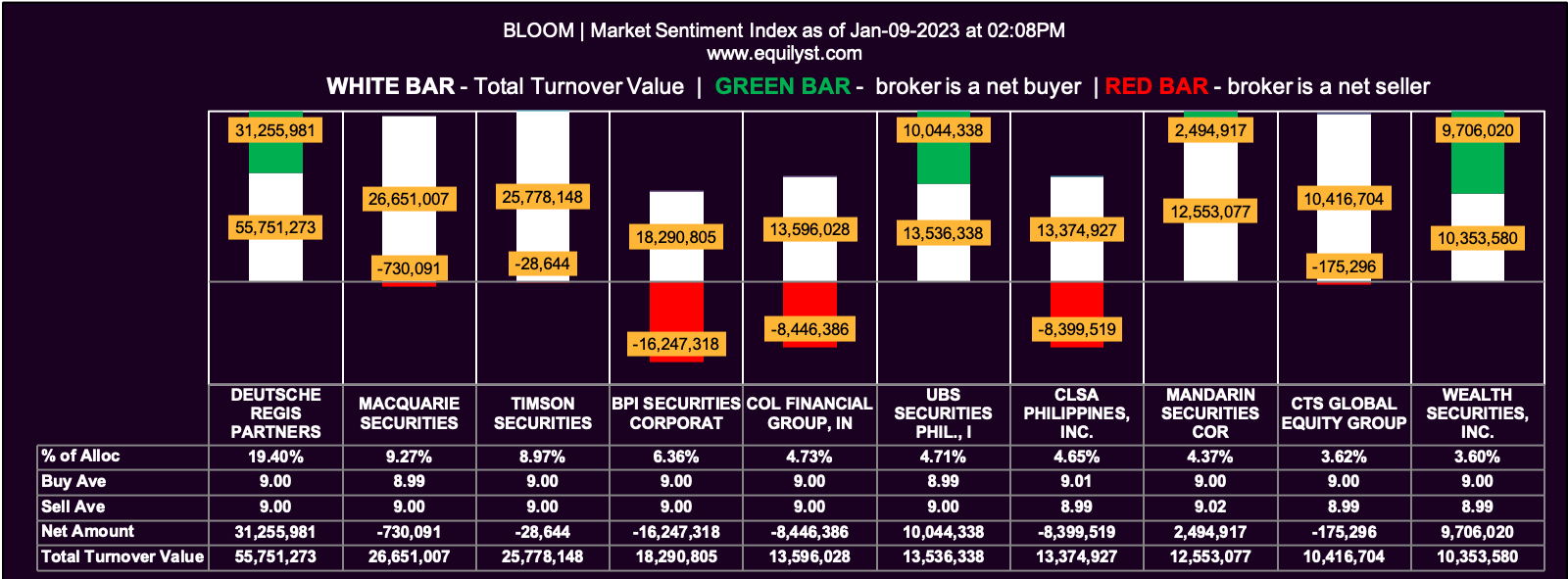

Market Sentiment Index: BULLISH

15 of the 48 participating brokers, or 31.25% of all participants, registered a positive Net Amount

16 of the 48 participating brokers, or 33.33% of all participants, registered a higher Buying Average than Selling Average

48 Participating Brokers’ Buying Average: ₱9.00364

48 Participating Brokers’ Selling Average: ₱8.99945

3 out of 48 participants, or 6.25% of all participants, registered a 100% BUYING activity

19 out of 48 participants, or 39.58% of all participants, registered a 100% SELLING activity

Even though there are more participants with a 100 percent selling activity than the ones with a 100 percent buying activity, Bloomberry Resorts Corporation managed to print a bullish Market Sentiment Index.

Does Bloomberry Resorts Corporation Have a Buy Signal?

Yes, it has a buy signal based on the bullish ratings of the six criteria that make my proprietary algorithm in stock trading and investing in the Philippine Stock Exchange.

If you are yet to have BLOOM in your portfolio, it is a must that you compute your initial trailing stop first. Then, you calculate your reward-to-risk ratio. Buy within the dominant range if, and only if, you are satisfied with your reward-to-risk ratio.

If you need my personal guidance on how to execute this properly, you may avail of my stock consultancy service. Click here to read your options.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025