I’d like to feature the Market Sentiment rating of the top 5 losing stocks according to day change as of the timestamp indicated in each chart.

- Concrete Aggregates Corp. B

- Benguet Corporation B

- Oriental Pet. and Minerals Corp. A

- Pryce Corporation

- Mabuhay Vinyl Corporation

Before we dive deep into the data, I need to tell you first the rationale for using my Market Sentiment Index. This is my proprietary indicator. I invented it. No one else can explain it better than I do.

Why did I create my proprietary Market Sentiment Index indicator?

I am using my proprietary Market Sentiment Index (MSI) to identify the overall mood of the top 10 brokers.

I want you to understand that my Market Sentiment Index is not a determiner of trend but sentiment.

I use this chart on several occasions. Here are some examples of its usage.

Scenario 1

Let’s say the stock is still moving above your trailing stop loss. All other indicators you check are bullish.

You want to top up, but you saw a huge Net Foreign Selling. Now you’re half-hearted to continue your plan to top up even though your other indicators are bullish just because you saw that the foreign fundies are bearish.

However, you saw that the Market Sentiment Index of the stock is bullish. That means the majority of the top 10 brokers bought the dips.

Doesn’t that give you the confidence to top up, too?

Scenario 2

Let’s say the stock is still trading above your trailing stop loss. However, the other indicators you monitor are bearish.

Now, you’re torn between pre-empting your trailing stop loss (selling even before it gets hit) and respecting it (sell only when it’s hit).

However, you see that the Market Sentiment Index is bullish.

Doesn’t that give you the confidence to hold your position because you see that the majority of the top 10 brokers are still interested in buying the dips?

Scenario 3

The stock is still trading above your trailing stop loss.

You see that the foreign investors registered a huge Net Foreign Buying.

Now, you’re asking yourself, “Does it make sense for me to top up (buy the dips) because the foreign investors are aggressively buying the dips EVEN IF the current price is not higher than the previous trading day’s opening price?”

But seeing that the Market Sentiment Index is bearish, you decided not to pursue the plan to mimic what the foreign fundies are doing.

You realize that the foreign fundies can afford to buy the major dips because they have billions in their pocket.

You realized, “Why should I hurry in buying the dips when the majority of the top 10 brokers are not even showing signs of interest yet?”

Now you’re ready to see the Market Sentiment Index rating for the stocks I mentioned above!

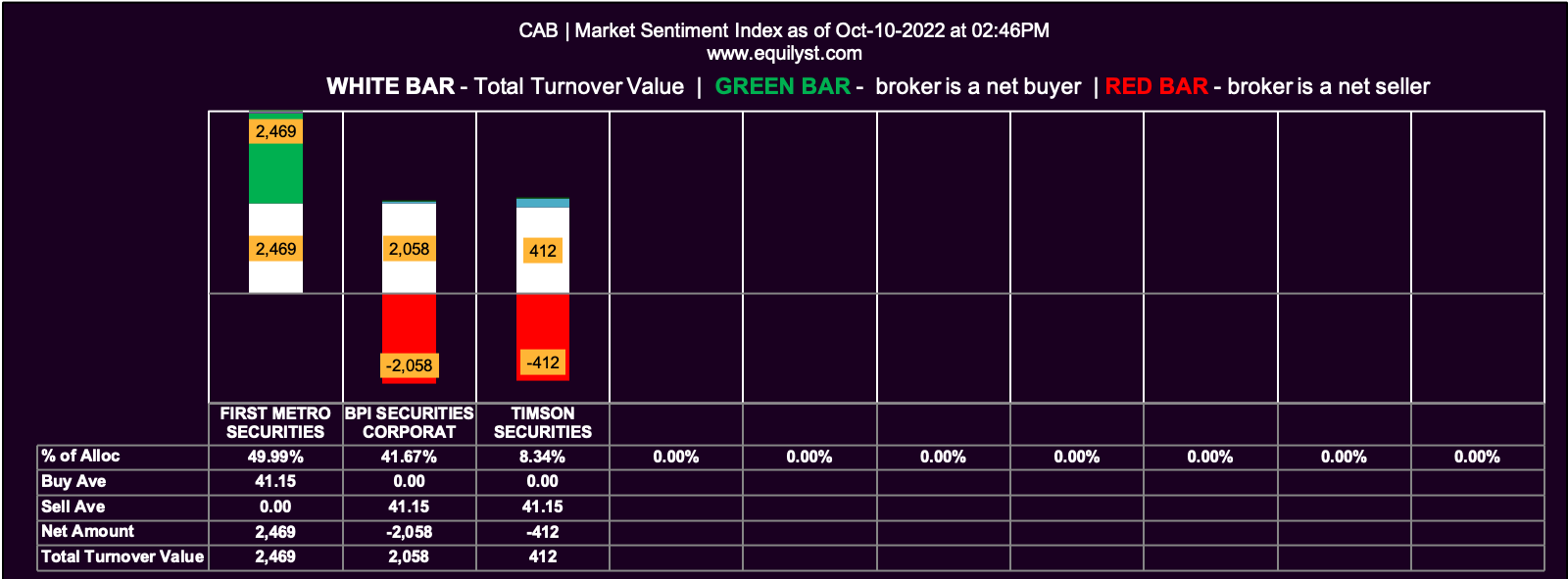

Concrete Aggregates Corp. B

Market Sentiment Index: BEARISH

1 of the 3 participating brokers, or 33.33% of all participants, registered a positive Net Amount

1 of the 3 participating brokers, or 33.33% of all participants, registered a higher Buying Average than Selling Average

3 Participating Brokers’ Buying Average: ₱41.15000

3 Participating Brokers’ Selling Average: ₱41.15000

1 out of 3 participants, or 33.33% of all participants, registered a 100% BUYING activity

2 out of 3 participants, or 66.67% of all participants, registered a 100% SELLING activity

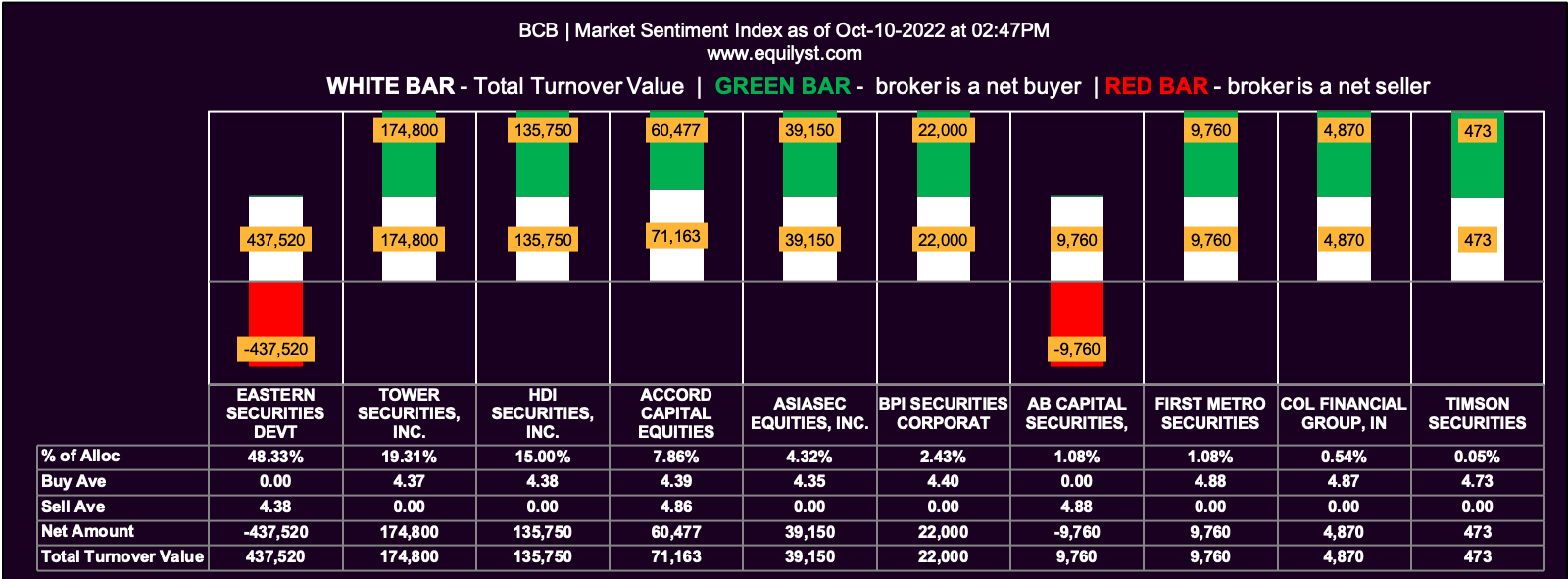

Benguet Corporation B

Market Sentiment Index: BULLISH

8 of the 10 participating brokers, or 80.00% of all participants, registered a positive Net Amount

7 of the 10 participating brokers, or 70.00% of all participants, registered a higher Buying Average than Selling Average

10 Participating Brokers’ Buying Average: ₱4.54588

10 Participating Brokers’ Selling Average: ₱4.70417

7 out of 10 participants, or 70.00% of all participants, registered a 100% BUYING activity

2 out of 10 participants, or 20.00% of all participants, registered a 100% SELLING activity

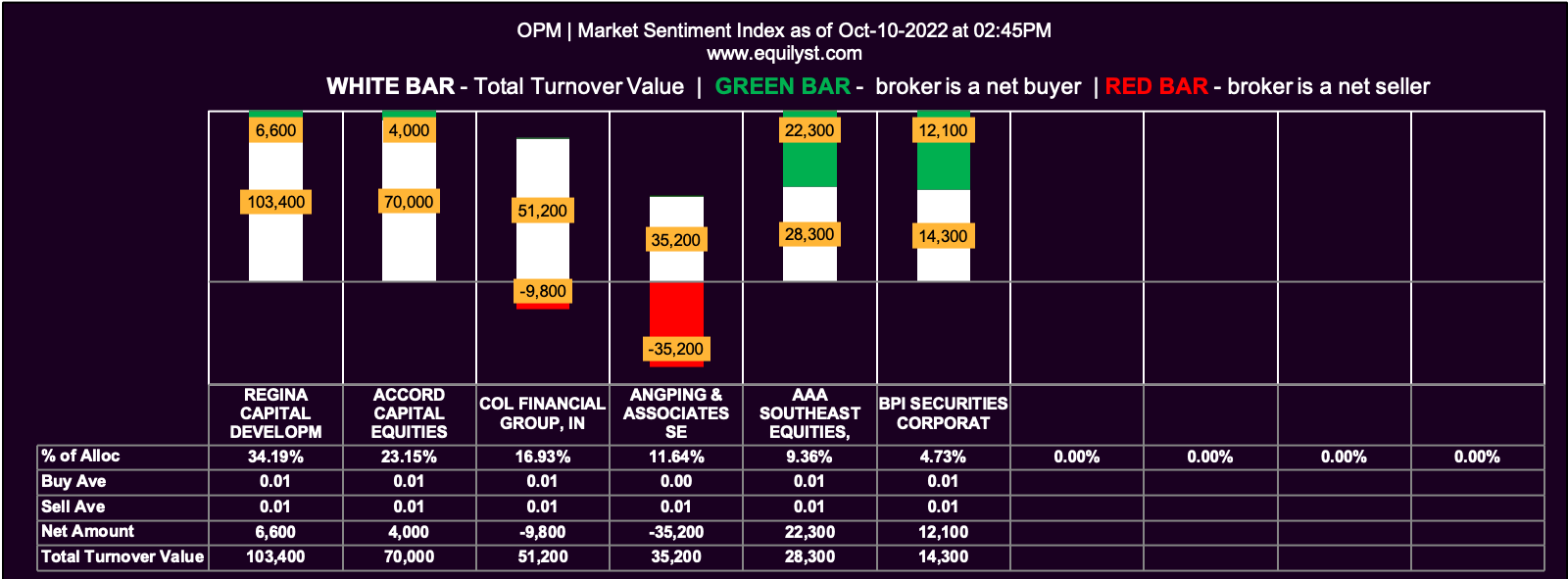

Oriental Pet. and Minerals Corp. A

Market Sentiment Index: BULLISH

4 of the 6 participating brokers, or 66.67% of all participants, registered a positive Net Amount

1 of the 6 participating brokers, or 16.67% of all participants, registered a higher Buying Average than Selling Average

6 Participating Brokers’ Buying Average: ₱0.01096

6 Participating Brokers’ Selling Average: ₱0.01082

0 out of 6 participants, or 0.00% of all participants, registered a 100% BUYING activity

1 out of 6 participants, or 16.67% of all participants, registered a 100% SELLING activity

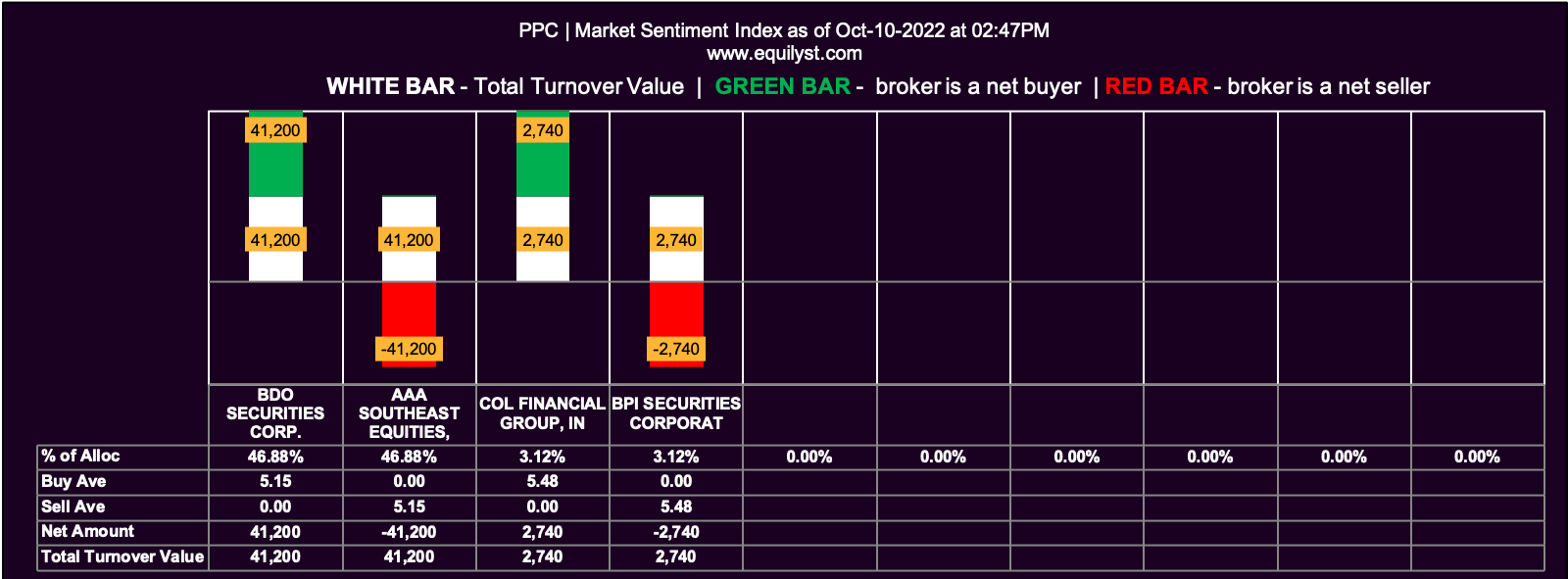

Pryce Corporation

Market Sentiment Index: BULLISH

2 of the 4 participating brokers, or 50.00% of all participants, registered a positive Net Amount

2 of the 4 participating brokers, or 50.00% of all participants, registered a higher Buying Average than Selling Average

4 Participating Brokers’ Buying Average: ₱5.31500

4 Participating Brokers’ Selling Average: ₱5.31500

2 out of 4 participants, or 50.00% of all participants, registered a 100% BUYING activity

2 out of 4 participants, or 50.00% of all participants, registered a 100% SELLING activity

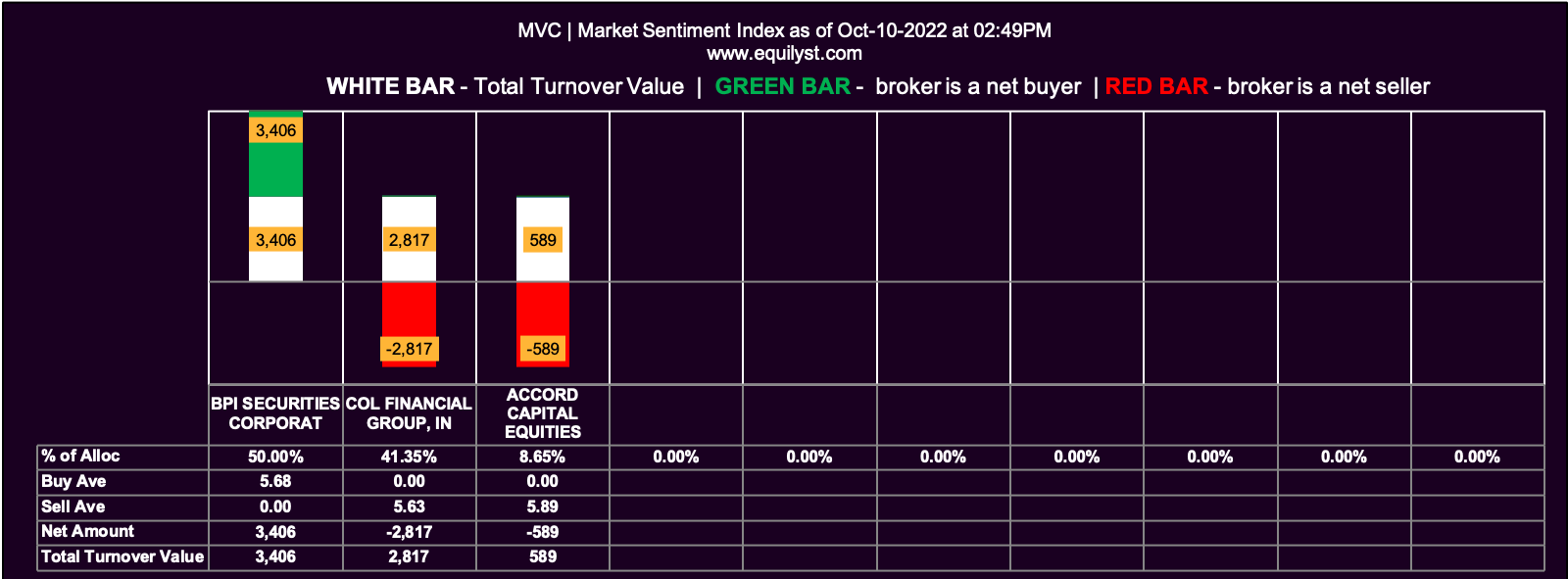

Mabuhay Vinyl Corporation

Market Sentiment Index: BEARISH

1 of the 3 participating brokers, or 33.33% of all participants, registered a positive Net Amount

1 of the 3 participating brokers, or 33.33% of all participants, registered a higher Buying Average than Selling Average

3 Participating Brokers’ Buying Average: ₱5.67670

3 Participating Brokers’ Selling Average: ₱5.76200

1 out of 3 participants, or 33.33% of all participants, registered a 100% BUYING activity

2 out of 3 participants, or 66.67% of all participants, registered a 100% SELLING activity

Final Advice

Know that the Market Sentiment Index rating is just 1 of the 6 indicators that make up my Evergreen Strategy (my proprietary strategy in trading and investing in the Philippine stock market). If you want me to teach you the entirety of my strategy so you can trade independently and invest profitably, subscribe to my premium stock market consultancy service.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025