Fruitas Holdings (FRUIT) Technical and Sentimental Analysis

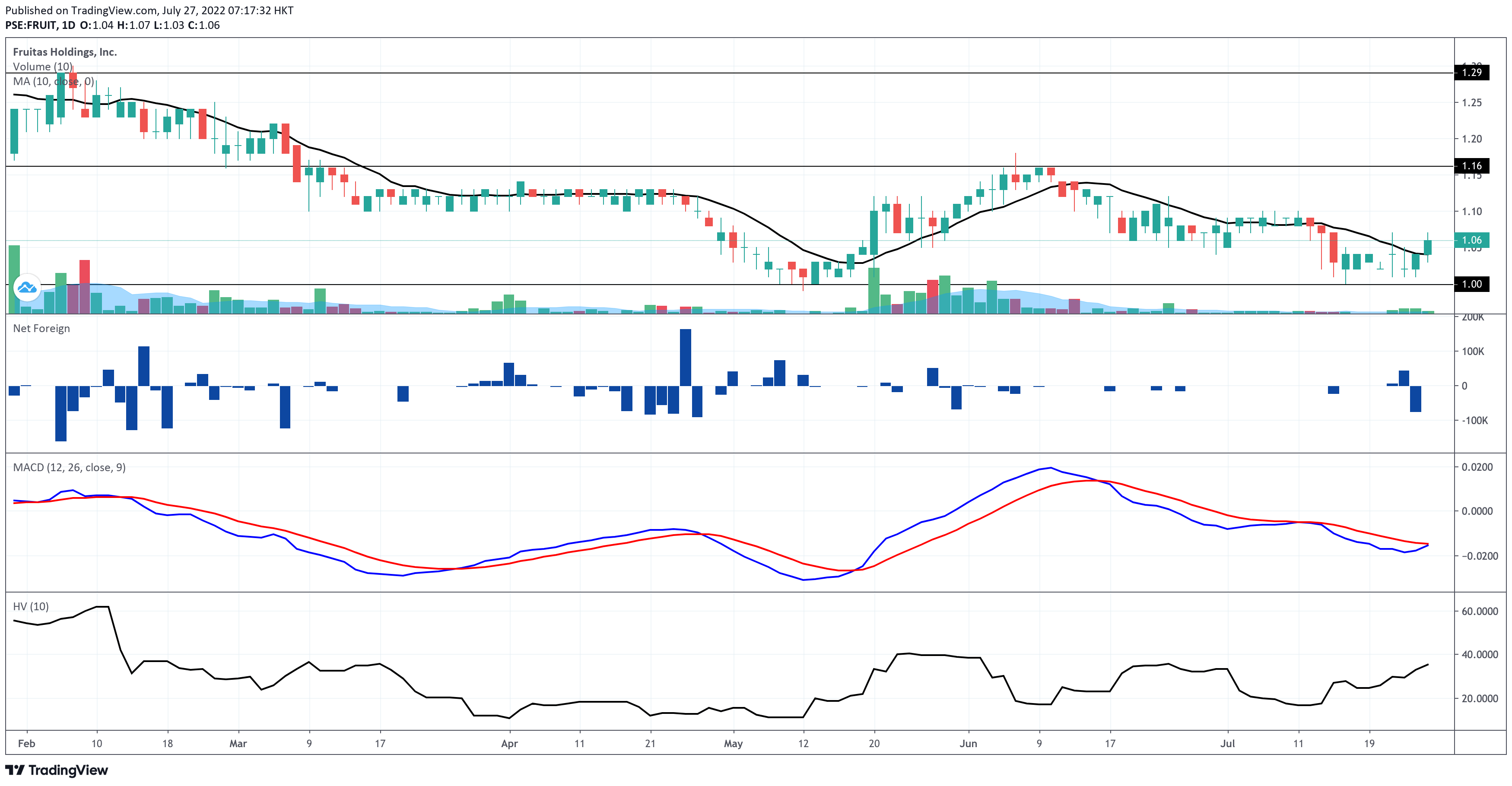

Fruitas Holdings (FRUIT) is trading above its 10-day simple moving average. Although FRUIT can be regarded as bullish in the short term, it’s not the time for FRUIT holders to rejoice because FRUIT has a history of not being able to sustain its ascent above the 10-day SMA. FRUIT is not out of the woods yet.

As of closing on July 26, 2022, FRUIT is closer to its immediate support at P1.00 per share than its resistance at P1.16 per share.

If you’re following my strategy, I know you think that the position of the current price of FRUIT gives you a better reward-to-risk ratio. Keep in mind that I only compute my reward-to-risk ratio once the 6 indicators I monitor are bullish. Otherwise, it’s a waste of time computing my reward-to-risk ratio if you’re not going to buy due to the lack of a confirmed buy signal.

Here are the 6 criteria that must turn bullish for me to say that the stock has a confirmed buy signal.

Here are the 6 criteria that must turn bullish for me to say that the stock has a confirmed buy signal.

- The last price must be higher than the 10-day simple moving average.

- The last price must be higher than the volume-weighted average price.

- The last volume must be above 50% of the 10-day average.

- The moving average convergence divergence (MACD) must be higher than the signal line.

- The Dominant Range Index must be bullish.

- The Market Sentiment Index must be bullish.

Foreign Investors

FRUIT is not getting the interest of foreign investors. Although I see bars in the Net Foreign histogram, those are relatively insignificant amounts only. So, whether the foreign investors are net buyers or sellers year-to-date, it won’t influence my decision.

MACD

The moving average convergence divergence (MACD) is poised to cross above the signal line. We might see a golden cross above the signal line once FRUIT touches the P1.09 level.

Risk Level

How risky is it to trade FRUIT according to its erratic movements? FRUIT is still trading within the low-risk level based on its 10-day historical volatility score of 36%.

Remember that having a low erraticity score doesn’t automatically make the stock a good one to buy. After all, I only use the historical volatility score of a stock to know how erratic its price fluctuation is without actually seeing the daily chart.

I’ll show you the Dominant Range and Market Sentiment Indices of FRUIT so you can complete the assessment of the 6 criteria I am monitoring.

Dominant Range Index

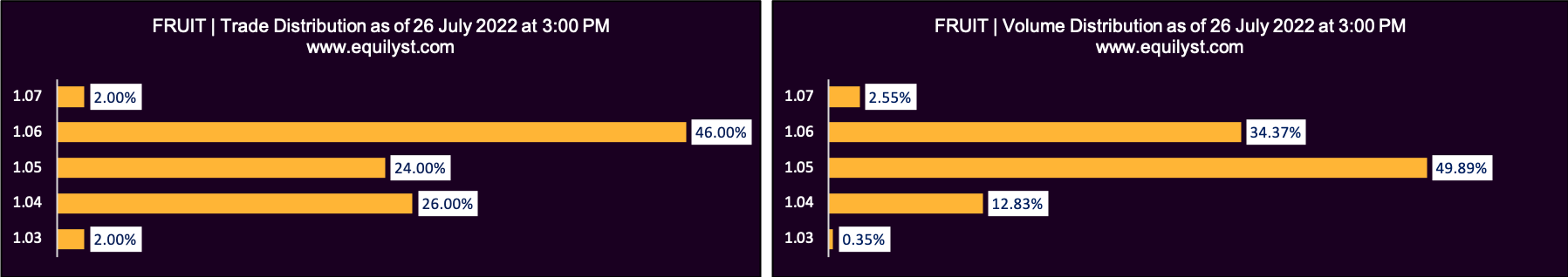

Dominant Range Index: BULLISH

Dominant Range Index: BULLISH

Last Price: 1.06

VWAP: 1.05

Dominant Range: 1.05 – 1.06

Market Sentiment Index

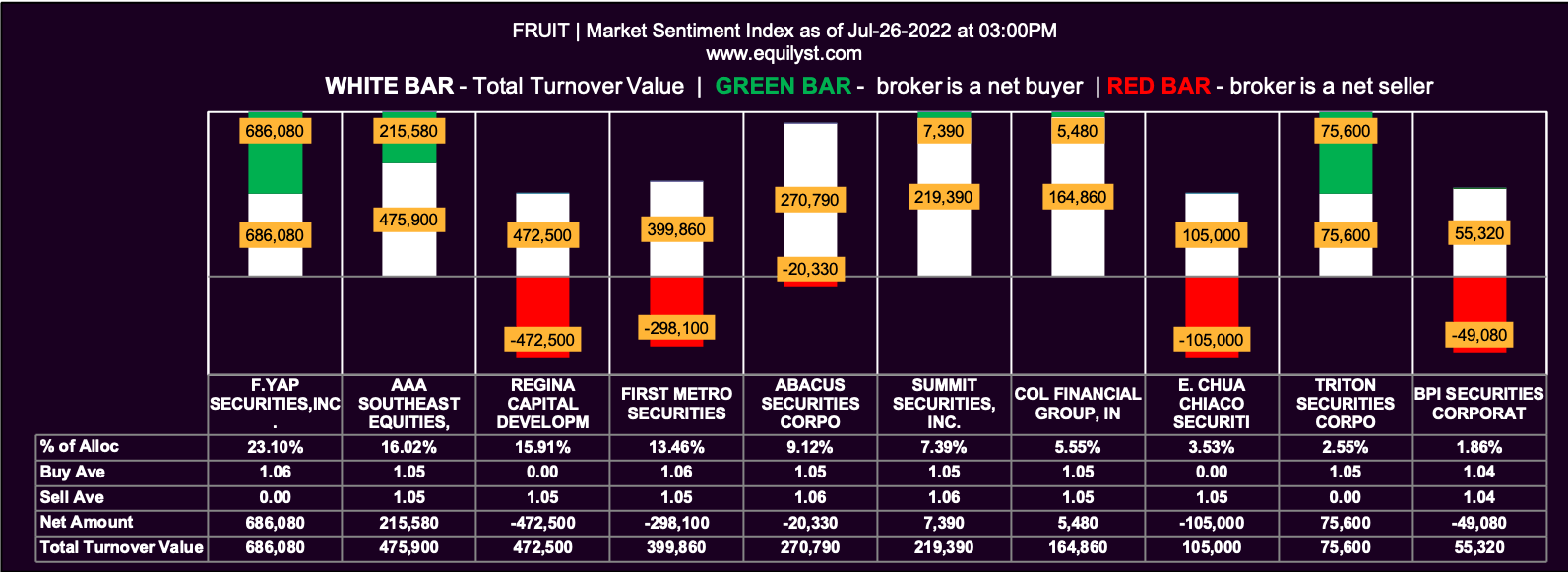

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

5 of the 12 participating brokers, or 41.67% of all participants, registered a positive Net Amount

4 of the 12 participating brokers, or 33.33% of all participants, registered a higher Buying Average than Selling Average

12 Participating Brokers’ Buying Average: ₱1.05088

12 Participating Brokers’ Selling Average: ₱1.05091

2 out of 12 participants, or 16.67% of all participants, registered a 100% BUYING activity

4 out of 12 participants, or 33.33% of all participants, registered a 100% SELLING activity

Does Fruit Have a Buy Signal?

So, does FRUIT have a confirmed buy signal according to my Evergreen Strategy as of closing on July 26, 2022?

There’s no buy signal yet. But keep an eye on FRUIT because 5 out of 6 criteria are bullish. I’m just waiting for its MACD to turn bullish. Once all 6 indicators are bullish, I’ll start calculating my reward-to-risk ratio. If I’m satisfied with the ratio, I’ll compute my initial trailing stop and position for a test-buy within the prevailing dominant range.

Understand that the ratings of each of the 6 indicators are not constants but variables. Not because they’re bullish now, it doesn’t mean they remain bullish forever. When you re-check the status or rating of one indicator, you have to re-check all 6 indicators.

Lastly, keep an eye on your trailing stop if you get the chance to do a test-buy on FRUIT. The market is not bound to follow any Pontious Pilate’s analysis. We, traders and investors, need to adapt to the market. Your trailing stop can help you preserve your capital, protect your gains, and prevent unbearable losses, especially when reality contradicts the forecast.

Would You Like Me to Teach You My Strategy in Person?

Would you like me to personally teach you my strategy from the very start? Subscribe to my stock market consultancy service so you’ll get a ticket to my whole-day workshop, or you can buy a ticket to my Evergreen Strategy seminar as an ala carte service.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025