My Market Sentiment Index chart generator can check the sentiment for up to 30 days.

I check the week-to-date and month-to-date Market Sentiment Index of a stock to see if there’s a uniformed sentiment for the daily, weekly, and monthly ranges.

I will not explain in this article the use of my Market Sentiment Index.

I’ve already explained it many times in my other articles.

Please read my previous articles with “Market Sentiment Analysis” on the title on the RESOURCES section of my website.

In this report, I’ll share with you the Market Sentiment Index for the following stocks from August 1, 2022 to August 8, 2022:

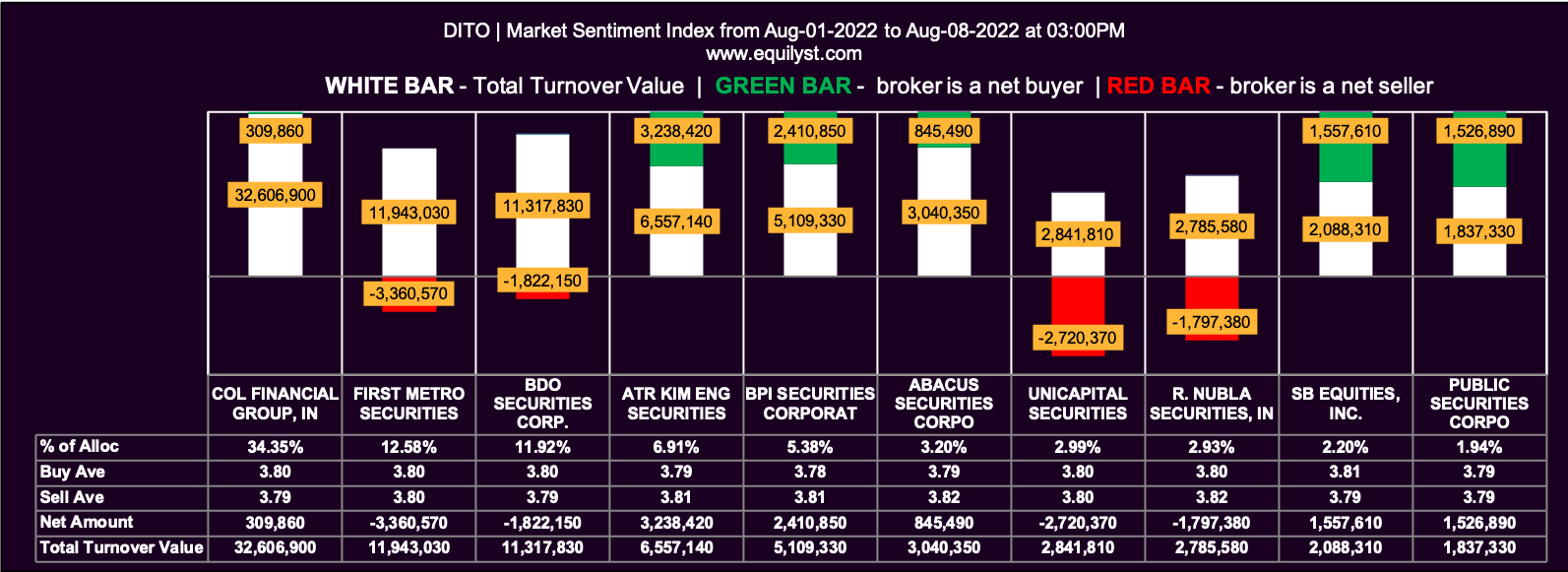

- DITO CME Holdings Corp (DITO)

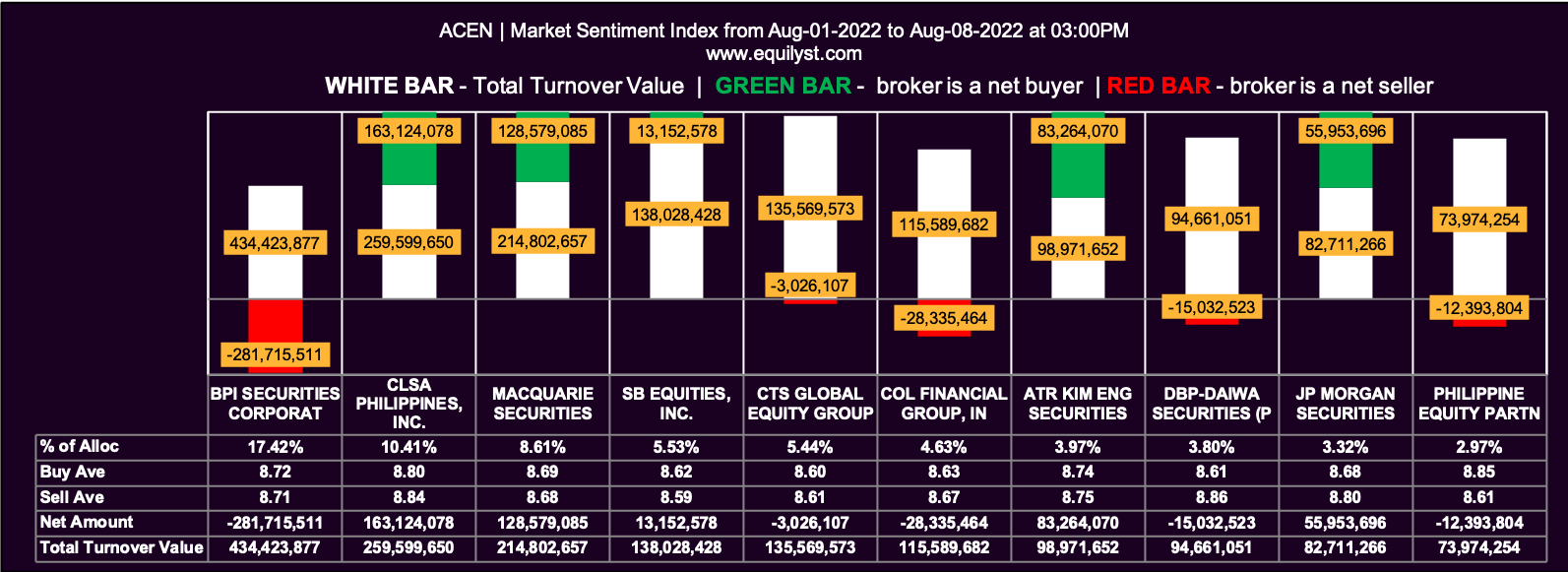

- ACEN Corporation (ACEN)

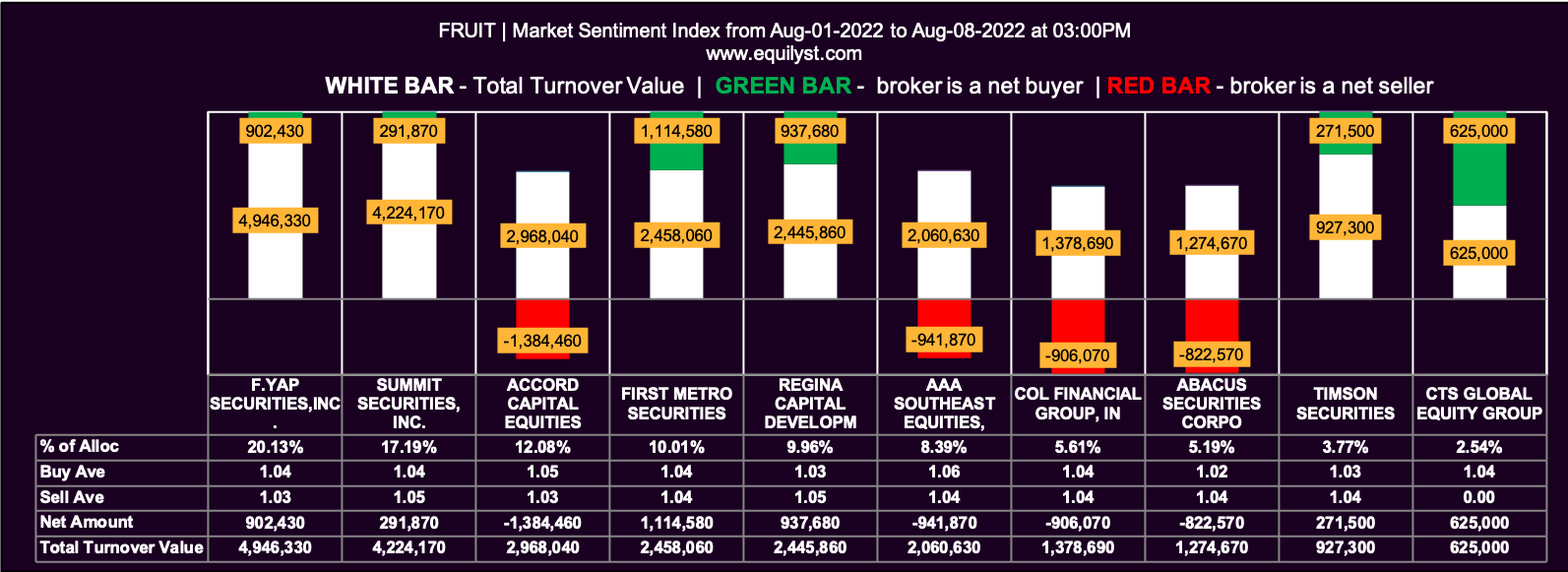

- Fruitas Holdings (FRUIT)

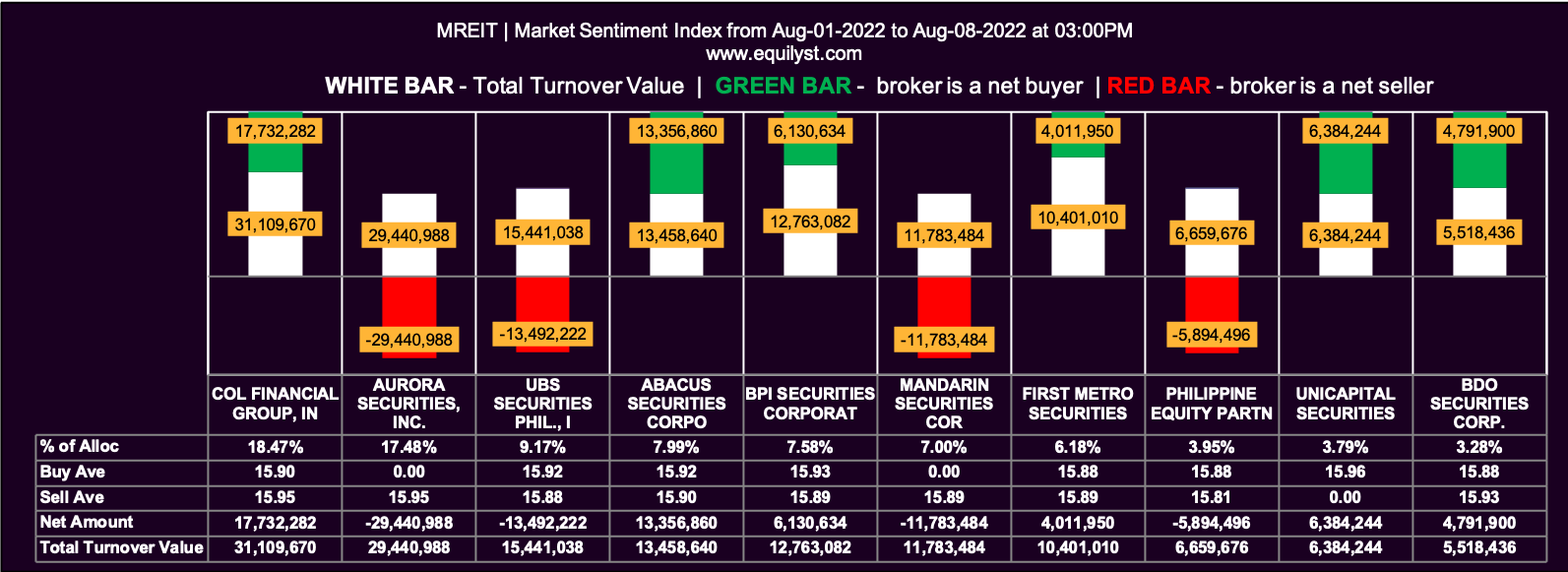

- MREIT

- Semirara Mining and Power Corporation (SCC)

DITO CME Holdings Corp (DITO)

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

28 of the 53 participating brokers, or 52.83% of all participants, registered a positive Net Amount

27 of the 53 participating brokers, or 50.94% of all participants, registered a higher Buying Average than Selling Average

53 Participating Brokers’ Buying Average: ₱3.79255

53 Participating Brokers’ Selling Average: ₱3.79334

16 out of 53 participants, or 30.19% of all participants, registered a 100% BUYING activity

14 out of 53 participants, or 26.42% of all participants, registered a 100% SELLING activity

ACEN Corporation (ACEN)

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

28 of the 88 participating brokers, or 31.82% of all participants, registered a positive Net Amount

27 of the 88 participating brokers, or 30.68% of all participants, registered a higher Buying Average than Selling Average

88 Participating Brokers’ Buying Average: ₱8.67804

88 Participating Brokers’ Selling Average: ₱8.69892

6 out of 88 participants, or 6.82% of all participants, registered a 100% BUYING activity

24 out of 88 participants, or 27.27% of all participants, registered a 100% SELLING activity

Fruitas Holdings (FRUIT)

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

10 of the 20 participating brokers, or 50.00% of all participants, registered a positive Net Amount

9 of the 20 participating brokers, or 45.00% of all participants, registered a higher Buying Average than Selling Average

20 Participating Brokers’ Buying Average: ₱1.03569

20 Participating Brokers’ Selling Average: ₱1.04226

4 out of 20 participants, or 20.00% of all participants, registered a 100% BUYING activity

4 out of 20 participants, or 20.00% of all participants, registered a 100% SELLING activity

MREIT

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

33 of the 44 participating brokers, or 75.00% of all participants, registered a positive Net Amount

29 of the 44 participating brokers, or 65.91% of all participants, registered a higher Buying Average than Selling Average

44 Participating Brokers’ Buying Average: ₱15.90780

44 Participating Brokers’ Selling Average: ₱15.89390

20 out of 44 participants, or 45.45% of all participants, registered a 100% BUYING activity

6 out of 44 participants, or 13.64% of all participants, registered a 100% SELLING activity

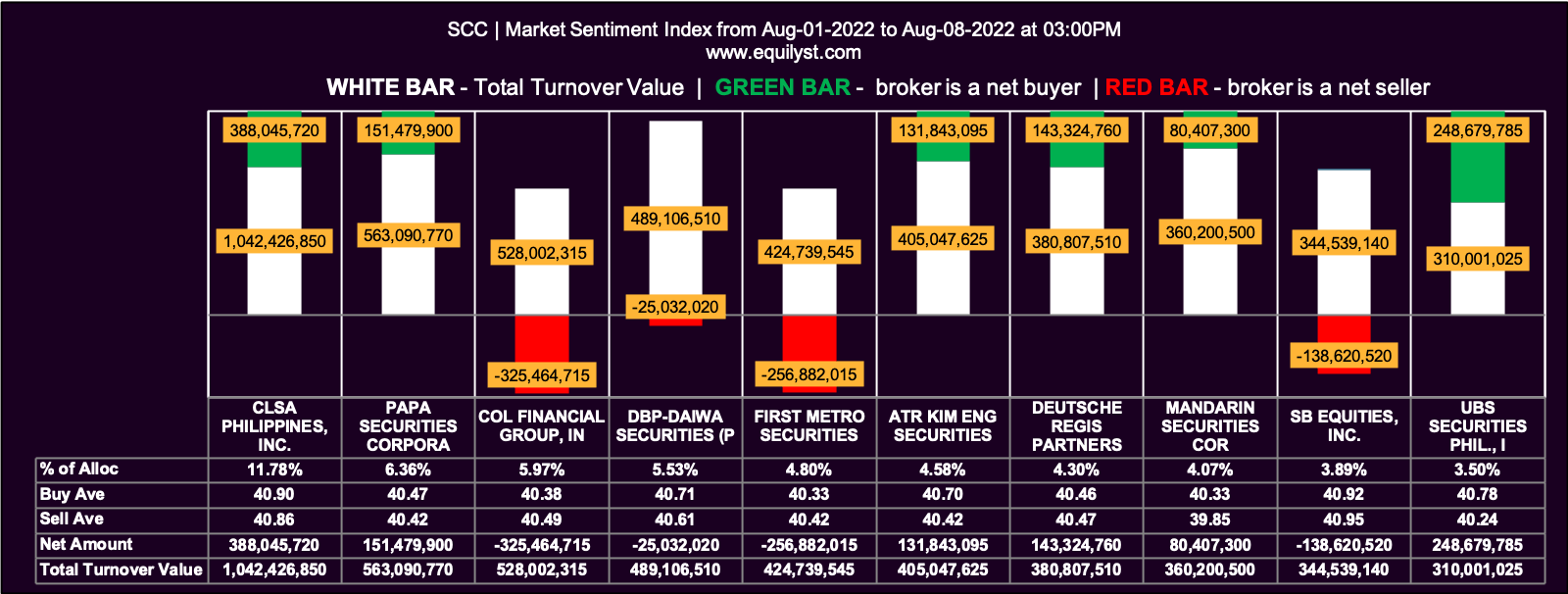

Semirara Mining and Power Corporation (SCC)

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

34 of the 94 participating brokers, or 36.17% of all participants, registered a positive Net Amount

37 of the 94 participating brokers, or 39.36% of all participants, registered a higher Buying Average than Selling Average

94 Participating Brokers’ Buying Average: ₱40.26462

94 Participating Brokers’ Selling Average: ₱40.55457

11 out of 94 participants, or 11.70% of all participants, registered a 100% BUYING activity

18 out of 94 participants, or 19.15% of all participants, registered a 100% SELLING activity

Would You Like to Learn More from Me?

The Market Sentiment Index is just 1 of the 6 indicators I check when I look for a confirmed buy signal.

Would you like me to teach you how to preserve your trading capital, protect your gains, and prevent unbearable losses trading and investing in the Philippine stock market?

Subscribe to my stock market consultancy service.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025