DITO CME Holdings Corp. Technical Analysis

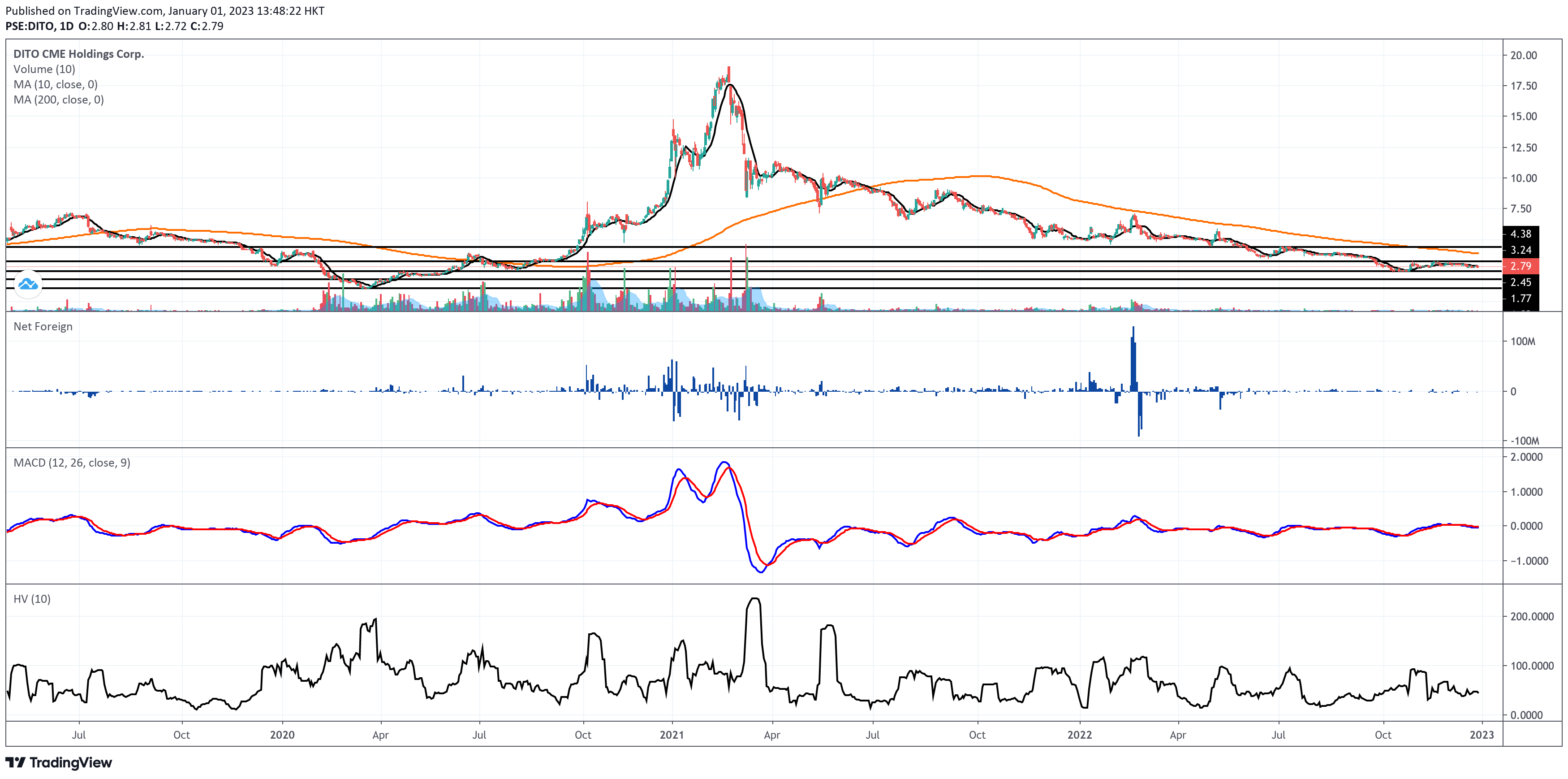

DITO CME Holdings Corp. (DITO) is -44.75% in 2022 from its 2021 closing price of P5.05 per share to its 2022 closing price of P2.79 apiece.

If you think that’s worst, something’s worse than that, and that’s its relative change of -85.31% from its all-time high of P19.00 per share registered on February 23, 2021 to its 2022 closing price.

Indeed, 2022 is not the year for DITO holders again. If you followed your trailing stop, I am sure you didn’t realize losses higher than what you can realistically handle.

Losses happen to everyone. What counts is your entire portfolio’s year-to-date relative change. Tap yourself on the back if you’re still a net gainer for 2022 despite your unpleasant experience trading or investing on DITO CME Holdings Corp.

DITO continues to fail the hopefuls by closing the year below its 10-day simple moving average (SMA) last December 29, 2022. It means this stock is still relatively bearish in the short term.

Curious about DITO’s stance in the long term based on its longer-term 200-day SMA? It’s also bearish. This stock must rise above P3.87 per share to re-enter the bullish view based on its longer-term 200-day SMA.

To say that DITO is not out of the woods is a conservative way of saying how much work is left to become attractive for short-term traders and long-term investors searching for signs of selling exhaustion.

If DITO doesn’t recover above its 10-day SMA soon, it runs the risk of re-visiting the support near P2.45 per share. The immediate resistance is near P3.25.

If DITO draws closer to P2.45 per share, we might see it crawl in the southward direction near P1.80 per share as a precursor to P1.00 per share.

I know that’s different from what you want to hear from me, especially if you still have DITO stocks in your portfolio, but I’m only stating the data-driven possibilities (no guarantees). Don’t shoot the messenger.

Foreign Investors

The foreign investors stopped registering significant amounts of net foreign buying or selling after the first quarter of 2022. There were many days with a below-P1 million net foreign amount. DITO remains an unattractive stock for foreign fundies.

Moving Average Convergence Divergence (MACD)

The MACD line of DITO concurs with the bearish sentiment painted by the moving averages and foreign investors’ stance. Both MACD and signal lines traverse toward the south. I see no formation of a bullish convergence between the two lines.

Erraticity Level

While DITO is trapped in the bearish territory, it doesn’t register engulfing candlesticks or price gaps. That’s why its 10-day historical volatility remains below 50%, which is a low erraticity level for me.

This is not a signal to buy the dips for me. This tells me whether the stock fluctuates erratically without needing me to check its daily chart.

Dominant Range Index

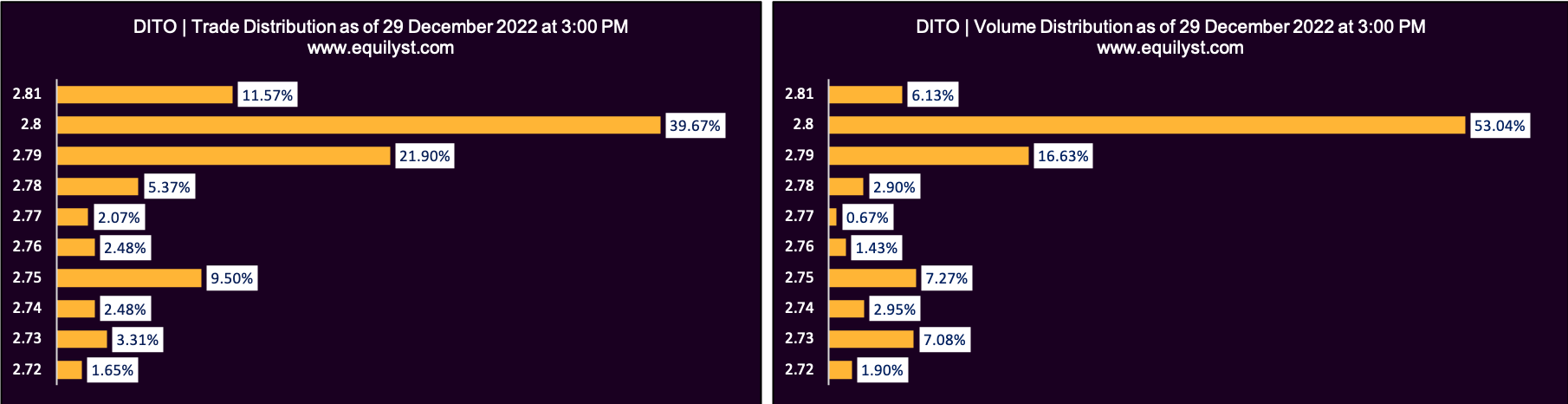

Dominant Range Index: BULLISH

Last Price: 2.79

VWAP: 2.79

Dominant Range: 2.8 – 2.8

Market Sentiment Index

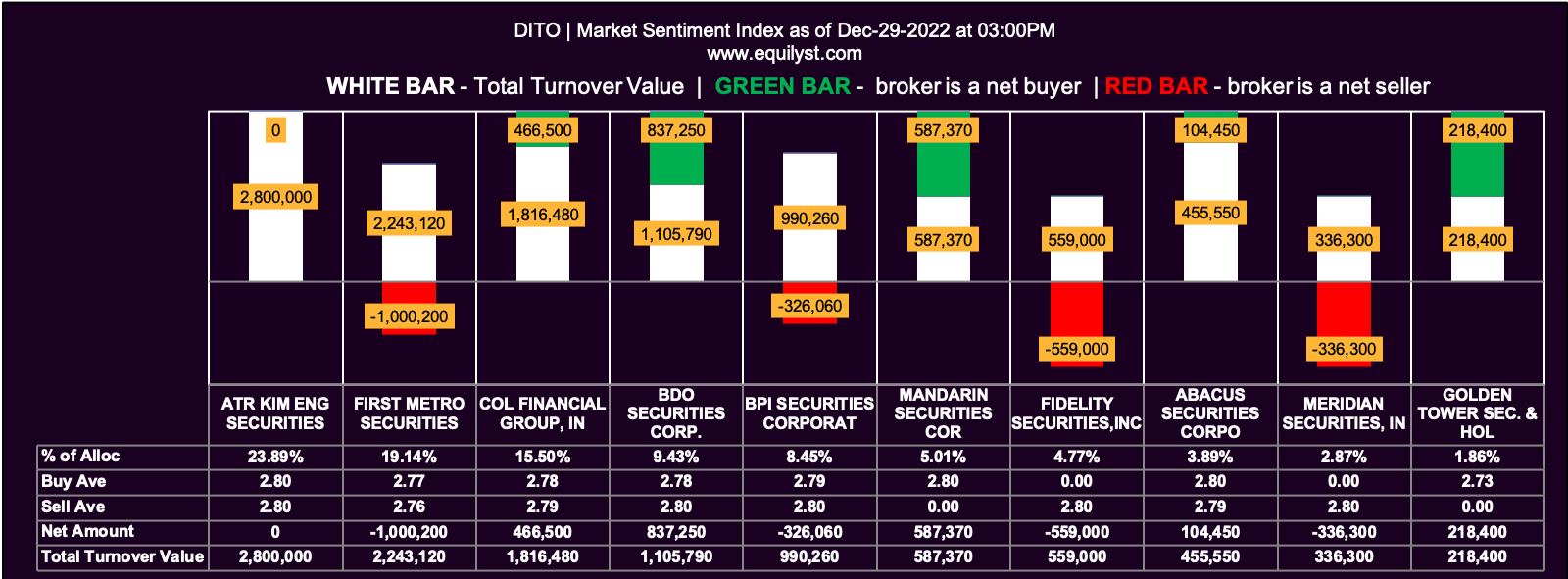

Market Sentiment Index: BEARISH

9 of the 19 participating brokers, or 47.37% of all participants, registered a positive Net Amount

8 of the 19 participating brokers, or 42.11% of all participants, registered a higher Buying Average than Selling Average

19 Participating Brokers’ Buying Average: ₱2.77651

19 Participating Brokers’ Selling Average: ₱2.79117

6 out of 19 participants, or 31.58% of all participants, registered a 100% BUYING activity

4 out of 19 participants, or 21.05% of all participants, registered a 100% SELLING activity

What to Do If Your Trailing Stop Is Still Intact?

You have a data-driven basis for holding your position since DITO’s Dominant Range Index last December 29, 2022 was still bullish. Consider trimming your losses once both Dominant Range and Market Sentiment Indices become bearish.

What to Do If Your Paper Loss Doesn’t Let You Sleep Anymore?

It only means you have a broken trading or investing strategy. A wise trader or investor already knows the price where he should sell should things go south even before he buys the stock.

Compute your trailing stop using my trailing stop calculator in the RESOURCES tab of this website.

If your calculation shows that you should have trimmed your losses a long time ago, you sell at a loss or sell on strength.

If you need my detailed advice, subscribe to my stock market consultancy service at Equilyst Analytics.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025